This article is from the Australian Property Journal archive

DEXUS has confirmed the capital raise for its Wholesale Airport Fund (WAF) – offering stakes in Melbourne and Launceston airports – exceeded the $130 million target.

The Australian Financial Review has reported Dexus raised nearly $200 million for the fund, which owns a 1% investment in the unlisted Australia Pacific Airports Corporation.

The additional funds offer capacity for further potential acquisitions to grow its stake in APAC.

It is the first fund Dexus has brought to market since first completion of the acquisition of AMP Capital’s domestic real estate and infrastructure businesses.

“WAF offers a rare opportunity for wholesale investors to obtain exposure to a key piece of privately owned infrastructure, which up until now had been tightly held by institutional clients,” Dexus CEO, Darren Steinberg said.

“The equity raise highlights strong wholesale investor interest in high-quality real assets.”

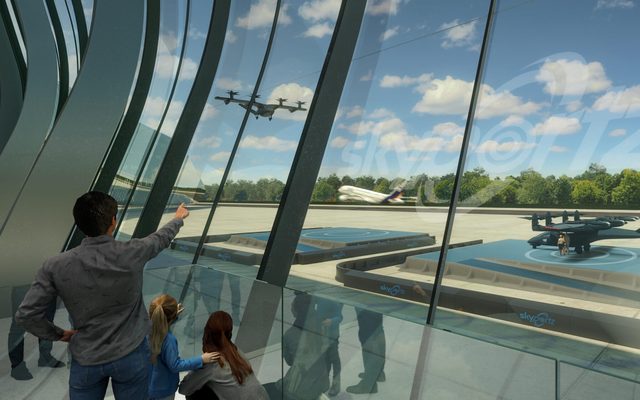

Melbourne Airport has one of the world’s largest airport land holdings, across 2,741 hectares, servicing 39 million passengers annually and operates without a curfew. Its commercial revenues are derived from a range of ground transport, retail and other property activities.

Dexus touted to investors Melbourne being forecast to become Australia’s largest city by 2031 or 2032, with 77 million passengers expected to pass through the Airport by 2042. A planned third runway, future terminal development, land access upgrades and ongoing property development represent medium term opportunities of scale.

In 2021, Dexus acquired Perth’s Jandakot Airport and surrounding logistics and warehouses in a $1.3 billion deal, which attracted a major investment from Cbus Super.