This article is from the Australian Property Journal archive

A HOUSING shortage will see Brisbane, Perth and Adelaide outperform their capital city rivals for house price growth in 2024, according to ANZ, which is tipping national house price growth to slow to 5% to 6% this year.

The major lender is expecting a similar 5% increase nationally in 2025 as more disposable income offsets the alleviation of the current supply shortage.

In its latest Australian housing chartpack, Housing outlook: Price growth to slow, ANZ senior economists Adelaide Timbrell and Blair Chapman said market indicators are cooling nationally.

“Listings and vendor discounts are (modestly) rising, as is median time on the market, while monthly price increases are slowing. Though auction clearance rates strengthened in January, which suggests potential for further price momentum,” they said.

That momentum has carried through to February, with the preliminary clearance rate holding above 73% for three weeks.

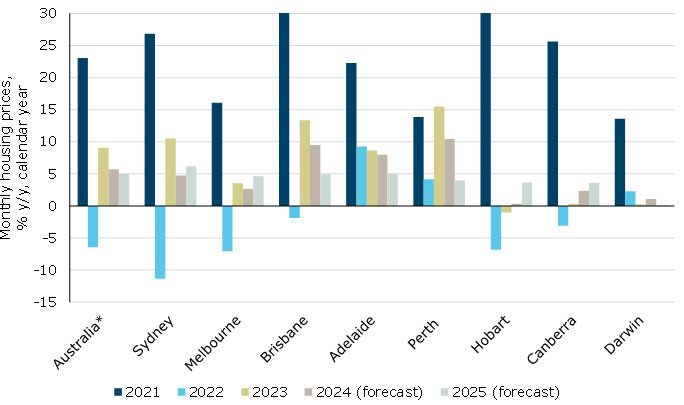

“Price growth will be slower this year. We expect capital city housing price growth of 5% to 6% in 2024 after 9.1% growth in 2023,” they said.

Brisbane, Perth and Adelaide are likely to outperform other cities due to the continued shortage of available homes, they said.

“Housing prices are at new peaks in these cities and lending in their respective states has grown stronger than other states over recent months, particularly for investors.

“Price momentum is much weaker in Sydney and Melbourne moving into 2024, perhaps due to higher sensitivity to rate increases.”

Total listings have increased sharply in Melbourne, have been relatively stable in Sydney, and continue to trend down in Brisbane and Perth.

“We expect prices to rise around 5% in 2025 as increases in household disposable income offset an expected cooling in the shortage of available housing,” Timbrell and Chapman said.

Big four rival NAB earlier this month retained its forecast of a 5% rise in prices nationally this year and 4% in 2025. Commonwealth Bank is also predicting a 5% rise in 2024.

ANZ Research housing price forecasts*

Demand still outpacing supply

Timbrell and Chapman said demand is still outpacing supply, and noted that residential construction activity is still well below its previous peak and demand remains strong as population growth remains elevated amid low vacancy rates and lower-than-average housing listings.

The national vacancy rate fell back to a record low of 0.8% in January, according to Domain.

“We expect housing prices to outpace construction costs this year, which could encourage more building,” Timbrell and Chapman said.

For the moment, building approvals have fallen to their lowest level since 2012.

Supply is the hot topic across the market, as the nation mulls how to alleviate the housing crisis. The Albanese government has introduced a raft of measures to increase supply in a bid to tackle accessibility and affordability of rentals sitting at long-term lows and more and more Australians being priced out of the housing market.

The National Housing Accord has the aim of delivering 1.2 million “well-located” new homes, five years from July. However, the target has been described as “very unrealistic” given building activity rates, construction costs and labour shortages.

The Housing Australia Future Fund is aiming to deliver 20,000 new social and 10,000 new affordable homes over the same five-year timeframe. The legislation passed through Parliament last year after protracted negotiations with the Greens that yielded a further $2 billion in funding for the Social Housing Accelerator that will see another 4,000 homes built.

In addition, the National Housing Accord Facility – part of the National Housing Accord – will aim to deliver a further 10,000 new affordable homes.