This article is from the Australian Property Journal archive

WHILE Australia’s industrial real estate market is enjoying its strongest period in some time, a slowdown in online retail trade growth may pull back demand for logistics space and the secondary market may have already peaked.

The Australian Industrial: Winter 2019 report from m3property showed industrial land values have skyrocketed by 21.6%, prime net face rents up 3.8%, and vacancy averaging a low 2.6%.

Meanwhile, prime yields hit record lows in the June quarter 2019, ranging from 4.5% to 8.75% nationally for prime stock and 5.5% to 10% for secondary stock, and sales activity over 2018 was at the strongest recorded level since the mid-2000s.

However, the NAB Online Retail Sales Index has shown online retail trade growth has softened, and may translate into contraction in tenant demand for the logistics sector. Vacancy rose over the March quarter, suggesting demand is no longer outpacing supply.

National director research, Jennifer Williams said Australia’s industrial market is in the upturn phase of the current cycle and.

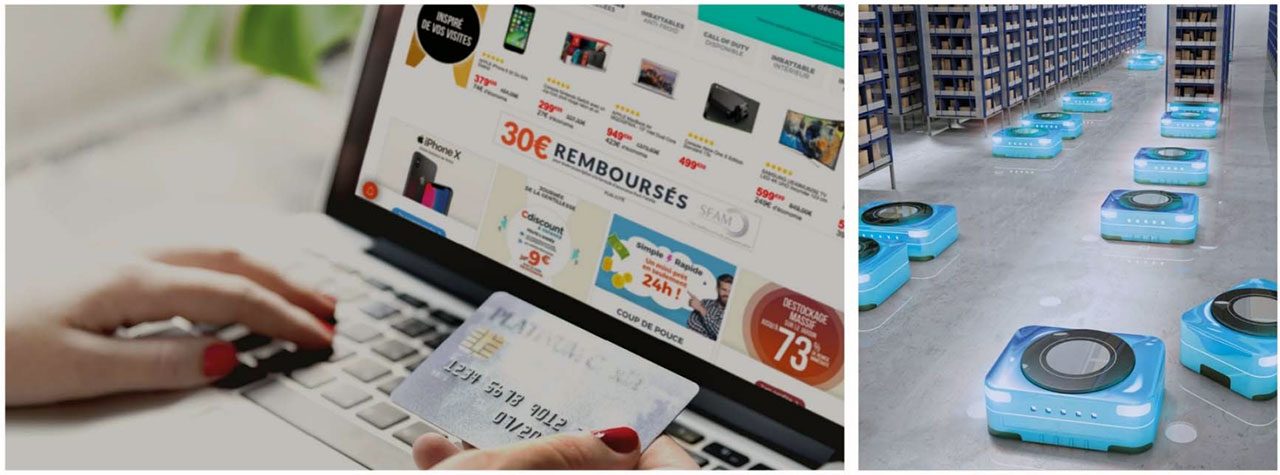

“Rents, which were previously stubbornly stagnant for a decade, are finally showing some real growth and land prices reflecting the enormous increase in demand for new stock on the back of the e-commerce revolution.”

Williams said that while some states are further advanced in the cycle than others, it is generally a time when landlords should be locking in longer-term deals.

Rental growth in Sydney over the year to 2019 was almost triple the 25-year annual average, and prime net face rents are now between $90 to $220 per sqm, while incentives are at 9.9% and prime yields from 4.5% to 7%.

Land value growth was more than four times the 13-year annual average, at 36.2%.

Melbourne tenant preferences for new stock over existing space has driven significant land value increases of 30%, but also constrained rental growth. Rents average $70 to $90 per sqm, incentives 14% and prime yields 5% to 6.5%.

Over the past three years, Brisbane land rates values have soared by 46%. Prime rents are at $100 to $150 per sqm, with incentives at 12.9% and yields from 5.75% to 7%.

Williams said the industrial market is overall travelling very well with economic stimuli including tax cuts, lower mortgage rates and easier access to loans likely to drive economic activity and keep industrial markets in an upturn phase over the short-term.

“However, the risks are growing,” she said. “Prime well-located space should continue to out-perform and see further rental growth over 2019 but the secondary market is likely to have peaked in many markets and is starting to push up vacancy nationally.

“The dip in online sales growth since late in 2018 is also a warning to investors but, more importantly, to speculative developers who need to be aware of the risk of an overblown response to the e-commerce led demand for new distribution stock.

“Already we are seeing a slight rise in vacancy for quality, well managed, industrial space.”

The NAB online retail sales index recorded one of the strongest growth periods in the series’ history from January to September of 2018, averaging more than 1.6% per month, but activity has since slowed to an average below 0.5% per month.

James Farrugia, national director industrial at m3property, said he expected strong investment demand to continue for at least the remainder of 2019 as the existing acquisitive players in the market continued to reweight their portfolios from other asset classes into industrial, particularly logistics, assets.

Among those is Stockland, which is forging ahead with a $1 billion divestment program as it looks to increase its portfolio exposure to the industrial sector from 21% to between 25% and 35% over the next five years.

While slightly less advanced in the upturn, Adelaide’s market has seen solid demand and rental growth on the back of an “impressive list” of projects. Prime rents command $70 to $105 per sqm, while incentives come in at 11.3% and yields range from 6.75% to 8.75%.

Perth’s best-located prime was performing well, but secondary stock was languishing and rents are down 2.3%. Prime rents range from $60 to %105, with incentives at 12.5% and yields from 5.75% to 8.5%.

Farrugia said low interest rates and the search for yield in an asset class that has traditionally offered attractive yields, had combined with the e-commerce revolution, a downturn in the apartment market and a troubled retail market, to produce the best industrial investment market in decades.

“Yields may tighten further, but less than the last 12 months and certainly for super prime/prime assets which have already attracted the tightest yields and are now testing a growing number of purchaser’s return on investment tolerances when assets are bought to the market and these purchasers advance through the various rounds of negotiations.

“Secondary investments may offer more scope for tightening, however the yield gap between prime and secondary assets has already contracted considerably in the last 12 months.”

Limited development and investment options in Sydney, as well as steady demand for modern logistics space and ongoing interest from domestic and international purchasers, are expected to drive increased activity across the Melbourne and Brisbane markets, particularly for land acquisitions.