This article is from the Australian Property Journal archive

VICTORIAN buyers are growing their focus on townhouse greenfield lots and townhouse developments in response to high house prices in Melbourne, with the land market closing out 2021 with record figures.

According RPM’s latest Greenfield Market Report, the demand pushed greenfield lot prices across Melbourne’s growth corridors and Geelong up 6.4% in the December quarter to a record $347,000.

Buyers emerged out of the Delta lockdown with an intent to purchase. There was 6,793 lots sold during the quarter, a 2% increase on the same period in 2020 that had already been boosted by the federal government’s HomeBuilder package.

“2021 was a year of records for Melbourne’s greenfield land market and it’s clear an increasing number of buyers have turned to it as a more affordable choice as median house prices soar well past the million-dollar mark,” RPM managing director project marketing, Luke Kelly said. Median house prices in Melbourne hit $1,125,000 – a 4.2% increase from the third quarter and 21.9% higher over a year.

Activity in the englobo land sector eclipsed previous market peaks, with $3.8 billion in major land transactions recorded in 2021 as developers sought to replenish their pipelines at a pace that RPM described as “unsustainable long-term”. Greenfield land transactions totalled over $1.2 billion in the December quarter alone, comparable to the entire value of land transacted in 2020, and spanned 2,300 hectares – the equivalent of 35,000 lots.

Momentum in sales activity bought the average time on market down to just over a month as total lot supply was reduced by nearly 20% to 2,300 lots. There were 6,104 lots released in the quarter.

“Key challenges that many developers now face as a result of burgeoning consumer demand is how to sustain supply in the market and effectively manage long title timeframes, caused by a construction backlog impacted further by nationwide materials and labour shortages,” Kelly said.

“This year, we expect to see more developers begin to drip-feed vacant land releases to give them time to catch up on construction and lower long-term risk factors.”

The supply deceleration and high demand will “no doubt” apply more upward pressure to vacant lot prices.

Lot sizes continued to shrink, down 3.1% to 380 sqm, with RPM predicting a continued growth in townhouse product from both a supply and demand perspective.

“Looking at how prices are performing and with the potential of tougher borrowing restrictions, RBA rate rises on the horizon and international borders reopening, the need and popularity of townhomes is only set to grow, particularly among the first home buyer cohort,” Kelly said.

First home buyers accounted for 46% of townhouse purchasers in the quarter, and over a third of all townhouse purchasers were single buyers.

Western corridor dominant

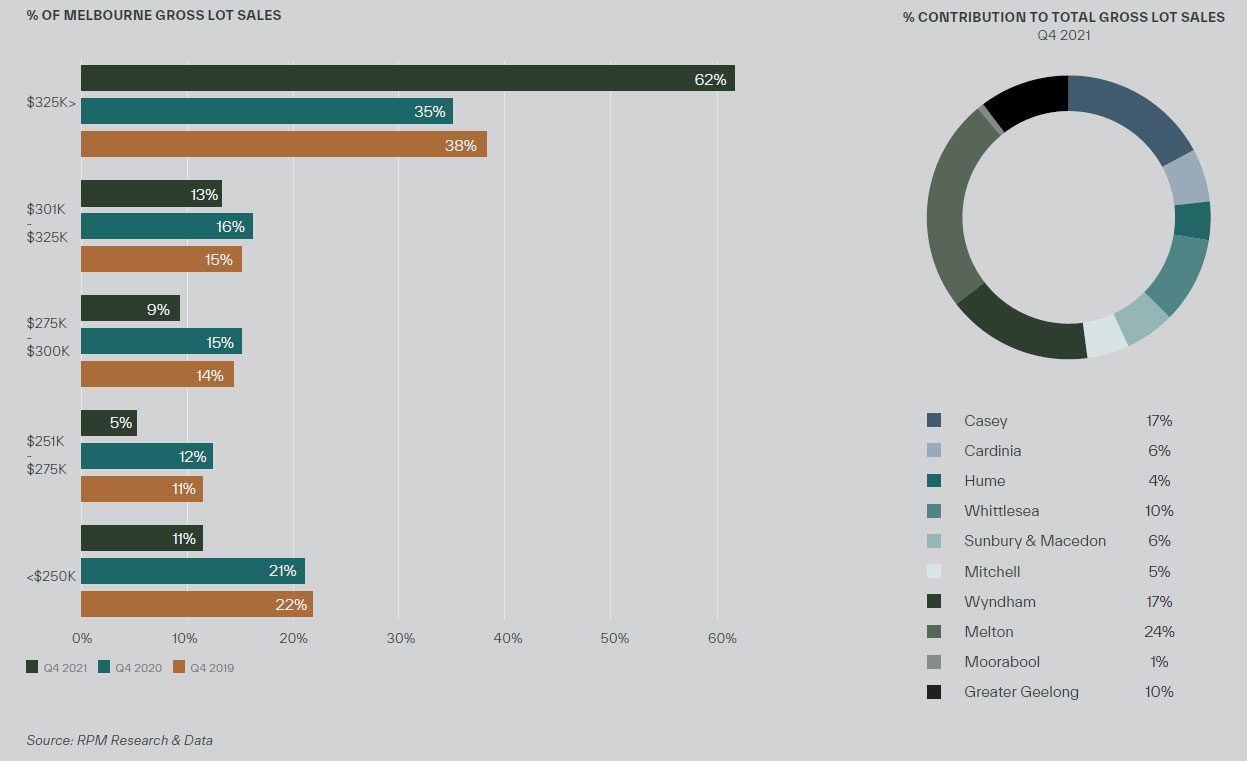

Melbourne’s western growth corridor – incorporating Melton, Wyndham and Bacchus Marsh – maintained predominant proportion of sales activity across the growth areas with 42% of market share. Sales eased from record highs in the quarter to 2,839 lots, but this was still 11% higher than the same time a year earlier and driven by Wyndham’s 28% annual growth. Median lot sizes in the corridor fell by a further 5.1% in the quarter to just 356 sqm, notably smaller than other growth corridors.

Lot sales contracts in the northern corridor over the year by 7%, while nearly 1,500 new lots were released, increasing annual supply by 45%

The south east growth corridor, consisting of Casey and Cardinia, increased its share of total sales to 23% and annual sales rose by 11% to 1,577 lots. New supply closely matched sales activity with 1,457 lots released, and demand clearly favoured newly-released stock, with average time on market less than a month. The gap in lot prices widened over other growth areas. Casey’s median lot price increased by 12% to surpass $400,000 in the December quarter 2021, the first instance recorded by a municipality in the growth areas.

Active estate numbers across Geelong almost halved over 2021 and the corridor experienced 22% quarterly and 18% annual fall to 700 lot sales, with the corridor’s share of sales falling to a long-term low of just 10%.