This article is from the Australian Property Journal archive

HOBART remains the strongest performing residential market as Sydney led a national fall in house values through January, according to the latest CoreLogic Hedonic Home Value Index.

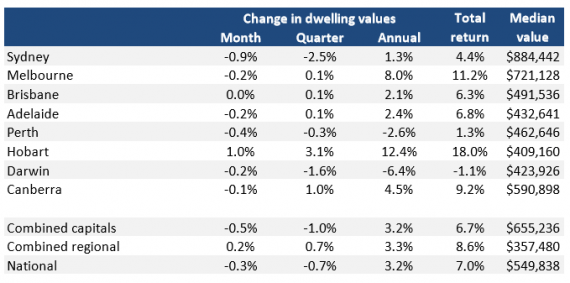

Prices are now 0.7% below the peak of September last year, with Sydney down 0.9%, Melbourne, Adelaide and Darwin by 0.2%, Perth by 0.4% and Canberra by 0.1% in January, for a total drop of 0.3%.

Hobart, however, was up 1.0%, and Brisbane steady.

Rather than reflecting the seasonally quieter period of the year, CoreLogic head of research, Tim Lawless, the negative monthly result lines up with recent months, which showed a softening trend, particularly in Sydney and, to a lesser extent, Melbourne.

“Our experience has been that this seasonality doesn’t exert much influence over the trend in hedonic valuations.

“In the absence of a catalyst to reinvigorate the market, such as lower mortgage rates or a loosening in credit policies, we expect to see a continuation of softening conditions across these markets,” he said.

APRA’s macroprudential regulations introduced last year has seen the dynamic of the market change, as first home buyers increase their share at the expense of investors that have been spooked by tougher lending conditions and added state government imposts.

The authority is shifting its focus this year to the data shared by lenders regarding the debt and spending of borrowers.

Chairman Wayne Byres has previously said that loan-to-income ratios as a metric are limited as they do not capture a borrower’s total debt level.

“Many other countries have used credit scores and positive credit reporting for some time as a means of sharing information and conducting comprehensive credit assessments. In Australia, other financial commitments remain something of a blind spot for lender,” he told the Australian Securitisation Forum late last year.

Lawless said that with financial markets forecasting a 25 basis point lift to the cash rate before the end of 2018, there is an increasing chance mortgage rates may lift this year.

“Even if the cash rate were to remain stable, there is the potential mortgage rates could be adjusted higher due to increased bank funding costs in the capital markets or in order to fulfil APRA’s local implementation requirements of the now finalized Basel III requirements for regulatory capital held against residential mortgages, particularly elements of the proposals which may lead to higher regulatory capital for some investment loans and high loan to valuation ratio loans,” he said.

“Higher mortgage rates would test the resilience of the housing market, especially considering household debt is tracking at record highs, however, the likelihood of mortgage rates moving substantially higher remains low.

ANZ downgraded its forecasts for house price growth through 2018, and said last month that the slowdown would bottom in the first few months of this year before accelerating again in 2019.

The latest CoreLogic data shows Sydney has retraced by 3.1% following the 75% growth stretch that lasted from February 2012 until the peak in July. Annual growth is at 1.3%.

However, it said that with a history of such strong capital gains, the fall in Sydney housing values to date has been mild and the vast majority of Sydney home owners remain in a strong equity position.

In annual terms, Hobart prices have grown by 12.4%. Lawless said Hobart’s high rate of capital gains could be partly attributed to low housing prices relative to the larger mainland capitals; with median house values around 59% ($616,000) lower than Sydney’s and 48% ($401,000) lower than Melbourne’s.

“With values rising quickly in Hobart and now easing in Sydney and Melbourne, this affordability advantage is being eroded,” he said.

Hobart’s annual growth was followed by Melbourne with 8.0%, and Canberra with 4.5%. Modest rises were seen in Adelaide (2.4%) and Brisbane (2.1%), while Perth and Darwin fell by 2.6% and 6.4% respectively.

Hobart retained the strongest rental growth at 9.7% per year, but rental yields have been tightening since early 2015 due to outpacing by price growth; gross yields do remain the second highest of any capital city at 5.0%.

Perth and Darwin renters are on average paying 1.9% and 1.5% less rent compared to one year ago, and gross yields in Darwin have pushed higher to 5.9%, remaining the highest of the capitals.

Melbourne rental yields have eased from record lows to be 2.91% gross.

“If dwelling values remain weak and rents continue to rise at the annual pace of 4.0% per annum, we may start to see yields lifting further from their record lows in Melbourne, however the process of yield repair is likely to be gradual,” Lawless said.

Australian Property Journal