This article is from the Australian Property Journal archive

INVESTORS have stormed back into the retail market at Burgess Rawson’s Melbourne auction, with 14 out of 15 offerings changing hands after lacklustre results at the Sydney edition on Tuesday.

The overall result included two assets that sold before yesterday’s event at Crown Casino, and one that passed in. David Scholes of Auctionworks handled proceedings, which saw 12 properties sell under the hammer.

A First Choice Liquor outlet in the border town of Albury sold for $6.6 million. The 3,036 sqm site at 417 Dean Street has a new lease to Coles Group Ltd until June 2023 plus further options, returning $341,903 per annum plus outgoings. It includes a frontage of 111 metres and 43 on-site parking spaces.

Another Coles-leased liquor outlet, the Liquorland at 69 Railway Avenue in Townsville, sold for $930,000. The 506 sqm site has a 174 sqm building area and is leased on a 15-year term until 2021 plus options to 2046, and returns $57,632 per annum.

Childcare centres again played a leading role in proceedings. The 137-place Elements Childcare centre in Geelong West sold for $5.45 million with a new 15-year lease plus options to 2052, bringing $345,530 per annum net. It occupies a 2,481 sqm corner site at 149-153 Church Street.

The $2.7 million sale of the Anderson Road Childcare centre, at 145 Anderson Road & 1a King Edward Avenue in Melbourne’s Sunshine, closed the day’s proceedings. The 1,724 sqm site traded with a new 15-year lease until 2033 and two 10-year options, and returns $187,650 per annum net plus outgoings and GST.

The G8 Education centre at 19-21 Greensted Grove in Roxburgh Park sold with a 10-year lease to 2024 and options until 2044 for $2.67 million. It has a modern 528 sqm facility licensed for 85 places on a 2,039 sqm site, and brings $153,628 per annum net plus GST and outgoings.

Another G8 Education Centre, at 103-105 Main South Road in South Australia’s Reynalla, sold prior auction with a 15-year lease and options to 2044, bringing $112,486 per annum net plus GST.

Making it a double for South Australian assets selling before the auction, the Maitland Pharmacy site of 785 sqm traded with a 10-year lease to Noel Allen Group until 2027 and options until 2037 with a return of $35,000 per annum. It has a 173 sqm pharmacy and 124 sqm storage building used by the tenant.

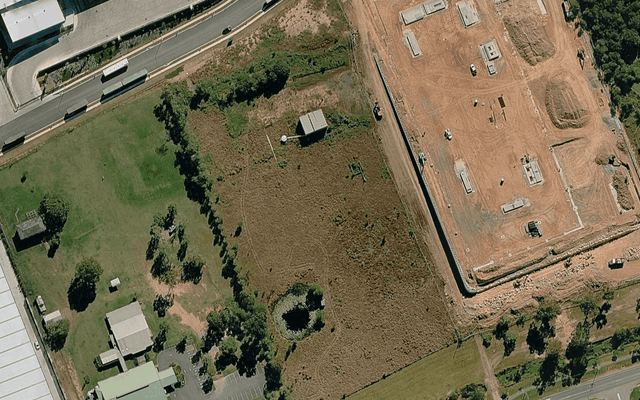

The Goodstart Early Learning centre at 187-191 Bruce Highway in Queensland’s Edmonton sold for $3.6 million, with a triple-net lease until June 2024 and a further five-year option, bringing $281,808 per annum plus outgoings and GST.

The Dulux showroom at 1&2, 8 Oleander Drive in Mill Park sold for $1.955 million with a renewed lease until 2023 and option until 2028. Zoned Commercial 1, the 507 sqm building is over two titles and returns $114,000 per annum.

A Woolworths Petrol station in the New South Wales south coast town of Moruya sold for $910,000. The 1,432 sqm highway site has a 112 sqm convenience store and 550 sqm canopy area and brings around $44,200 per annum net.

An as-new 678 sqm two-storey medical centre building at 116-118 Corio Street in Shepparton sold under the hammer for $2.42 million. Zoned Activity Centre 1, the 918 sqm site has a 68 sqm frontage and has a 10-year lease to 2027 and a 10-year option returning $155,250 per annum net.

Another Shepparton asset, a two-level, 517 sqm refurbished office building at 222-224 Wyndham Street, leased to the Victorian Government and contractors John Holland, sold for $1.25 million. It is on a 510 sqm site zoned Activity Centre and returns $91,947 per annum.

In Victoria’s north-west, a Swan Hill office building of 480.5 sqm at 152-162 Campbell Street sold for $2.33 million. It is leased to national operator Tristar Medical Group with a lease until November 2025 and options to 2035.

The 834 sqm Merri Health offices in Melbourne’s inner-northern suburb of Coburg, with a brand-new, $1.2 million fit-out, sold for $2.56 million. It has a five-year lease to the community health provider until 2022 and an option to 2025, with an annual rent of $204,960 per annum.

Australian Property Journal