This article is from the Australian Property Journal archive

A PREVIEW of commercial property investment and development opportunities available across Australia.

Submit sale campaigns to news@australianpropertyjournal.com.au, sponsorship opportunities available contact amy.guy@australianpropertyjournal.com.au or marketing@australianpropertyjournal.com.au

Retail

Toowoomba, QLD

A Tradelink showroom will be going under the hammer at Burgess Rawson’s next portfolio auction. The national tenant has been at 213 James Street for 18 years and has a 5+5-year lease running to 2030.

The rental agreement of the 1,971 sqm showroom and warehouse building returns net annual income of $238,100 plus GST, while the property has a high profile highway frontage to 21,000 vehicles passing each day.

Glenn Conridge and Sue Conridge are handling enquiries, with the auction to be held on 29th September at Brisbane’s Crystalbrook Vincent Hotel.

Industrial

Heatherton, VIC

Industrial property investors are expected to pounce on a last mile logistics offering in Melbourne’s south-east.

JLL’s Adrian Rowse and Tony Iuliano have been appointed to sell 18 Fairchild Street in Heatherton, 19km from the CBD by expressions of interest closing Tuesday 12 October 2021 at 4PM (AEDT).

The agents said the property is located within an extremely tightly held location and exhibiting all the characteristics of a genuine last mile asset.

The warehouse/office comprises a GLA of 8,469 sqm, set on a 13,290 sqm site with a significant 107 metre frontage.

It is securely leased to a transport and logistics business State Transport with a weighted average lease expiry of 4.7 years as at 1 October 2021, on passing income of $700,400 p.a. net ($83 per sqm) with 3.5% fixed annual rental growth.

Office

Dubbo, NSW

Dubbo’s only high-rise commercial office building is coming on the market.

Located at 32-40 Church Street, the offering includes Oliver House, a five-storey freehold building used previously as office accommodation with a spread of retail and office on ground floor and telecommunication assets on top floor and roof, adjoining vacant Citadel heritage building and adjoining car parking for 19 cars.

Constructed in the mid 1960’s by the Australian Workers Union (AWU), it was the first high rise development and remains the highest commercial building in Dubbo. The original anchor tenant was the NSW Department of Health over four floors. The first floor was occupied by AWU and others, with a restaurant and hair salon on the ground floor. The building is currently predominantly vacant with a number of telecommunication leases on the roof.

The property is for sale through Nick Lower and Selin Ince of Savills along with Graeme Board of Bob Berry Dubbo.

Lower said this large freehold asset offers flexibility for other uses (STCA) and is zoned B3 Commercial Core with excellent exposure in a busy commercial area.

Board said Dubbo is enjoying rapid growth, from being declared a city of 15,000 population in 1966, it now has a population of approximately 44,000 serving a regional shopping population estimated at 130,000.

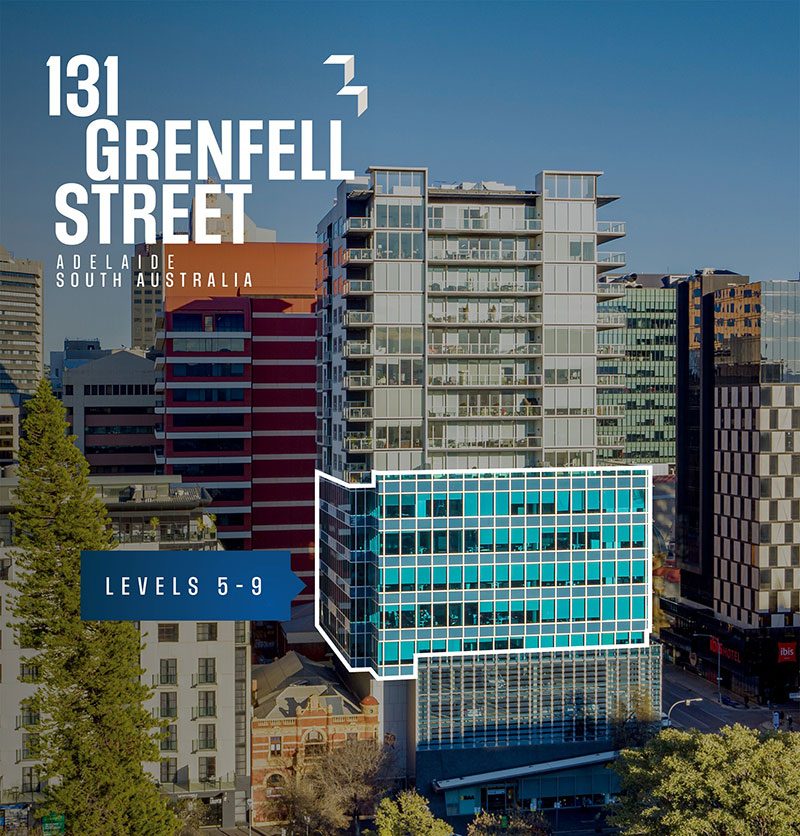

Adelaide, SA

Five floors of office within the 131 Grenfell Street building in Adelaide’s CBD will test the strength of the city’s office market as South Australia is set to reap the benefit from the landmark $90 billion nuclear submarine signed between the Australian, United Kingdom and United States government.

Knight Frank’s Guy Bennett and Oliver Totani, in conjunction with CBRE’s Ian Thomas and Alistair Laycock are handling the sale of Levels 5 – 9 within the 19-storey building via an expressions of interest closing 30th September 2021 at 4PM (ACST).

The offering comes as Adelaide’s office vacancy rate fall below pre-COVID 2017 levels despite the COVID-19 pandemic, according to recent data from the PCA.

The Adelaide office market is expected to benefit further from the defence sector after the Aukus $90 billion submarine deal, which will be built in Adelaide.

Premier Steven Marshall said the deal would be a jobs bonanza for the state.

“There are going to be jobs for today, jobs for tomorrow, and jobs for decades to come thanks to today’s announcements,” Premier Marshall said.

Comprising 4,020 sqm NLA, the five floors are fully leased to the South Australian and Commonwealth governments returning a passing net income of $1.646 million p.a. with 3% to 3.5% fixed annual rental increases.

The weighted average lease expiry is 3.16 years as at 1st September 2021 and includes 10 secure car spaces.

Development

Toorak, VIC

A rare Toorak apartment block, just 4kms from the Melbourne CBD, is up for grabs for the first time in 70 years and tipped to fetch around $9 million.

Agents Teska Carson’s Luke Bisset and Matthew Feld who are managing the expressions of interest campaign for the 549 Toorak Road property said it will likely attract a high level of interest from a broad range of buyers including investors and developers.

“This is an extraordinarily good opportunity, subject to council approval, to capitalise on what is currently a relatively strong market for luxury apartments in a location which has historically provided some of the best, most luxurious residences in the country.

“Based on nearby developments, there is precedent for a four level building located within walking distance of one of Melbourne’s most coveted retail strips – Toorak Village – which is home to a wide range of retail and commercial enterprises, including some very popular eateries and entertainment venues as well as supermarkets and banks, a key driver of the strong tenant/occupier demand,” Bisset said.

The property currently comprises a three level building with 12 strata-titled, two bedroom, apartments and associated parking, with a current income of $162,264 per annum and a potential, fully-let income of $224,304 per annum.

Zoned General Residential the 1,278 sqm site has a wide 24 metre frontage to Toorak Road facilitating any future redevelopment.