This article is from the Australian Property Journal archive

REAL estate private equity firm Altis Property Partners has bought an industrial park at St Leonards on Sydney’s lower north shore from Orchard Funds Management for $86.75 million.

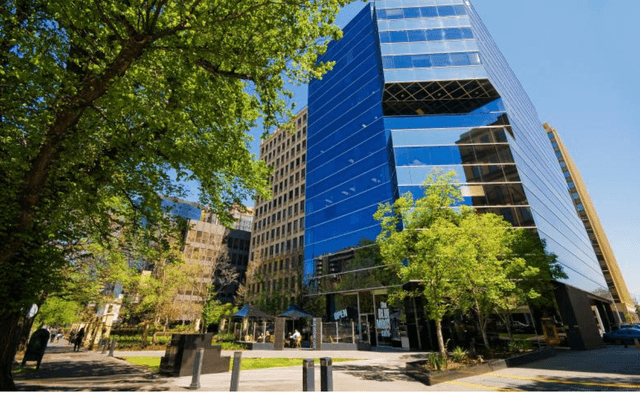

The property at 39 Herbert St is located in the heart of the St Leonards/Artarmon.

The asset comprises 22 industrial units of 25,026 sqm net lettable area and two office buildings of 10,304 sqm NLA plus 683 car spaces. The property has a diverse income profile and is 92% leased to 20 tenants with a current weighted average lease expiry of 4.6 years.

The price reflects a capital value of $2,440 per sqm and a passing yield of around 9.20% and over 10% on a fully leased basis. This property is being acquired 50% by AREEP #1 and 50% by two AREEP investors as a direct co-investment.

The purchase is a bargain for Altis because Orchard bought the asset in 2007 for $111 million, reflecting a yield of 6.25% at the time.

Altis principal Shaun Hannah said the property was a high quality estate on a 3.7 ha site in a tightly held established market.

“We believe there are opportunities to improve the income and lease profile through a range of active management strategies.

“This transaction is on the back of the recent acquisition of the PGA National Industrial Portfolio and previous purchases in North Sydney and Smeaton Grange. We have acquired nearly $200 million worth of high quality, income producing assets at or below replacement cost over the last 12 months,” he added.

The property was marketed through agents from CB Richard Ellis and Savills.

PropertyReview