This article is from the Australian Property Journal archive

PERTH’S office market has stepped further along the recovery path, posting consecutive quarters of positive net absorption since the beginning of 2018.

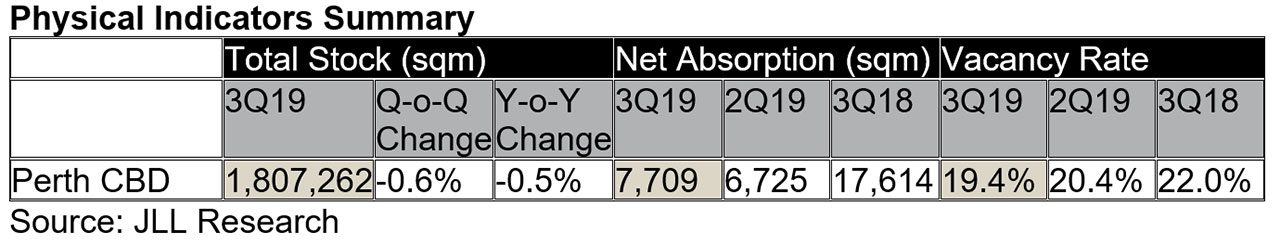

JLL research shows the CBD recorded a 7,700 sqm in the September quarter, and 39,800 sqm over the 12 months to September. Vacancy remains elevated at 19.4%, but the spread between prime and secondary grade stock – at 14.4% and 27.2% respectively – remains wide, reflecting an ongoing flight to quality.

Ronak Bhimjiani, JLL’s manager of strategic research, said the 1% decrease in the Perth CBD overall vacancy rate over the three months to September is the largest quarterly decrease in vacancy in comparison to other states.

“The Perth CBD leasing market has experienced a tangible improvement in leasing conditions during recent times. Net absorption has remained positive since 1Q18, with over 73,900 sqm of office space taken up since then.

“It is anticipated that positive demand will continue over the rest of 2019, which will lead to a continued downward trend in the overall vacancy rate.”

Lease expiries and the opportunity to upgrade office space is likely to drive activity from existing CBD tenants, while secondary vacancy is expected to remain elevated as a result of occupier upgrades.

The long-term spread between Perth and Sydney CBD average prime yields is 145 basis points, which widened to 206 bps in the September quarter.Recent mining investment and public infrastructure announcements in Western Australia is positive for sentiment across the Perth CBD, and expected employment growth is expected to drive positive demand for office space, as well as provide investment opportunities for new entrants who may now consider entering the Perth market to establish or expand their business footprint, Bhimjiani said.

“This, together with the limited number of purchasing opportunities should enable the Perth CBD office market to sustain strong investor appetite going forward,” Bhimjiani said.

Among the most recent deals include conference, function and meeting venue company Karstens leasing 988 sqm across the whole of level one at 111 St Georges Tce in a deal negotiated by JLL’s Nick Van Helden, and representing the group’s entry into Perth.

Van Helden said enquiry levels remain strong overall with strong interest from new tenants entering the Perth CBD market. JLL has transacted over 12,000 sqm of new tenant deals this year so far.

More broadly, other fresh leases include Worley taking up 10,706 sqm at 240 St Georges Tce; St John of God taking 5,232 sqm at 556 Wellington St; WeWork signing up for 3,414 sqm at 45 Francis St, and the Minister for works leasing 10-year leases on St George Tce of 3,222 sqm at number 55 and 3,077 sqm at number 32.

Chevron renewed its lease of 14,699 sqm 256 St Georges Tce, ahead of its move into a new $360 million office tower at Elizabeth Quay, expected in 2023, while Rio Tinto renewed a lease over 6,784 sqm at 95 William St.

In its July Office Market report, the Property Council had Perth vacancies down slightly to 18.4%, while Knight Franks says the current advertised levels sit at around 15.4% for the core CBD and providing an indication of where vacancy figures may be heading.