This article is from the Australian Property Journal archive

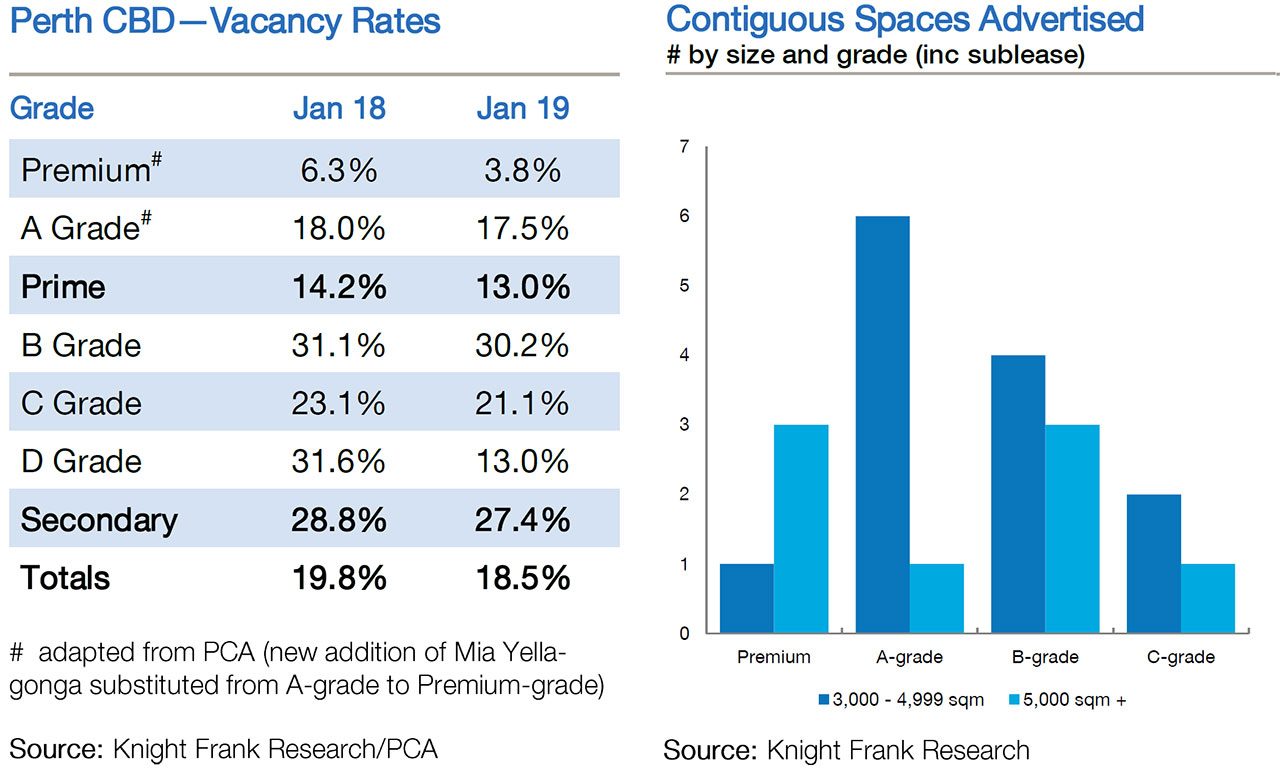

PERTH’S CBD office market has only six spaces larger than 5,000 sqm available for lease, offering lucrative prospects for a small handful of landlords before more supply hits the market over the next 12 to 18 months.

Knight Frank’s latest CBD office research report shows a further 14 spaces larger than 3,000 sqm are available across the CBD, although many of these buildings “don’t have the attributes multi-floor tenants require, and as such are not genuine option”.

Contiguous full floor availability is forecast to increase in early-to-mid 2020 when state government leases expire at Westralia Square and The Atrium, and Chevron’s expires at Dynons Plaza at 905 Hay Street.

Greg McAlpine, Knight Frank joint head of office leasing – WA, said that said those landlords might find themselves in the position to push for effective rental growth, however this would depend largely on how imminently space was needed.

“There are still a number of unknowns in the market, with resource based, project space requirements likely to be the driver for short term requirements.

“The movements of the WA Police who currently occupy space at Westralia Square will also soon be known and this should provide clarity to what competing space will be on offer for tenants bringing their requirements to the market over the next 12 to 18 months.”

Perth currently has a premium vacancy rate of 3.8%, historically low in context with the performance of the total market at 18.5%.

From 1997 to 2005, prior to the large economic expansion that was to the benefit of all building grades, premium space had an average vacancy rate of 5.2%, compared with an overall average of 11.1%.

Knight Frank research analyst, Nicholas Locke said that the logical conclusion to draw from the lack of premium availability would be to assume that A-grade space would benefit.

“While this is true, it is important to note that 41% of the market is graded A, and the current vacancy rate of 17.5% reflects 127,000 sqm of vacant stock

“Above-trend absorption will be required to make significant inroads on this space, yet the space available is far from equal in its appeal, with significant differences in age, floorplate size and external glazing impacting upon the desirability to potential tenants.”

Analysis by Knight Frank of space currently advertised for lease indicated that floorplates under 750 sqm are three times more likely to be vacant than those over 1,500 sqm, and that floors in buildings with partially framed and/or inset external glazing were three times more likely to be vacant than those with floor-to-ceiling glazing.

Knight Frank’s research showed prime net face rents have remained generally unchanged since mid-2015, at an average of $591 per sqm. Recent deals for premium grade space have been recorded in the range of $565 per sqm to $785 per sqm, with incentives ranging from 35% to 53%; and A-grade space deals struck in the range of $500 per sqm to $615 per sqm with incentives ranging from 46% to 53%.

“In the past 12 months a minor, albeit noticeable, decline in incentives has emerged with deals for premium-grade space now more regularly struck in the range of 45% to 50%,” Locke said.

Secondary net face rents have come in at $376 per sqm, down by 1.5% year-on-year, and incentives at 51.7%.

Australian Property Journal