This article is from the Australian Property Journal archive

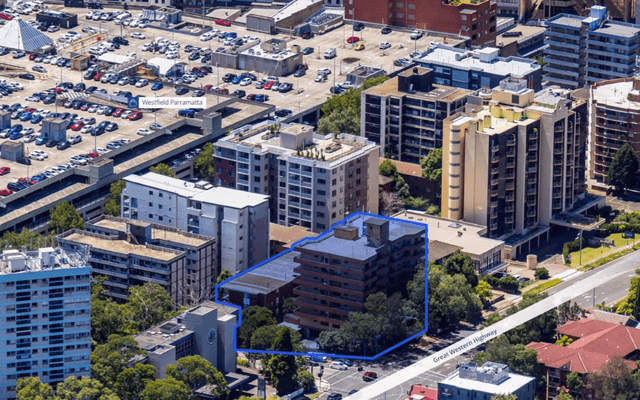

IT now takes 40 years to own a house in Sydney and Melbourne, but home buyers in Sydney’s inner western suburb of Strathfield on a median income would spend 144 years to pay off an average mortgage.

Analysis by proptech platform HtAG Analytics has found that housing affordability has continued to decline.

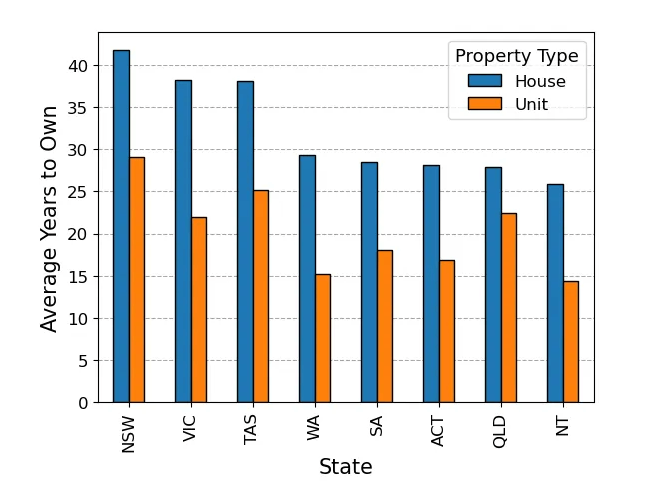

NSW is the least affordable location for houses, taking 42 years to pay down based on median home prices and median family income levels. In Victoria, it takes 39 years, and in Tasmania 38.

Strathfield is the least affordable suburb in the country going by the “years to own” metric, followed by Gerroa (125 years to own) and Chinderah (124 years) in NSW. Queensland’s least affordable location is Sunshine Beach in Noosa, at 120 years, and Victoria’s is the eastern Melbourne suburb of Balwyn, at 110.

The most affordable suburbs were found in Morowa in WA, at just 4.4 years, Kambalda East in WA (5.19 years) and Dysart in Queensland, (5.97 years).

For units, Soldiers Point in NSW was the most unaffordable location in the country, requiring 82 years of payments to own a house outright. Noosa Heads was next, at 75 years, and then Byron Bay at 74 years.

Units in Mt Isa in Queensland only require 3.5 years to pay off.

HtAG Analytics co-founder, Alex Fedoseev said the Sydney and Melbourne property markets have now reached an unaffordable level compared to the rest of the country. In states like South Australia and Queensland, the gap between owning a house and a unit is relatively smaller, indicating a more balanced property market, he said, while in contrast, NSW and Victoria exhibit a larger disparity, demonstrating the dominance of higher-priced houses in those markets.

Fedoseev said high house prices coupled with a prevalence of renters or exclusive locations with generational wealth are the two common factors that contribute to the consistent unaffordability of suburbs with years to own above 100.

“In these markets, a significant portion of the population is engaged in renting units rather than owning a house,” he said.

“While the majority of household incomes in these suburbs may suffice for renting or owning a unit, they may not be adequate for purchasing houses.

“This leads to a property market that primarily supports rental properties in units and maintains high house prices.”

The data follows Real Estate Institute of Australia figures showing mortgage holders were facing the worst housing affordability since September 2008 by the end of the March quarter – before the Reserve Bank’s interest rate hikes in May and this month. Housing affordability, rental affordability and first home ownership all declined over the first three months of 2023.

This month’s 0.25% rate hike to 4.1% – its highest level since 2012 – would add $76 to monthly repayments on a $500,000 loan, which would have jumped by $1,134 since April last year. More than 1.4 million Australians are now in mortgage risk, or 29.2% of mortgage holders.

Fedoseev said the years-to-own figure in Strathfield has ballooned from 84 to 144 years within a span of three years, because of the already high house prices, reduced affordability as interest rates have risen and the wide disparity of incomes within the suburb.

Fedoseev said he expects the most unaffordable suburbs to see slower growth than more affordable areas going forward.

“Suburbs with high ‘years to own’ values are likely to experience downward pressure on house prices, as locals may struggle to afford purchasing houses as prices rise and incomes lag,” he said.

“However, there are other market variables that may still push the prices up even in low affordability markets.

“The key driving forces contributing to decreasing affordability in the housing market are suggesting that the situation may get worse before improving,” he said.