This article is from the Australian Property Journal archive

DIRECT Commercial Property (DCP) has snapped a $10 million property in Brisbane’s thriving industrial market.

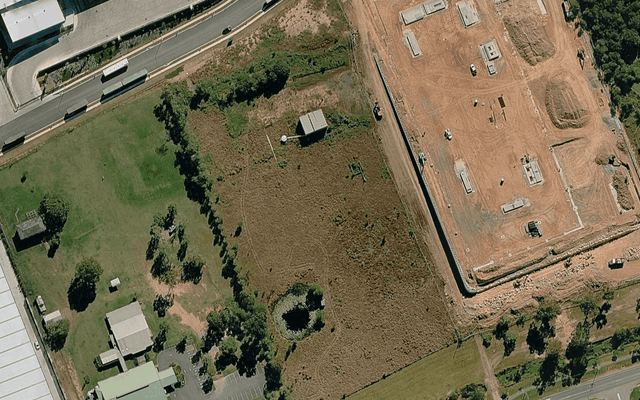

Home to dangerous goods facilities, 44 Aquarium Avenue sits in the established industrial hotspot Hemmant, around 15km east of the CBD, within the city’s global export area, Australia TradeCoast.

Cushman & Wakefield head of industrial David Gibson and director Aaron Dahl managed the sale of the 10,145sqm site, which includes a building area of 4,565sqm.

The strategic acquisition follows DCP’s three acquisitions for a combined value nearing $30 million at the close of 2021, in line with an annual average capital return to investors of over 25%.

“With an immediate income distribution of 8% to investors, the equity required was taken up very quickly and oversubscribed within an hour,” said Ed Bull, managing director of DCP of the new portfolio addition.

Bull noted the current nationwide industrial investor interest in Brisbane and Queensland portfolios, particularly in a time of heightened industrial investment.

Recent data from m3property revealed, after $18 billion in turnover for properties over $20 million for the sector in 2021, industrial rents across the country are surging, with industrial space in Brisbane bringing around $124 per square metre.

“Being able to secure the purchase of this Hemmant property, at a time when land supply is so limited is a coup for us. Right now, DCP has surplus capital looking to deploy in quality assets that represent value for our investors, and 44 Aquarium Avenue represents significant value,” added Bull.

The property includes three recently upgraded, approved and compliant dangerous goods warehouses, in addition to office space.

“Importantly, the property is home to specialised dangerous goods facilities which carry a huge replacement value; there are currently no existing vacancies in Brisbane with dangerous goods use approval,” said Bull.

The site is leased through to 30 June 2023 to manufacturer and distributor of automotive aftermarket products ITW Australia Pty Ltd, part of the broader US$13.4 billion ITW family, which currently operates across 57 countries.

Bull remarked that the property would provide its investors with a strong value proposition, thanks to its specialised approvals, rental uplift and positioning to transport infrastructure.

44 Aquarium Avenue includes ample access to Port of Brisbane Motorway and direct access to the Gateway Motorway

“Land-rich opportunities of this nature within the TradeCoast precinct are extremely scarce. DCP were attracted to the strong underlying land value with quality improvements that are ideal for the tenant’s use,” said Gibson.

According to Gibson, the TradeCoast in experiencing significant levels of rental growth, thanks to high occupier demand paired with limited supply of both existing and speculative stock.

“For investment groups to gain exposure to this, they are targeting short WALE investment product,” concluded Gibson.

Recent industrial activity across Brisbane has included Charter Hall’s wholesale PGGM Industrial Partnership $60 million purchase of a 1.56-hectare brownfield industrial site, while Clarence Property announced plans for a $150 million industrial estate after buying a 17-hectare Heathwood block for $30 million.