This article is from the Australian Property Journal archive

DESPITE some 2.3 million sqm of warehouses currently under construction across the country and a normalisation in demand following the pandemic boom, Australia’s industrial market is set to remain severely undersupplied, with construction costs and servicing delays set to temper supply completions in the coming years.

Cushman & Wakefield’s Is Oversupply and Overstatement report showed that vacancies will remain below the 5.0% market equilibrium, and also found uncertainty in the delivery and timing of the 2025 supply chain as a result of elevated construction costs and capital constraints.

“Strong market fundamentals have underpinned a large rise in warehouse supply within the Australian market in recent years but the landscape going forward is more complex,” Luke Crawford, head of logistics and industrial research, Australia, Cushman & Wakefield said.

“Occupier demand has somewhat normalised in 2024, which is likely to have implications for the overall supply pipeline as the case for speculative strategies in select markets is reassessed.”

“At the same time, higher construction costs and planning and servicing delays in several key precincts add further complexity and costs to developers, which will test the feasibility of projects.”

Just under three-quarters – 73% – of the supply current under construction is scheduled for completion in the second half of 2024, while there remains uncertainty and challenges in the delivery and timing of some projects for 2025. Just 15% of the 2025 pipeline has commenced construction, compared to 30% at the same point in 2023 for the 2024 pipeline. Meanwhile, just 23% of the 2025 supply pipeline is committed, and a “considerable” share of the balance will only proceed once a pre-commitment is secured.

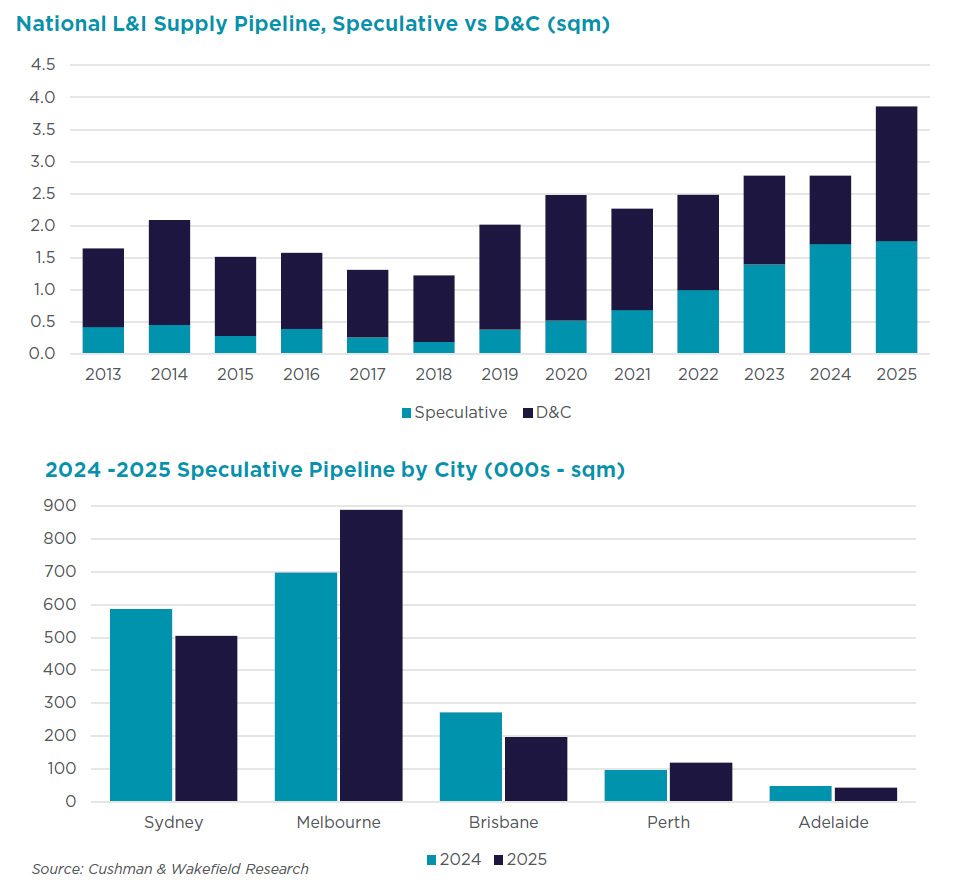

Cushman & Wakefield said it initially forecast around 3.4 million sqm of supply in 2024; however, delays meant this was downgraded to approximately 2.8 million sqm. Assuming a similar scenario plays out and some projects pivot to D&C, supply for 2025 is likely to settle closer to 2.8 million to 3.0 million sqm.

Elevated construction costs are been a major drag. Steel prices have fallen over the past 12 months, but this has been offset by higher costs for cement and labour. Warehouse construction costs average $1,250 per sqm, up from $750 per sqm in 2020. Multi-level developments in Sydney are substantially higher, at $3,000 to $3,700 per sqm.

The pace of price growth for construction costs is expected to settle closer to 2.5% per annum. In combination with land values holding steady around 180 basis points of yield expansion, economic rents have shifted higher in order to make developments feasible.

Meanwhile, infrastructure and servicing challenges are delaying the delivery of supply, most acute most acute in outer western Sydney’s Mamre Road precinct.

A difficult economic environment is also crimping developers’ efforts to raise capital to fund their development pipeline.

“Severe” undersupply

According to the report, there is potential for 135 facilities above 10,000 sqm to be delivered. Overlaying demand, there have been 172 lease deals per annum above 10,000 sqm on average over the past three years.

“While demand and enquiry have softened in 2024, even if we assume a 20% fall in deals above 10,000 sqm, it still matches supply in this size bracket (138 deals per annum), and with vacancy rates currently at just 2.0%, it suggests the severe undersupply of warehouse space will likely remain.

“Not all of this supply is expected to eventuate, exacerbating the undersupply issue.”

The sectors that have driven demand above 10,000 sqm are transport and logistics and retail trade occupiers, which have collectively accounted for 68% of deals by number over the past three years.

“While demand has been patchy in 2024 for these sectors, take-up is expected to increase over the next 18 months, driven by improving economic conditions, positive real income growth, and contract renewals for the transport and logistics groups, which will trigger deal activity.”

Five submarkets account for 72% of the current under-construction pipeline, led by Melbourne’s west, Sydney’s outer west, and Melbourne’s north. Pitting the under-construction supply pipeline against the 10-year annual average level of take-up shows that supply is well balanced across the country. Even for Melbourne’s west, where just over 500,000 sqm is under construction, this is matched by a similar level of annual take-up.

Submarkets where supply moderately outpaces long-term take-up volumes include Brisbane’s west, Melbourne’s north and Adelaide’s outer north; however, in each case, vacancy rates remain well below balanced levels.

Alternatively, supply in Melbourne’s south-east, Sydney’s central west and west and Brisbane’s Trade Coast falls short of annual demand levels, which is expected to drive an outperformance of rental growth.

Demand shifts to smaller facilities

Following years of robust demand for facilities above 20,000 sqm, demand has shifted in 2024, with smaller leases being the most active by a “substantial” margin. In the first half of 2024, 77% of lease deals nationally by number were in the 3,000 to 10,000 sqm size bracket, while the average deal size has fallen 45% from the level recorded in 2022.

The supply pipeline doesn’t marry up to the demand, Cushman & Wakefield said, largely because plans were submitted and approved prior to 2024 when demand was still robust for big box facilities.

In 2024 and 2025, 40% of supply additions will be facilities above 20,000 sqm, while just 22% is for facilities in the 3,000 to 10,000 sqm range.