This article is from the Australian Property Journal archive

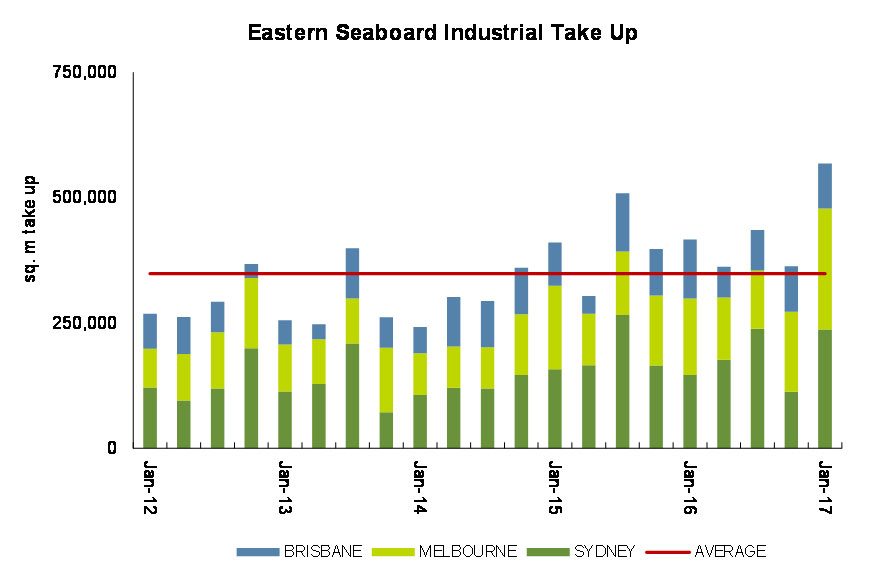

DEMAND for industrial properties across Australia’s east coast has soared with 1.73 million sqm of space leased, according to Knight Frank.

The latest report found industrial take-up posted a 36% increase on the same period a year ago. This in turn has seen a fall in the overall vacancy rate over the quarter.

Over the January quarter take-up was strongest in Sydney and Melbourne, at 63% and 58% higher year-on-year respectively.

Knight Frank head of industrial, Tim Armstrong said that coinciding with the strong take-up, the overall level of available industrial stock fell by 2% over the past quarter following increases in the previous two quarters.

Total vacancy along the east coast now sits at 2.30 million sqm, down from 2.35 million sqm recorded in the October 2016 quarter.

“Speculative stock completed or under construction over the January quarter remained stable at 247,000sqm, with the bulk of this being built in Melbourne,” Armstrong said.

“Currently, there is just 7,545sqm of speculative industrial stock under construction and vacant in Sydney with speculative stock in Brisbane totalling 96,000sqm.

“Speculative industrial stock under construction and vacant in Melbourne increased to 144,000sqm, its highest level since January 2015,”

Leasing demand in Sydney returned to above-average levels in the final quarter of 2016, 60% higher than the average, with vacancy dropping by 3.6% to 530,185sqm of properties above 5,000sqm. The number of properties being leased prior to vacancy rose, measuring 74,954sqm.

Armstrong said the Sydney industrial market continues to go from strength to strength, supported by a buoyant labour market off the back of a spate of infrastructure projects and broadening tenant demand as a diverse mix of businesses seek new or expansionary space.

“These favourable conditions have continued to show in the leasing market, in particular, in the Outer West which accounted for 53% of the gross take-up over the January quarter,” he added.

“With businesses continuing to gravitate towards new prime space, supply has been met with solid demand with 90,431sqm of speculative stock leased over the past quarter (both under construction and completed) including Mirvac’s 60 Wallgrove Road, Eastern Creek (18,970sqm) and Stockland’s 35 Stennett Road, Ingleburn (28,800sqm),” New South Wales industrial director, Matthew Lee said.

Prime vacant stock in Sydney has decreased 12% to 314,686sqm over the past quarter, accounting for 59% of all vacancies across Sydney.

The level of secondary space has continued to fluctuate quarter to quarter with an increase of 14% over the final quarter of 2016 and is currently at its highest level since the July 2015 quarter.

“With speculative builds continuing to lease well, an upswing in speculative development is earmarked over the coming two quarters as a select group of developers look to capitalise on a period of moderate supply. Notably, these projects are concentrated in the Outer West region and included planned developments by Goodman, Dexus, Mirvac, Charter Hall and GPT,” the report found.

Knight Frank Victorian director, Gab Pascuzzi said that despite the increase of speculative development, five-year high quarterly leasing activity in the Melbourne market resulted in a decrease in industrial vacancy, falling by 65,655sqm, with the total vacancy now measuring just over one million sqm.

Gross take-up in the Melbourne industrial market was241,952sqm, 71% above the long-term average and the highest quarterly total since 2011.

The Western region recorded its highest quarterly level of leasing activity on record, making up for 65% of activity with 156,000sqm absorbed across 11 buildings.

Existing vacant stock accounted for 86% of total vacancy, and completed speculative space accounted for 7%, at 71,803sqm.

Only the South Eastern industrial precinct recorded an increase in vacant stock levels, and vacancy in the North fell to its lowest level since Q4 2014.

Speculatively-built space accounted for 84,971sqm leased in 2016, 56% above levels recorded in 2015.

Of the 87 vacancies available across Melbourne, 43 are sub-10,000sqm. There are currently 44 options available for 10,000sqm-plus users, 59% of which are of prime quality grade.

Stock levels are forecast to remain elevated over the medium-term, driven by backfill vacancy and additional properties likely to come on line throughout 2017 relating to the automotive industry.

Brisbane’s industrial market saw vacancies reach a new series high, despite take-up remaining at above average level.

Joint head of industrial in Queensland, Chris Wright, said positive signs in the Brisbane market are emerging, with tenant enquiry broadening and increased tenant mobility.

Brisbane industrial vacancy increased over the final quarter of 2016 to 743,558sqm. The higher additions to vacancy of 110,504sqm resulted in a 4.9% increase in vacancies, predominantly driven by secondary market vacancies, which grew by 7.7% to 390,925sqm, and the prime market by only 2.0%.

Secondary industrial stock accounting for 53% of the total available space, with prime space reducing to 47% of the market.

“The average time on the market for secondary stock has decreased over the past quarter as activity picks up in the sector, falling from 18.7 months to 16.9 months (median 12months). The gap between prime and secondary vacancy has begun to widen once again over the past two quarters,” he said.

Wright said backfill space has continued to be a trigger for additional vacancy, however corporate activity in the form of the Masters closure and Wesfarmers consolidation have also created available space.

All precincts, except for the North, recorded increases to available space over the past quarter. The TradeCoast (up 3% to 201,090sqm),Greater North (up 15% to 24,026sqm), South (up 5% to 270,006sqm), South West (up 4% to 86,396sqm) and South East (up 11% to 104,490sqm) all increased over the quarter. The North saw a decrease by 3.4% to 57,550sqm.

Take-up was 90,394sqm across 18 properties with the majority of leases in smaller or mid-sized properties such Santa Fe Wridgeways (5,288sqm) and Neumann Steel (3,000sqm).

Australian Property Journal