This article is from the Australian Property Journal archive

A FLURRY of investment activity this week has seen over $600 million of offices change hands in Sydney and Melbourne, with deals taking longer to eventuate.

A slow start to the year Mirvac has divested the 40 Miller Street North Sydney office building to Barings for $140 million and 367 Collins Street for $345 million. Both deals were struck at a 20% discount to peak book values.

It was the second major office transaction in a week, after a long drought, coming hot on the heels of Swiss fund AFIAA selling 628 Bourke Street for $115.8 million to Bayley Stuart. The sale result will be disappointing for the Swiss fund as the sale price is below the $185 million it paid M&G Real Estate seven years ago and AFIAA spent a further $35 million refurbishing the building.

M&G bought the asset from Investa Office Fund for $129.6 million in May 2014.

AFIAA put the Bourke Street office building on the market in September last year. Originally constructed in 1989, the refurbished A-Grade office building sits on a 3,301sqm site, with four street frontages, with 24,127sqm of net lettable area, which is 90% leased to majority government and listed corporations.

Located adjacent to North Sydney Railway Station, 40 Miller Street was developed by Mirvac in 2000 and is an A-grade office building built in 2000, offering 12,614.8 sqm across 11 levels. The sale price is below the 2003 value of $191 million.

Meanwhile Asian private equity and real estate company PAG has bought 367 Collins Street for $345 million, which is below the 2023 book value of $371 million and the 2022 book value of $427 million. Mirvac had been trying to sell the building for sometime after an initial deal with Goldfields Group fell over.

It put the property on the market in 2022 and had hoped it would fetch around $430 million.

Purpose-built for the Commonwealth Bank in 1975, 367 Collins Street later became the Optus Centre. The building comprises a net lettable area of approximately 37,000 sqm and the building has two basements, lower ground and 32 upper levels.

Mirvac bought the building from Colonial First State Global Asset Management’s Direct Property Investment Fund for $228 million in 2013 on a fully let yield of 7.8%.

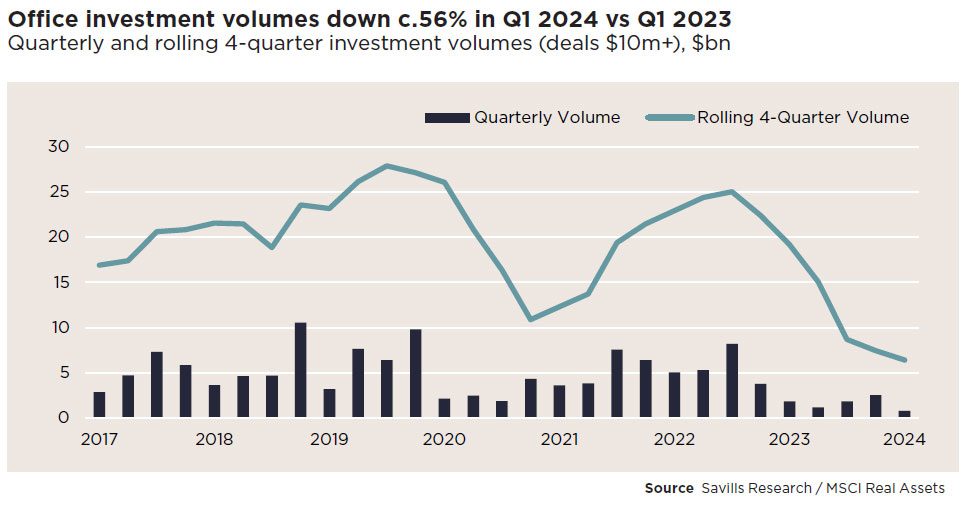

These latest transactions have given the market a shot in the arm as data shows office investment volumes plunged by 56%.

These sales follows Keppel REIT’s acquisition of a 50% interest in 255 George Street for $363.8 million in April, representing a 9% discount.

The Mirvac sales were transacted at a 20% discount to valuation, similar to Dexus’ divestment of 1 Margaret Street and the other three deals this week.