This article is from the Australian Property Journal archive

VALUES have not bottomed out in Melbourne’s office market with the gap between buyer and seller expectations widening further, implying that the current repricing cycle, which has already outstripped the correction seen during the global financial crisis (GFC), prices need to fall by at least another 18%.

Although it paints a challenging picture for the Melbourne office market in the year ahead, particularly for vendors looking to offload assets on their books, Australia’s commercial property market showed promising signs in the Q2.

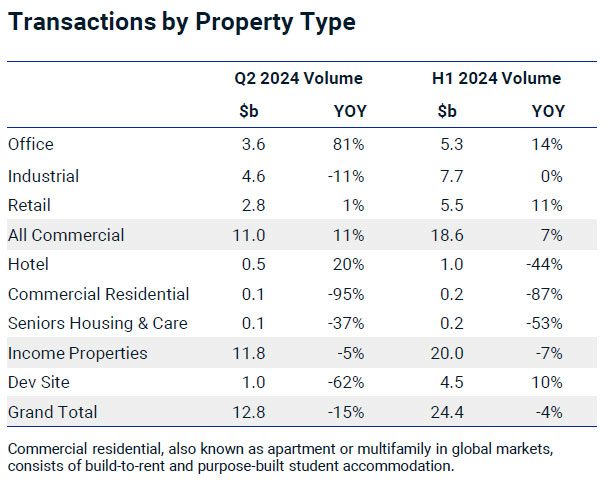

According to the latest MSCI Capital Trends Report, after two lacklustre years transaction volumes in Q2 2024 totalled $11.8 billion, which is just 5% below Q2 2023. It is still a slight year-on-year decline but represents a significant improvement compared to the sharp double-digit decline in the previous quarter.

In total, volumes for the first half of the year are just 7% below H1 2023 at $20.0 billion.

However MSCI Pacific head of real estate research Benjamin Martin-Henry noted that volumes for Q2 2024 were around 27% below the five-year average for Q2, indicating the market is still off its usual pace.

“Nevertheless, this recovery was not expected to be V-shaped like the post-Covid resurgence, so any signs of revival are welcome news for the market. In these turbulent times, the devil is in the details, however. A key driver of the uptick in transaction levels is the convergence of pricing expectations, thanks to significant write-downs in valuations, particularly for offices,” he added.

Industrial continued to lead during the quarter with $4.6 billion transacted, taking the year’s total to $7.7 billion, making it the most active market. However, it is not all smooth sailing for industrial, as volumes for the second quarter were down 11% YOY. Nevertheless, volumes were on par with H1 2023.

“Whilst investors still appear happy to deploy capital to the sector, they have perhaps become more circumspect regarding which assets they are procuring. For example, the average price paid for an industrial asset in H1 2024 was $5.9m, 26% above that of H1 2023,” Martin-Henry said.

Retail volumes were up by 1% YOY for Q2 and 11% for H1 2024 relative to 2023. Neighbourhood and sub-regional shopping centres activity surged by 36% compared to the first half of 2023. Furthermore, volumes were 43% above the average of the past five years and already account for 80% of last year’s transaction total.

Notable transactions in the first half include the sale of Westfield Tea Tree Plaza, Stockland Glendale and Cairns Central. And recently Scentre Group and Barrenjoey acquired a 50% stake in Westfield Westlakes for $167.30 million, which is 36% below peak value.

The average size of retail volumes increased to $10.5 million from $6.4 million in H1 2023.

“Overall, deal sizes increased substantially from 2023 and became more comparable with five-year averages. This is a positive sign for the market in general, as it indicates renewed investor confidence for deploying larger pools of capital into real estate,” he added.

The office sector followed a similar pattern with an average price paid of $10.7 million in the first half of 2024, significantly higher than $6.5 million a year earlier. This increase helped volumes lift to $3.6 billion for Q2 2024, up 81% YOY, indicating that buyer and seller expectations may have realigned after significant write-downs in the sector.

Notable transactions were include Mitsui Fudosan, which acquired a 66% stake in the office development of 55 Pitt Street for $1.3b in the largest deal of the year so far, 50% stake in 255 George Street in Sydney for $364 million, a 17% discount to the peak book value, 5 Martin Place in Sydney to Cbus Property for $296 million, 24% discount to the peak value, while Mirvac has just divested the 40 Miller Street, North Sydney office building to Barings for $140 million, and 367 Collins Street in Melbourne for $345 million, with both deals struck at a 20% discount to peak book values. Quintessential has bought 240 Queen Street at a 17% discount to peak valuation.

Martin-Henry said investors acquiring office properties evidently believe in the sector’s long-term viability.

“Valuations have adjusted enough to provide evidence to sellers that they have to drop their price more. On the other hand, buyers are happy to take advantage of the discounts currently on offer,” he continued.

He highlighted that the price gap expectations in Sydney have narrowed from 18% at the end of last year to 14%.

But in Melbourne, the MSCI data shows the price gap expectations has ballooned from 20% to 35%.

“From these numbers it doesn’t look like the office repricing cycle is going to slow.

“There is more pain to come,” he added.

So far MSCI data shows Melbourne office peak to trough values have fallen 21% in this cycle, which is more than the 14% decline recorded during (GFC). Based on the current data, it would imply values will need to decline by another 18% for liquidity to return to the market.

This comes as the latest Property Council of Australia Office Market Report shows Melbourne now has almost 1 million sqm of vacant office space.

Meanwhile the latest results of the MSCI/Mercer Australia Core Wholesale Monthly Property Fund Index show in the 12 months to June 2024, the overall index fell 13.8%, predominantly driven by the office specialist funds, which saw values fall by 19.5%. The total return for the index was -10.4%, the worst annual result since 2009.

No fund type in the index managed to avoid write-downs in the last financial year. Industrial and retail funds recorded capital growth of -8.6% and -7.2%, respectively. Retail specialist funds were the best-performing fund type over the last 12 months, whilst diversified funds recorded capital growth of -13.0%, largely due to their higher weighting towards office assets.