This article is from the Australian Property Journal archive

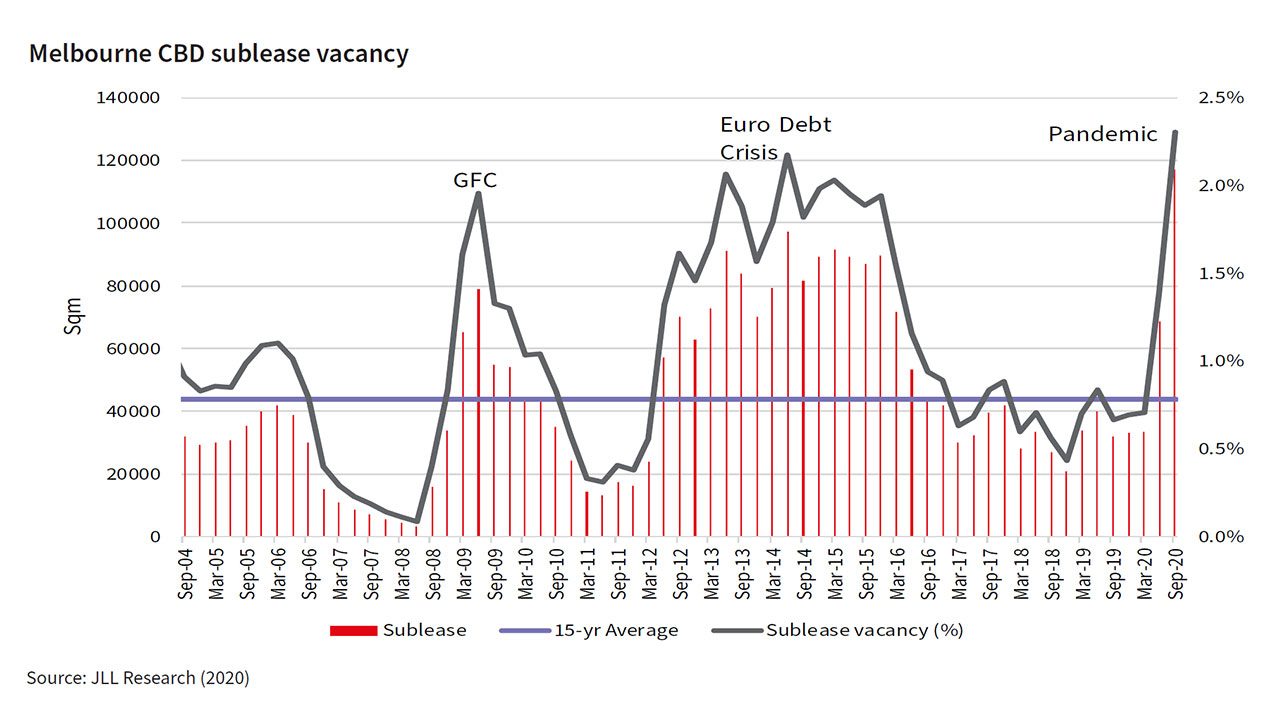

SUBLEASE vacancy rates are increasing in the Melbourne CBD office market, to levels above the euro debt and global financial crisis as the Victoria government announced office workers will be permitted to return at the end of month.

According to a new report from JLL Research, while sublease vacancies in Melbourne’s CBD office market are below their recorded peak of 3.1% in 1993, at 2.3% sublease vacancies in October are above the 2.0% recorded in the GFC and the 2.2% seen during the Euro Debt Crisis.

These numbers are compared to 2017-2019 numbers that ranged from 0.6% to 0.9% of total stock, with the first quarter of 2020 before the onset of the global pandemic recording sublease vacancies of 0.7% of total stock.

Sublease vacancy increased to 1.4% in quarter two of this year, before the third quarter experienced the second wave of restrictions and jumped to 2.3% of total stock, or 117,200sqm.

“Melbourne’s CBD office supply cycle has delivered seven brand new office assets (329,000 sqm) to the market in 2020. Overall, the assets are 95% pre-committed to 41 tenants. At the time of signing their leases, 63% of these tenants, by number, committed to more space than they already occupied,” said Annabel McFarlane, strategic research and senior director at JLL Research.

And while easing restrictions and government incentives such as the JobKeeper wage subsidy contributed to rising positive sentiments in the market and the containment of increasing sublease vacancy, the unique circumstances of remote work increasing during the pandemic, has left many corporate tenants reassessing their space requirements.

85% Sublease vacancies in the CBD are primarily made up of prime grade stock, at 10,300sqm of premium grade and 89,000sqm of A-grade stock. While B-grade stock makes up the majority of the 12% secondary grade sublease vacancies, with 17,800sqm. Only 3% of vacancies are located in C-grade and D-grade assets.

The financial services sector makes up 33% of sublease vacancies, with 38,380sqm, followed by the technological services sector at 18%, with 20,688sqm and the insurance services sector at 12% with 13,956sqm. Sydney, for comparison, has seen vacancies far more evenly dispersed across sectors.

At the precinct level subleasing activity is more evenly dispersed, though the Docklands at 3.5% and Western Core at 1.6% sat well above the average, with 38,458sqm and 28,217sqm respectively. This is compared to the next highest precinct Parliament at 14,380sqm.

However, the proportion of COVID related and non COVID related sublease space by industry, shows the professional services industry as far more effected by the pandemic, with 60% of all subleasing space being COVID-19 related. Compared to finance services and insurance services, who reported 38% and 0% COVID related subleasing space respectively.

The majority of all subleasing activity has been located in the 2,000+ sqm segment of the market, from sectors struggling under COVID-19 and those already predisposed to higher levels of subleasing.

“Sublease space will continue to be attractive for some organisations, providing cost saving and shorter-term leasing opportunities. However there are a large portion of organisations who will continue to gravitate to direct lease opportunities for a range of factors including the ability to design a workplace tailor-made for their specific needs ensuring maximised productivity and engagement, especially important in the post COVID-19 environment,” said Nick Drake, joint lead of leasing Victoria at JLL Research.

Meanwhile Victoria Premier Daniel Andrews yesterday offices will reopen from November 30 in phases, with up to 25% of the workforce allowed to return in the first stage.

“I want to be clear though – unless you’re one of those people nominated by your employer – you need to keep working from home.” Premier Andrews said.