This article is from the Australian Property Journal archive

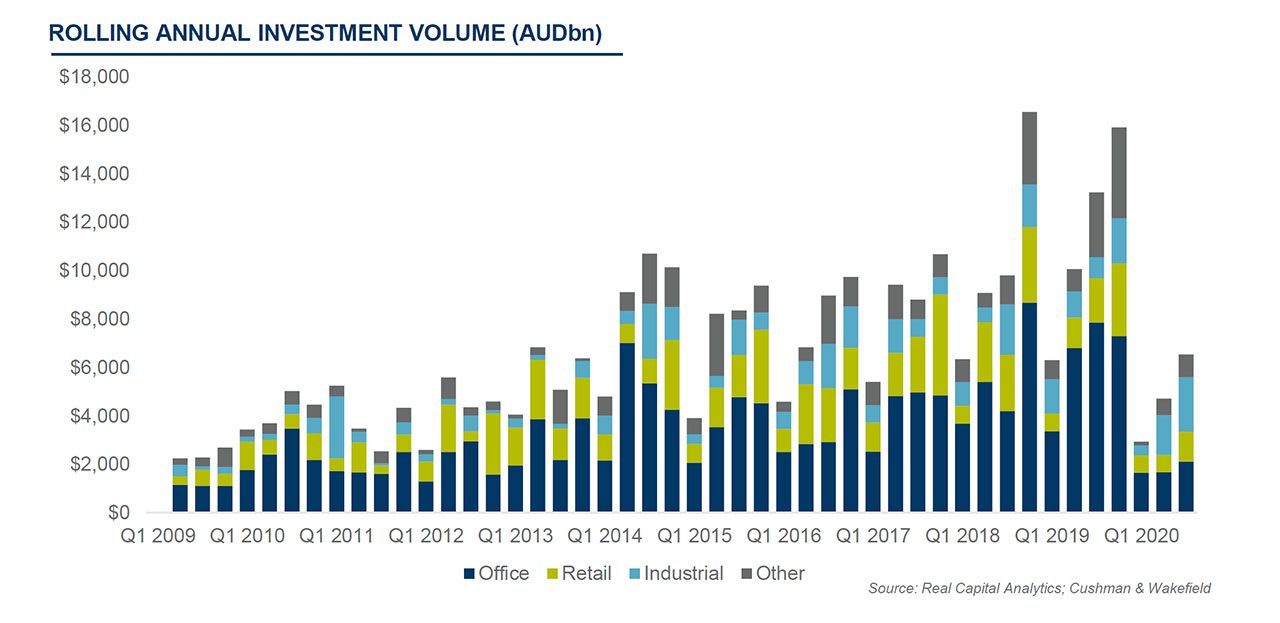

INDUSTRIAL transactions outpaced office volumes for the first time in almost 10 years during the September quarter, as investment into Australian commercial real estate continued a slow rebound in line with most of the country coming out of lockdown.

According to Cushman & Wakefield research, total transaction volumes hit $6.5 billion, up 38% from the June quarter total of $4.7 billion.

Cushman & Wakefield believes that while overall investment activity in commercial real estate assets remains subdued amid the COVID-19 pandemic, a growing pipeline of deals is expected to support further growth in the December quarter and into 2021.

Industrial assets led the way with $2.24 billion in transactions, compared to $0.9 billion in the same period last year. The sector has found itself a beneficiary of online shopping habits that have been accelerated during the pandemic.

Major deals during the quarter included Dexus’ sale of six assets into its joint venture vehicle with GIC, the Dexus Australia Logistics Trust, for $270 million, and Charter Hall’s acquisition of the OIA Glass portfolio for $214.6 million and the automotive logistics park in Minto from Qube for $207 million.

Quarterly investment into the office market totalled $2.12 billion, making September the second time on record that industrial volumes outpaced office investment, accounting for 36% of all transactions. The last time this occurred was in the first quarter of 2011, owing largely to Goodman Group’s $2.5 billion acquisition of the ING Industrial Fund.

Major office deals in the quarter included Dexus’ sale of Riverside Plaza for $454 million to Deka Immobilien and 222 Exhibition St in Melbourne to GIC for $205.7 million.

Simon Fenn, managing director, commercial real estate NSW at Cushman & Wakefield said that assuming the COVID-19 virus is contained, office sales volumes are expected to increase in the final quarter and will be higher again in the first half of 2021.

“Many owners now better understand the depth and quality of the buyer demand, where the capital is coming from and how it is pricing assets, so are increasingly confident about deciding which assets to sell.”

Growing vacancies in the country’s office towers is threatening to slash values in the sector. According to quarterly figures from JLL, vacancy rates in both the Sydney and Melbourne CBD ballooned to double-digit territory as corporate Australia reassessed their space requirements. Addressing the JLL figures, Macquarie analysts reaffirmed the expectations of a 5 to 15% decline in asset values “driven by reducing income assumptions”.

Retail continued to lag other sectors, albeit improving from $719 million to $1.25 billion, with the “other” category increased from $939 million to $680 million.

John Sears, Cushman & Wakefield head of research, Australia and New Zealand said activity has picked up each quarter during 2020 across all commercial asset classes.

“Overall, we expect that transaction volumes will remain below average until an effective and widely available vaccine is developed, however, our outlook is that volumes will continue to gradually build in the December quarter and beyond.”

NSW led the states with the highest volume of transactions in the quarter, at $2.5 billion in transactions, accounting for 38% of the national total. This was closely followed by Victoria recording $2.1 billion, or 32% of activity – despite Melbourne going back into lockdown during the period – and Queensland with $521 million, equating to 8%.

Foreign investment into Australian commercial real estate fell from 42% to 26%, dipping well below the average of about 40% over the past seven years as international travel stymied in-person inspections and negotiations.

Singaporean investors were the most active during the quarter, with six transactions totalling $875 million. Keppel REIT underpinned the total with the $306 million acquisition of Pinnacle Office Park in Sydney’s North Shore.

Germany was the other major source of offshore capital with two purchases worth $603 million.