This article is from the Australian Property Journal archive

AUSTRALIA will miss its much-vaunted Nation Housing Accord target by hundreds of thousands of homes, according to Oxford Economics Australia, as labour shortages in the construction industry hamper national cabinet’s efforts to boost housing supply amid a national housing crisis.

Oxford Economics Australia’s Building in Australia report forecasts total dwelling completions to total 940,000 over the five years to the middle of 2029 – some 22% below the target of 1.2 million “well-located” homes, with lumpy results between the states and territories.

The negative pass-through of higher interest rates and strong cost escalation to dwelling construction has almost reached its end, the firm says, and it is estimating dwelling starts will end FY2024 down 10% to a trough of 155,700. The latest Australian Bureau of Statistics (ABS) data showed starts fell to their lowest annual level since 2012 in the year to March.

A strong population underpinning demand will result in a dwelling stock deficiency of 146,000 as of June, Oxford Economics Australia says, tipped to grow further to 164,000 by June 2027.

“The biggest drag and the biggest downside is capacity,” Timothy Hibbert, report author and head of property and building forecasting for Oxford Economics Australia told Australian Property Journal.

“We had supply issues early in the pandemic. A lot of the narrative was around access to materials. Now it’s labour – it’s really how some of this resolves and whether the industry is able to adjust to the housing requirements.

“That’s a function of productivity. It’s a function of new entrants into the construction sector in terms of workers, and also those that may be kind of at the end of their career and leaving the sector.”

BuildSkills Australia estimates the country faces the impossible task of finding 90,000 extra tradies to meet the government’s housing program targets, and data from the National Centre for Vocational Education and Research showed building and construction apprenticeship numbers have plummeted by a further 22% year-on-year.

May’s federal budget included a $91 million investment to increase the building and construction workforce numbers.

Hibbert said there are signs of improvement in some of the headline numbers.

“We can see some correction playing through in the backlog. It’s not necessarily across every single state or jurisdiction. There are still areas where it’s really bad, but there has been improvement.

“There’s still some way – a decent way – to go.”

Improving house construction is set to drive the marginal growth forecast of 2% for national total dwelling starts in FY2025 to 158,300.

In some modest welcome good news, growth in construction costs has slowed to its lowest rate in 22 years, CoreLogic’s latest Cordell Construction Cost Index showed.

Hibbert said policy shifts at both the state and federal level, combined with substantial pent-up housing demand, provide a firm platform for the next upturn. Interest rate cuts are expected from early 2025, which Oxford Economics Australia forecasts will be the beginning of a normalisation towards a neutral setting by late 2026.

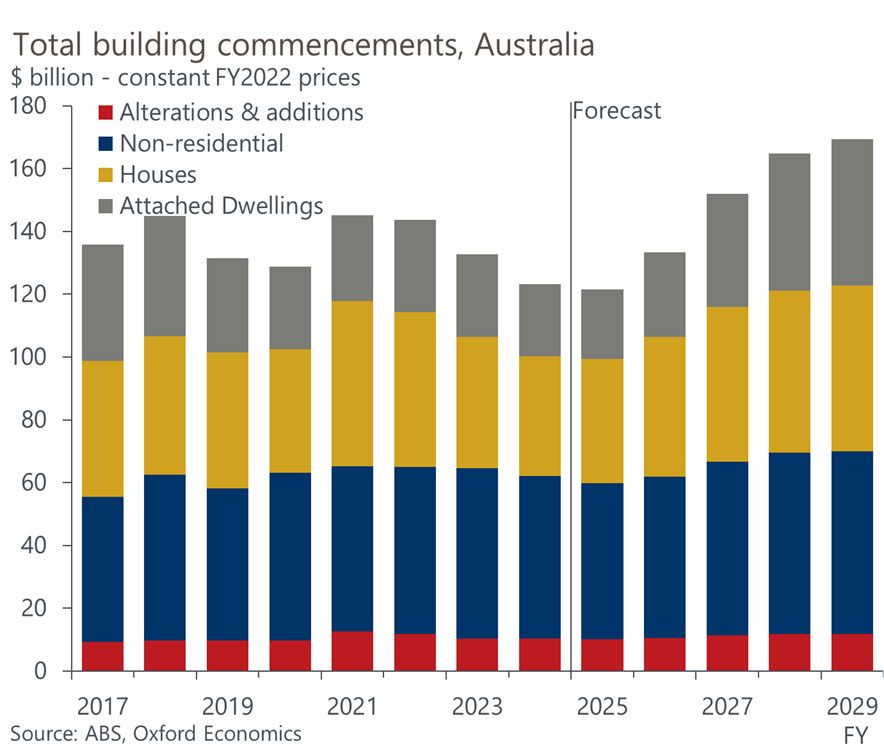

| Total building commencements, Australia | |||||

| $ million – constant FY2022 prices | |||||

| Year ending | Alterations & additions | Non-residential | Houses | Attached Dwellings | Total |

| Jun-17 | 9,229 | 46,331 | 43,223 | 36,983 | 135,766 |

| Jun-18 | 9,642 | 52,940 | 44,109 | 38,233 | 144,924 |

| Jun-19 | 9,643 | 48,587 | 43,225 | 30,112 | 131,568 |

| Jun-20 | 9,684 | 53,505 | 39,293 | 26,273 | 128,754 |

| Jun-21 | 12,527 | 52,703 | 52,654 | 27,224 | 145,108 |

| Jun-22 | 11,794 | 53,272 | 49,306 | 29,243 | 143,615 |

| Jun-23 | 10,263 | 54,256 | 41,801 | 26,488 | 132,808 |

| Jun-24 | 10,311 | 51,865 | 38,070 | 22,863 | 123,109 |

| Jun-25 | 10,125 | 49,801 | 39,438 | 22,063 | 121,427 |

| Jun-26 | 10,549 | 51,396 | 44,395 | 26,893 | 133,233 |

| Jun-27 | 11,308 | 55,293 | 49,283 | 36,138 | 152,021 |

| Jun-28 | 11,784 | 57,789 | 51,599 | 43,640 | 164,812 |

| Jun-29 | 11,858 | 58,148 | 52,686 | 46,654 | 169,347 |

| Source: ABS, Oxford Economics | |||||

WA outperforming, Queensland to shine next

Western Australia has been leading the pack of late, with leads for new house demand including land lot sales and lending for new construction well up on a year ago.

“Queensland is primed as the next to move,” Hibbert said.

“There’s just a lot of very positive investment thematics in the state,” he told Australian Property Journal.

“There’s a very strong investment outlook in the state. The government’s gone on to build a lot of new hospital builds under its Health and Hospitals plan. The 2032 Olympics will have over $10 billion of infrastructure. There’ll be kind of further indirect investment as well that will stem from it. You have kind of also big uplifts in areas like water and renewables as well in the state.

“And we expect that to kind of soak up an increased share of kind of migration as a consequence with that. And it’s going to flow through to residential construction too.”

At the other end of the scale is NSW, which has a target of 377,000 homes over the five-year National Housing Accord period, or about 75,400 per annum.

“In 2019, NSW did produce about 70,000, almost 75,000 dwellings in that one year. But more recently, we expect it’s running closer to below 50,000.”

He said there may be a similar dynamic in Victoria.