This article is from the Australian Property Journal archive

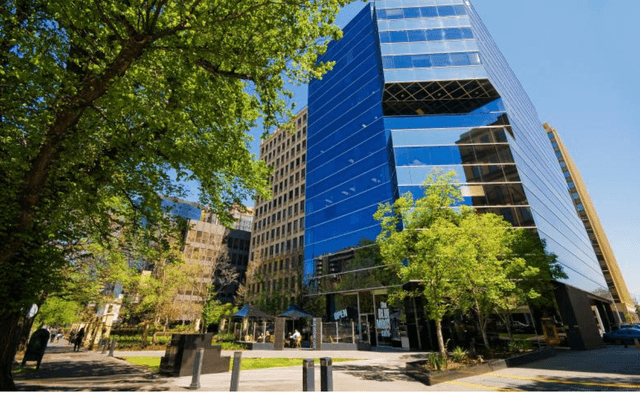

A FUND managed by Deutsche Asset and Wealth Management is selling 575 Bourke St in Melbourne's CBD and it is expected to fetch in excess of $90 million.

Deutsche bought 575 Bourke St from Valad in April 2013 for $70 million on behalf of BVV Germany. And Valad bought the building in 2005 for $50.87 million on a yield of 6.34%.

Colliers International’s Nick Rathgeber and Leigh Melbourne, and CBRE`s Mark Coster and Luke Etherington have been appointed to sell the property.

Rathgeber said 575 Bourke St is the first institutional grade office building offering for 2015 and he expects strong demand from a wide range of buyer groups from within Australia and offshore.

The offering follows the recent sale of 565 Bourke St next door for over $81 million, reflecting a yield of 7.25%, and 710 Collins St which was purchased by Abacus for $76.5 million, on a yield of 6.35%.

“Melbourne witnessed a record year of CBD office investment sales in 2014 with volumes of just over $3 billion easily surpassing the 2013 figure of $2.375 billion,” Rathgeber said.

Coster said the property is a unique opportunity to acquire one of the best located office investments in the Melbourne CBD.

“575 Bourke St is in excellent company, sharing the block with some of Melbourne’s most notable office towers including Bourke Place, CBW, 530 Collins St, 570 Bourke St and AMP Square,” Coster said.

The asset offers unmatched proximity to a wide variety of dining options, public transport, Docklands, the law courts and Melbourne’s retail core, ensuring strong tenant depth.

The 16-level building comprises 16,179 sqm of space with ground level foyer and retail accommodation and a two-level basement car park. It is leased to a diverse mix of tenants in the legal, government, information and finance industry. Logie-Smith Lanyon, the Victorian government and Lit Support have occupied the building for in excess of 10 years.

The property is being offered for sale by expressions of interest, closing prior on April 16.

Australian Property Journal