- What WeWork’s deal to sub-let 145,000 sq ft in Manchester in current guise is off

- Why RBS rejected current sub-letting deal on the table from the workspace firm

- What next WeWork still wants more space in Manchester and UK regions

A WeWork letting deal for 145,000 sq ft in Manchester has stalled and represents the first casualty in the UK regions from the ongoing fall out surrounding the workspace provider, React News can reveal.

RBS has shelved the current deal

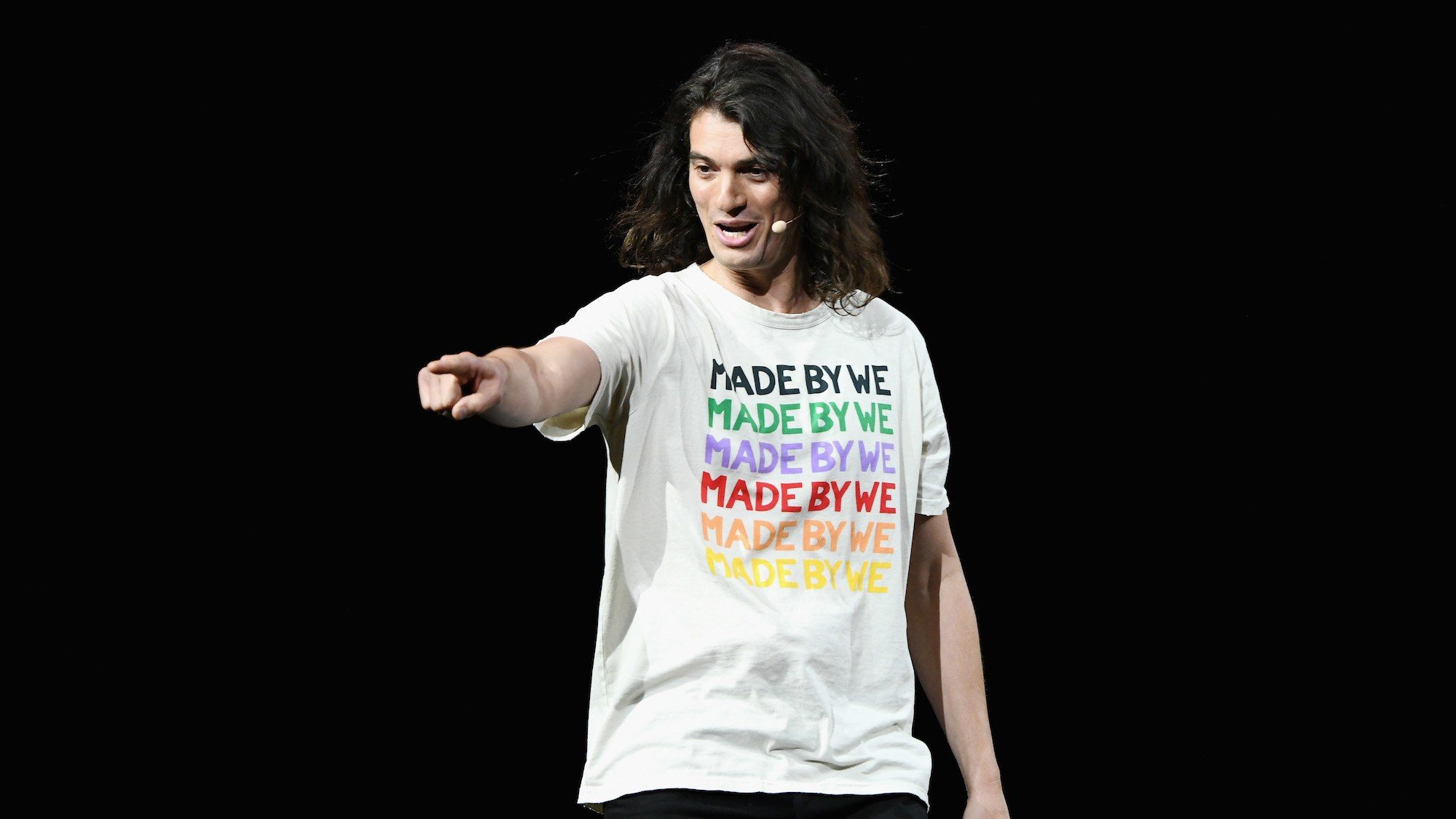

WeWork, which has now aborted plans for an IPO and removed the enigmatic Adam Neumann from the chief executive role, had been in advanced discussions with Royal Bank of Scotland to sub-let its former office space at One Spinningfields Square. However, RBS has rejected the current deal on the table from WeWork, according to market sources.

It is thought the issue centred on the fit-out costs which for the 145,000 sq ft building would be well into the multi-millions. While the deal in its current guise is now off the table, talks are understood to be still ongoing.

Banking group RBS has vacated the space at Spinningfields Square, relocating staff to its Hardman Boulevard office. One Spinningfields Square stands on the corner of Deansgate and Hardman Street and was delivered by Allied London for RBS. M&G Real Estate acquired it and Hardman Boulevard for £320m in 2014.

Despite the growing furor around the governance of the flexible workspace provider, WeWork is understood to be keen to continue to grow its portfolio in the UK regions. Its Manchester centres are amongst its best performing and it still actively seeking additional space there, according to several market sources.

WeWork says

A spokesperson from WeWork said: “WeWork’s core business is strong and we will continue to sign new lease agreements and evaluate opportunities with our landlord partners. Consistent with our strategy, we expect the pace of growth to slow over the next several quarters as we focus on strategic expansion and profitability.”

The collapse of the negotiations over One Spinningfields Square comes as WeWork struggles to stem the fallout from the decision to cancel its initial public offering, which cost CEO Adam Neumann his job. Since then, a new leadership team has been put in place and there have been murmurings of large-scale job cuts within the business.

In the short-term, at least, WeWork rapid growth plans in the UK regions will be scaled back as it looks to move towards a more stable and profitable corporate structure. WeWork is under offer on two office buildings in Glasgow – 50 Bothwell Street and 6 Atlantic Quay – which total close to 160,000 sq ft.

RBS declined to comment