This article is from the Australian Property Journal archive

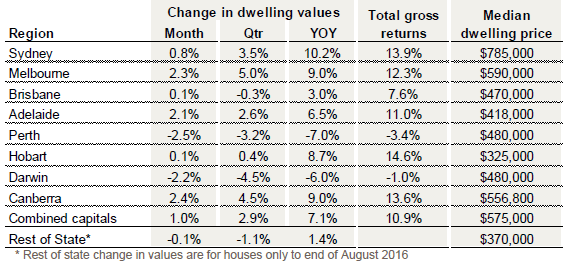

HOUSE prices across the national rose by 1% in September and 2.9% over the quarter. However not all cities experienced growth with Perth prices falling to 2007 levels.

According to the latest CoreLogic Hedonic Home Value Index, the combined capital city index, which is heavily weighted towards the Sydney and Melbourne markets, recorded a 1.0% month-on-month gain, taking capital city dwelling values 41.3% higher since the growth cycle commenced in June 2012.

The top performing market was Melbourne where dwelling values pushed 5.0% higher over the third calendar quarter, due largely to a strong rise in house values (+5.2%) which balanced a softer result for the unit market (+2.9%). Canberra showed the second highest rate of growth over the quarter with values up 4.5%, followed by Sydney at 3.5%.

The quarterly pace of capital gains in Sydney peaked over the June quarter of 2015 at 7.4% and, similarly, Melbourne’s quarterly rate of capital gain peaked at 7.9% over the same quarter.

On the other hand, the weakest housing market was Darwin where dwelling values declined by 4.5%, to be 11.1% lower than the most recent 2014 peak in property values and 13.9% lower than the previous 2010 peak in dwelling values.

Perth prices also fell 3.2% over the quarter to take the cumulative decline in values to 10.4% since their December 2014 peak, and 5.2% below the previous peak in 2010.

Darwin dwelling values are now roughly equivalent to what they were seven years ago, while in Perth, dwelling values have retraced back to 2007 levels.

Brisbane dwelling values also slipped lower over the quarter falling by a marginal 0.3%, attributable mostly to larger declines across the unit sector.

While modest declines were recorded across most of the ‘rest of state’ housing markets, the weakest conditions continue to be experienced in regional Western Australia, where house values have fallen 12.4% over the past 12 months.

While Sydney and Melbourne continue to lead the way, the index found the markets are not as strong as it was at the peak.

Growth continues to be supported by high auction clearance rates which are now at their strongest levels since the June 2015 quarter. In Sydney, clearance rates remained above 80% throughout September, while Melbourne clearance rates have consistently been above 75%, albeit on substantially lower volumes than a year ago. The top three auction markets for spring activity have been: Inner Melbourne (780 auctions over the four weeks of September with a clearance rate of 75%), Melbourne’s Inner South (560 auctions with a clearance rate of 82%) and North Sydney/Hornsby (545 auctions with a clearance rate of 85%).

The most successful auction markets have been Sydney’s eastern suburbs where 89% of auctions were successful during September, Melbourne’s Mornington Peninsula (88% of auctions cleared) and Sydney’s Ryde (87% of auctions cleared).

Australian Property Journal