During these challenging times, few property sectors are set to emerge from the crisis potentially reinforced; logistics is likely one of them. The sector benefitted from strong demand fundamentals driven by the growth of online retail, this has been supported further by the current lockdown.

The sharp uptake of online retail, particularly in categories such as groceries that previously recorded lower internet sales, has likely increased the speed of transition from traditional retail to ecommerce – so while the destination in terms of online penetration levels may not have changed, the journey could prove shorter than previously anticipated.

Demand: Near-Term Pause Doesn’t Affect Longer-Term Resilience

At the end of last year, UK logistics saw a record 10m sq ft of space ‘under offer’ foretelling a potentially strong start for 2020. The majority of under offer deals and other pre-Covid-19 commitments are progressing, but because of current market uncertainty, take-up for Q1 will be lower than expected. With some prospective deals on hold until the dust begins to settle – especially operationally geared third-party logistics (3PL) occupiers dependant on retail sales and general business activity – a slowdown is inevitable in the near-term, albeit some delayed deals from Q1 might smooth the decline.

Demand is unequal. Increased for demand and home delivery for groceries, medicines, cleaning products, sports equipment, electronics and DIY items is driving a surge for short-term space requirements. Most of these needs have been satisfied either via taking back space formerly categorised as surplus or via using 3PL’s grey space.

While other areas are seeing lower activity, primary of which is fashion, and this comes despite the closure of physical stores as consumers focus on essential purchases. This initial response may continue as consumers reduce non-discretionary spend beyond the lockdown on the back of falling income levels and concerns about the economic outlook. The impact of temporary closures of manufacturing and assembling factories (due to supply chain issues and social distancing) appears to be broad, with some areas such as the motor industry being particularly affected in the near-term.

Supply: Delayed Deliveries Support Rents

New logistics supply continues to remain tight amidst the shortage of labour and construction supplies, with many schemes under construction on pause. Furthermore, with developers having frozen new scheme launches, and adopting a wait-and-see approach, the pipeline of deliveries is likely impacted well into next year.

However, any supply squeeze is unlikely to be long-lasting given very short build times (6-12 months typically versus 2-3 years for other property types). In the medium-term, with acceleration in certain trends – i.e. online groceries and greater prevalence of home working and cloud computing – greater emphasis will be placed on bespoke industrial units such as cold storage and data centres.

Even during these challenging times, the logistics occupier market continues to be supported by sound fundamentals – and while the nature of the demand is further evolving it is nonetheless likely to keep growing. Prime rents for big box logistics showed 1.6% growth in Q1 2020 for the South East and reflects strong demand, this may naturally pause as activity reduces, but the underlying strength is likely to persist given the demand-supply dynamic.

Investment Thesis: Stronger Than Past Crisis

Current occupier outlook is favourable compared to that witnessed in the Global Financial Crisis. The logistics sector in the UK has drastically transformed during the last decade due to the ecommerce revolution. Back in 2008, internet sales were only 4.9% of total retail sales while in 2019 the figure increased to 19.2% – the highest in Europe and among the highest in the world.

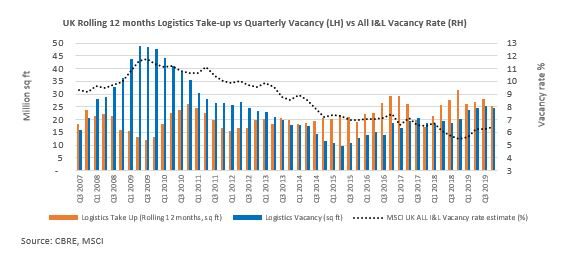

Additionally, supply is moderate, MSCI estimated vacancy rate for ‘all industrials’ at the end of 2008 was c.10% compared to the much lower figure of 6.4% at the end of 2019. The development pipeline is also far more driven by preleasing – at the end of 2008 an estimated 40% of the units under construction were speculative schemes, a much higher percentage compared to the latest figure of below 20%.

The combination of lower speculative supply and a pause in development activity mentioned earlier is likely to support rental levels near-term.

While investors are not pulling out of the logistics market, many have adopted a wait-and-see approach. Big players remain on the lookout for standing investment opportunities, especially where pricing is more attractive and/or competition is less fierce.

Appetite for developments is naturally lower given the increased uncertainty. While there have been some repricing attempts, none appear to be successful so far, as yields have remained stable during the first quarter of year. We are seeing interest in sale and leaseback opportunities, as distressed retailers have adopted that strategy and are currently putting their warehouses in the market in order to accommodate cash flow challenges due to their store closures.

In conclusion, the logistics sector is still seen by investors as well positioned to weather the current crisis. Time will tell if logistics are asymptomatic to Covid-19 or just mildly affected, but so far many will agree they should be placed in the low-risk category. As a result, we expect quality assets offered to the market to attract good interest, in particular as there is a general lack of investable logistics product.