This article is from the Australian Property Journal archive

SECONDARY grade office markets in Perth, Brisbane, Adelaide and Canberra are suffering from high levels of vacancy and have recorded zero or negative net effective rental growth over recent years, as a number of buildings age.

A new CBRE Viewpoint suggests improvements in prime office vacancy rates have masked the underlying issue.

CBRE senior research analyst, Aiden Bresolin said the secondary markets in Sydney and Melbourne have performed well because of strong economic fundamentals, low vacancy rates and increased demand for office space, in conjunction with strong white-collar employment growth.

“However, in Perth, Brisbane, Adelaide, and Canberra, it is a different story. Some secondary buildings in these locations are now virtually untenable or have a high vacancy of 40%-plus and require extensive refurbishment to be brought up to a modern standard.”

Secondary grade is a broad term for B, C, and D grade office buildings, typically characterised by smaller floorplates, lower energy efficiency and ageing design.

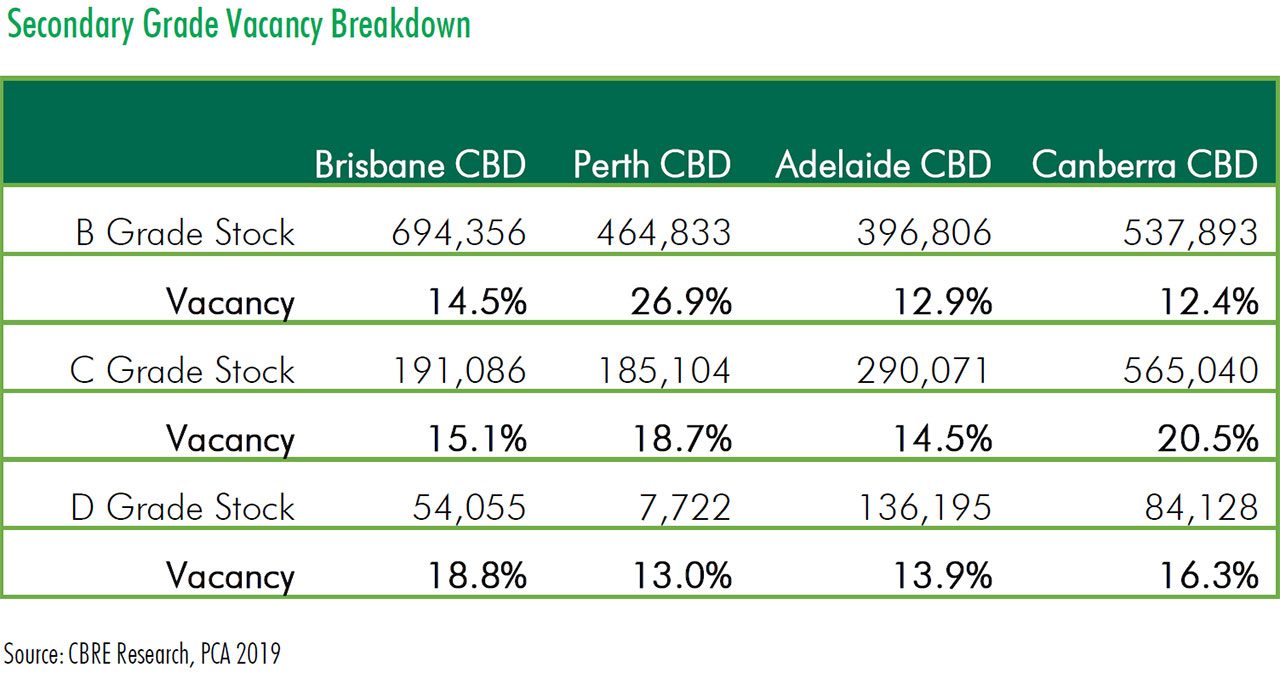

Adelaide has the highest proportion of secondary stock to prime space, however, in terms of total secondary stock, Canberra’s 1.2 million sqm is almost greater than Adelaide CBD’s total supply of office space.

Secondary assets play a large role in Adelaide due to the predominance of small to medium enterprises that are attracted to the size and lease budgets of older buildings. CBRE senior director, office leasing, Andrew Bahr said investor interest in the B grade market had remained buoyant, with interest from funds seeking to capitalise in Adelaide’s investment returns, which were amongst the highest in the country given the high-yielding nature of the market.

“Vacancy at an asset level allows for refurbishments to be conducted within a short time from purchase, adding immediate value and attracting and retaining tenants,” he said. Adelaide secondary vacancies are at 12.9% for B grade, 14.5% for C and 13.9% for D.

Owners can refurbish secondary buildings or reposition them to an alternative use such as residential apartments or hotel, or simply wait for a building’s underlying land value to become high enough to warrant a refurbishment or repositioning program.

“B grade office stock remains popular amongst investors because these buildings have a lower price point, are higher yielding and often have value add potential through refurbishment, whereas C and D grade assets present more of a challenge and higher risk, with attributes that make them difficult to modernise to meet the requirements of today’s tenants,” Bresolin said.

The spread between prime and secondary office vacancy has reached near record highs in both Perth and Canberra.

While’s Perth secondary vacancy is at a high 26.7%, improvements are expected in the medium term. B grade vacancy rates fell by 3.3% in the first half of 2019, the largest B grade vacancy fall since the second half of 2011, and just the second time in eight years that B grade vacancy has fallen. The figure is currently 26.9%, while C and D grade stock has healthier vacancies of 18.7% and 13.0% respectively.

“In the past 18 months, owners of B grade buildings have started to undertake significant building refurbishments, including aggressive speculative fit out programs. However, most C grade assets do not meet the requirements of tenants and are difficult to lease,” CBRE senior director, office leasing, Andrew Denny said.

“Common issues in Perth include ownership by high net worth investors, who are under little pressure to upgrade or sell and can service debt at such low rates.”

Brisbane is also on an upwards curve. The vacancy spread between prime and secondary stock has come down from a high of 10.9% in June in 2017 to currently sit at 6.8%. Vacancies in the B grade market sit at 14.5%, and increase to 15.1% for C and again to 18.8% to the D grade assets.

Larger tenants are leaving backfill space in a flight to quality that has been made possible by elevated levels of prime vacancy in recent years. But these opportunities are diminishing as prime vacancy continues to trend downwards.

Building upgrades are also occurring across the Brisbane market. The current Midtown Centre project will link existing C grade assets into one A grade building offering floor plates from 1,800 sqm up to 2,500 sqm.

In the nation’s capital, being host to a variety of government and institutional tenants requires high quality fit outs and buildings to retain staff.

“The public sector accounts for around one-third of white-collar employment in Canberra and, with the trend for these public bodies to move into A grade space, vacancy in secondary stock is expected to remain high and possibly expand over time,” CBRE’s state director, office leasing, Zoe Ferrari said.

Canberra’s current spread of secondary and prime vacancies is at an all time-high of 10.8%, w due to expansion of government tenants.

“Secondary buildings are ageing and losing appeal in the market as government requirements such as high NABERs ratings have contributed to a transition from secondary buildings to prime buildings,” Ferrari said.

“However, owners of secondary buildings who are proactively investing in refurbishments are continuing to experience solid tenant demand.”

She said many C grade assets have issues with noise, employee density, natural light, and lift and mechanical issues.

“With demand for this type of stock continuing to deteriorate, demolition and replacement would be the best strategy for optimum returns in the long run, albeit it’s not an easy strategy for owners to execute.”

B grade vacancies are at 12.4%, while C grade vacancies are at a higher 20.5%, and D grade at 16.3%.