This article is from the Australian Property Journal archive

THE pandemic’s smashing of Australia’s economy is becoming evident throughout the office market, with sublease space skyrocketing by more than 30% in the September quarter.

The national total hit a new peak of 352,768 sqm and is expected to continue edging higher, according to CBRE, and sublease space now represents 2% of the country’s total office stock as tenants continue to review their space and right size.

Sydney sublease space soared 56% in during the quarter to 164,950 sqm, its highest level since 1992, while Melbourne’s sublease space jumped 46% to a new seven-year high of 93,257 sqm.

Melbourne’s office market is expected to come under additional pressure due to the largest increase in new supply in almost three decades over 2020-2021. Although some 90% of that new supply is pre-committed, resulting backfill could put upwards pressure on vacancies.

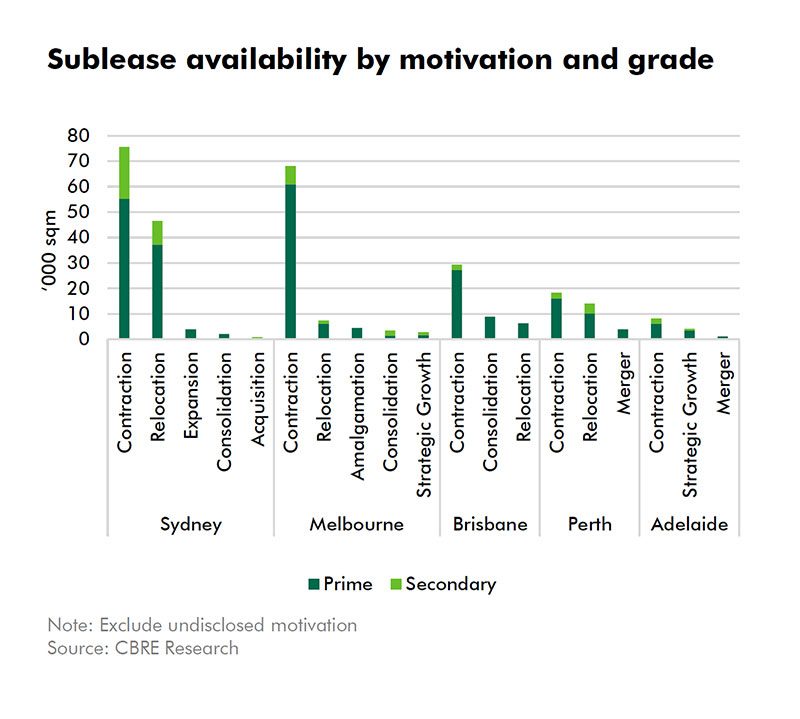

Contraction is the biggest driver of new sublease space nationally, accounting for two thirds of space in the market. Large tenancies of more than 2,000 sqm make up 70% of options now in the market by size.

Prime grade office stock is most vulnerable to rises in sublease space, accounting for 80% of volume in the market.

“The landscape of Australia’s office market has changed significantly in 2020, with occupiers shedding space that was earmarked for growth,” CBRE’s head of office leasing for Pacific, Mark Curtain said.

“When it comes to assessing and making decisions around long-term real estate strategy, occupiers are adopting a more intensive risk assessment amid growing economic uncertainties and the widespread adoption of remote and flexible working.”

Brisbane bucked national sublease trends with a 6% decrease in sublease volumes to 44,600 sqm, and Perth was mostly resilient with a small a 2.2% increase to 36,453 sqm, while remaining below the five year average.

Adelaide sublease volumes remain negligible, despite a 117% increase in sublease space to 13,000 sqm.

CBRE’s head of office occupier research, Joyce Tiong said continued economic headwinds would underpin the need for landlords to provide greater flexibility around leasing terms.

“The continued rise in sublease volumes will also provide an influx of attractive tenancy options in the market, including both short-term and longer-term opportunities for quality fitted space in major office locations.”