This article is from the Australian Property Journal archive

CHARTER Hall has acquired a $300 million office development that will be home to the Canberra headquarters of the Australian Taxation Office (ATO).

Charter Hall Prime Office Fund confirmed the development partnership, at 15 Sydney Avenue in Barton, comprising DOMA and Kenyon Investments, to fund construction and own the 33,000 sqm, five-storey building near Parliament House.

The ATO has committed to a 15-year lease and will move in on completion in 2025, consolidating offices in the Civic CBD and the other of Lake Burley Griffin.

DOMA and Kenyon Investments had bought the site for $38 million three years ago from the Department of Finance.

“We are delighted to extend our partnership with both DOMA and the Commonwealth government as a long-term tenant customer, as we modernise our office portfolios and select low vacancy markets which will drive long-term growth for our investors,” said Charter Hall Group managing director and group CEO, David Harrison said.

Charter Hall last year bought two government-tenanted buildings from Doma for $245 million, including the Doris Blackburn Building in Canberra that was purpose-built for Services Australia, and a Newcastle asset anchored by the NSW government.

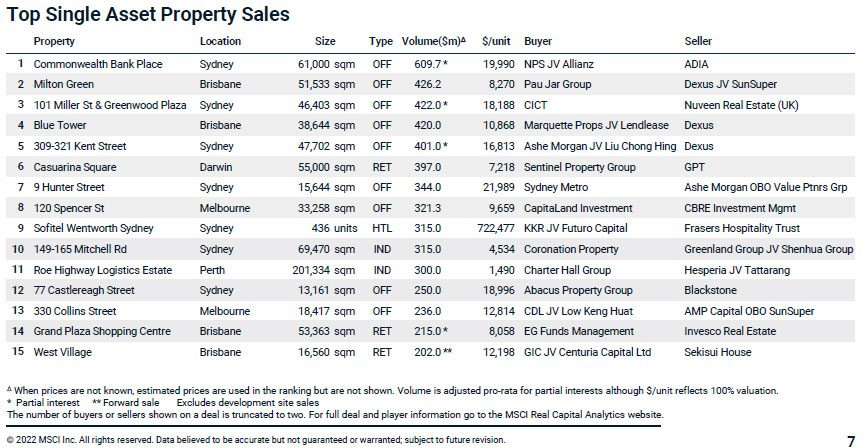

This transaction comes as offices reclaimed the capital markets crown from industrial in the June quarter. According to MSCI’s Australian Capital Trends report, industrial sector deals fell by 63% year-on-year down to $4.1 billion. Conversely, office sales lifted 7% to $5.4 billion.

This acquisition also extends Charter Hall’s run of buying up government-tenanted office buildings and in the national capital. Also last year, it bought the six-level campus-style Services Australia building in the ACTs Tuggeranong for $306 million, while it picked up Australian Taxation office buildings in Melbourne’s Box Hill, for $230 million, and the Albury city centre for $85 million.

Office CEO at Charter Hall, Carmel Hourigan, said the brand-new Barton project will extend its office funds under management to $29 billion, including committed developments, and reduce the weighted average age of its office portfolio towards eight years.

“This is in line with our strategy to take advantage of the bifurcation of office markets, where we continue to attract tenants to state-of-the-art, sustainable and well-positioned buildings offering premium amenity and wellbeing services,” she said

15 Sydney Avenue is targeting 4.5 Star NABERS Energy and 5 Star Green Star ratings.