This article is from the Australian Property Journal archive

THE exuberance witnessed in the childcare centre market has subsided and a flight to quality is underway with investors now focussing on dominant, strong lease covenant and trade area fundamentals, according to Peritus Childcare.

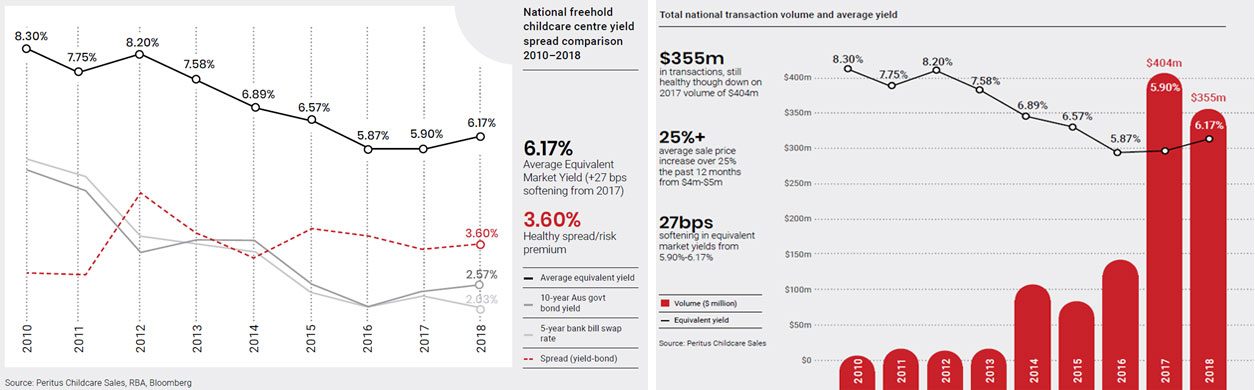

Peritus’ 2019 Investment Review and Outlook whitepaper revealed that transactions totalled $335.4 million in 2018 – down 12% from the recorded that was 2017.

Despite the decline, the sector has experienced a 25% increase in the average sale price from $4 million to $5 million, reflecting a slightly softer cap rate — equivalent yield of 6.17% compared to 5.90% in the previous 12 months.

Peritus Childcare principal Peter Fanous said the exuberance experienced in the market from 2014-2017 has abated with all stakeholders in the industry (financiers, developers, landlords and operators) much more cautious and risk averse in their decision making.

“There is now an increasing flight to quality. A clear widening in freehold investment yields and operating business EBITDA multiples is being reflected in the pricing of childcare centre investments,” Fanous said. “Risk is now being priced in appropriately with higher risk, higher beta centres exhibiting softer yields and EBITDA multiples. Investors are now focusing on lease covenant quality and the trade area fundamentals affecting the operators’ profitability.”

Fanous said purchaser appetite is shifting with higher risk aversion becoming more evident.

“Purchasers are conducting much more detailed due diligence into the trade area fundamentals and also looking at the future supply considerations. Investors are assessing future risk which can significantly change the demand:supply ratios and ultimately the hold utilisation, EBITDA and profit margin of the business / real estate investment under consideration.

“The fundamentals in respect to the trade area, lease structure and rental levels, delivery of the end product is now in focus,” he added.

Fanous said well-performing dominant centres with occupancy/utilisation in excess of 90%, located in robust trade areas with strong fundamentals such as a large number a strong demand:supply ratio in excess 3:1, a strong worker population and a high proportion of females aged 18-40 command very strong EBITDA multiple and valuation.

“Investor groups are attracted to these dominant centres and the macro fundamentals underpinning the industry such as very strong 0-5 year old population growth of 1.47% p.a. over the next 10 years to 2029,”

Other factors include very strong female workforce participation rate which is now at an all-time record high of 60.3% and federal hovernment funding support for the long day care sector increasing by 7.16% p.a. over the past 8 years and expected to continue.

“As long as investors are focused on trade area fundamentals, they will thrive. “There has been a long-running misconception that childcare centre ownership is a ‘money-printing businesses. While there will always be a need for childcare in Australia given the robust demand drivers, however, an operator or investor’s success largely hinges on the centre’s trade area fundamentals,” Fanous said.

Whilst transactions in 2018 declined, the year 2019 is off to a solid start. The Peritus report was released shortly after Peritus handled the sale of eight dominant childcare centres to Singapore’s MindChamps for $40.837 million.

In March Charter Hall Education Trust bought a 13 properties portfolio for $75.5 million.

In the same month, Think Childcare acquired four newly constructed centres in Perth for $6.5 million and has undertaken a $18 million capital raising to fund further acquisitions.

Australian Property Journal