This article is from the Australian Property Journal archive

A PREVIEW of hotel, commercial property investments and social infrastructure opportunities available across Australia.

Submit sale campaigns to news@australianpropertyjournal.com.au, sponsorship opportunities available contact amy.guy@australianpropertyjournal.com.au or marketing@australianpropertyjournal.com.au

Retail

Lilydale, VIC

A low-risk, high-yielding investment with a long WALE to a national tenant at 446 Maroondah Highway is expected to to sell on a circa 5.5% net yield.

Located on a 6,229sqm zoned Commercial 2 elevated corner site with 100 metres of street frontage, the property is occupied by a two-level 2,412sqm fully-leased building with a carpark allocation for 100 bays.

The building has undergone a $3 million renovation and returns $532,000 per annum with a WALE of nearly 10 years.

The new 10+5+5-year lease to Belgravia Health & Leisure accounts for 96% of the income, while Lilydale Hair Co occupies the 85sqm balance on a new seven-year lease.

Paul Burns of Fitzroys, who is marketing the property with colleague Chris James, said, “The current level of inflation is not expected to persist long-term. Assets purchased now, at historically high yields, will prove to be very prudent investments”.

Hotel & Hospitality

Adrossan, SA

Highview Holiday Village, on South Australia’s Yorke Peninsula coast, has been listed for sale offering development opportunities for potential buyers.

CBRE Hotel’s Scott Callow and Caravan Park Brokers Australia’s Dale Wood, are managing the sale via an Expression of Interest campaign closing 16th March.

The current lease is coming to an end offering the ability to acquire both the freehold and business assets, giving buyers an ongoing trading option or flexibility to expand or develop.

“The substantial land area is currently under 50% utilised which offers development potential across multiple avenues such as manufactured housing, retirement living, or expansion of the existing business,” Callow said.

The 4-star holiday village is situated on 7.46 hectares and comprises of chalets, cabins, ensuite sites, and a large residence. Guest amenities include a laundromat, BBQ areas, an inground pool, and a children’s playground.

Social Infrastructure

Monbulk, VIC

The site of the recently closed Mountain District Christian School east of Melbourne has hit the market, with expectations in excess of $3.5 million.

A gradual decline in enrolments saw the school’s board make the decision to close up at the end of 2022.

Offered with vacant possession, the 325 Macclesfield Road, Monbulk property improvements include classrooms, specific buildings for music, woodworking, arts and technology, performance spaces, food technology and canteen, as well as sporting facilities that include a sports oval, gym and multi purpose hall, outdoor basketball, netball and tennis courts and a nature walking trail

Marketing agent Paul Farrelly of Sutherland Farrelly said the property would be ideal as a second campus or with some modifications converted to a school camp.

Expressions of interest close 22nd March.

Ashwood, VIC

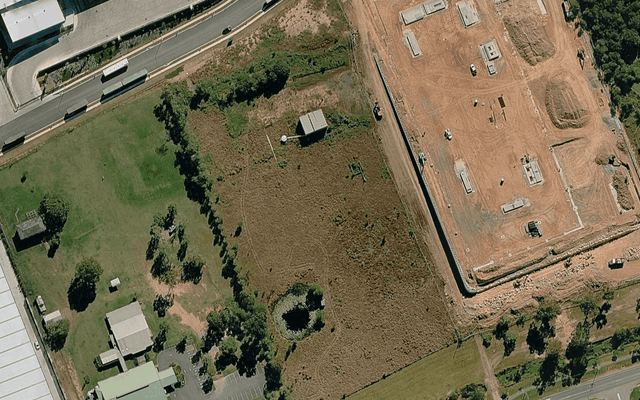

Three high exposure development sites with permit approvals for premium childcare facilities in Ashwood, Chelsea and Mitcham are up for grabs.

Though the sites would also suit a townhouse development, childcare is the preferred planning outcome due to the undersupply of such services in Victoria.

465-467 Warrigal Road in Ashwood sits on a prominent corner site on a key main road. The centre would comprise 104 places.

45-47 Embankment Grove in Chelsea is also a corner landholding, with a permit for 122 places.

403-405 Mitcham Road in Mitcham is on a main corridor and adjoins a linear reserve and placed a short distance from Mitcham’s activity centre on Whitehorse Road, with the permit comprising 98 places.

Two of the three sites have lease agreements in place to a national Montessori Education provider, while all three will feature spacious children’s rooms, outdoor play areas, and modern staff amenities.

Julian Heatherich and Benson Zhou from Savills have been appointed to manage the sale of sites.