- What £18m shopping centre sale in Lancaster

- Why Completion of asset management strategy

- What next Primark anchored centre, with 11 years to expiry, sure to attract attention

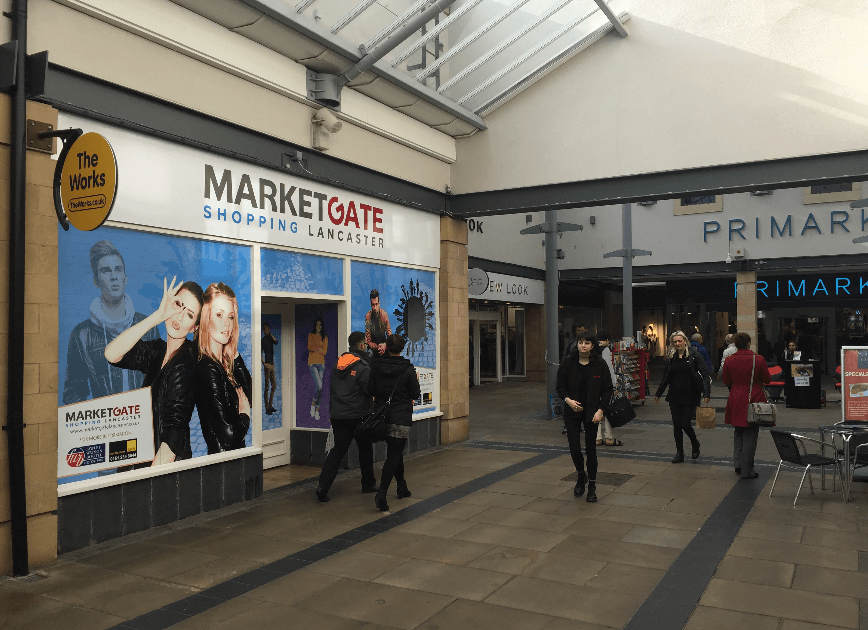

A Primark-anchored shopping centre in Lancaster has been put up for sale by Chenavari, the investment manager, and Roubaix Group following a successful asset management strategy, React News can reveal.

Cushman & Wakefield has been appointed to seek offers for the Market Gate mall, with offers in the region of £18m sought for the 135,000 sq ft scheme, according to market sources. The sale figure represents a net initial yield of 7.5%.

Chenavari, with Roubaix Group as asset manager, have revamped the Lancaster centre since taking control. The duo redeveloped the Lancaster marketplace space and created a 45,000 sq ft unit, which was subsequently let to Primark on a 15-year lease. The centre is majority let to Primark – with a rent roll weighting around 65% – which has an unexpired lease term of over 11 years.

The asset management strategy has been supplemented by the rebasing of rents and re-gearing a number of key tenants. Market Gate’s rent roll also benefits from substantial top up from the carparking provisions on offer at the asset.

Market Gate is the dominant shopping centre in the retail heart of the town and tenants include well-known brands such as New Look, WH Smith, Waterstones and Caffe Nero together with a direct pedestrian link into Marks & Spencer.

In 2014, it represented the first acquisition for Roubaix Group, a niche property investment business newly founded by Chris Beckerman, who has over 20 years’ experience in the field of retail investment, development and management. Roubaix typically targets lot size ranging from £5m to £100m. The acquisition was supported by Chenavari.

Chenavari and Roubaix Group did not respond to requests for a comment.