This article is from the Australian Property Journal archive

TWO major commercial car parks in Melbourne, boasting over 1,000 bays, are for sale, for the first time in almost a quarter of a century.

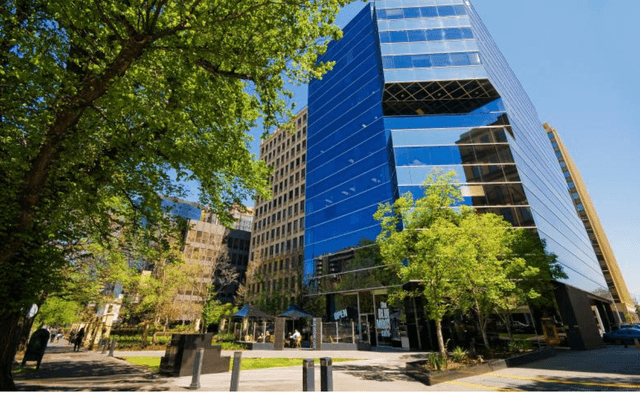

Singapore’s Lim family company Kim Lim Australia are cashing in their investment at 380-406 Queen St (corner A’Beckett St), Melbourne and 16-32 Leicester St, Carlton.

Colliers International’s Matt Stagg, Daniel Wolman, Oliver Hay and Trent Hobart have been appointed to sell the properties.

The car parks have been held by the family for 24 years after they bought 380-406 Queen St (corner A’Beckett St) for $9 million and 16-32 Leicester St Carlton for $4.5 million.

380 Queen St is expected to attract interest in excess of $70 million, whilst 16-32 Leicester St is estimated to sell for around $40 million.

380 Queen St is a large, 3,218 sqm site that is home to a six-level commercial car park comprising 556 bays, constructed in 1987. It also includes a 1,917sqm ground floor showroom and office.

16-32 Leicester St is a 2,040 sqm site comprising a six-level commercial car park with 454 bays, on the border of the Melbourne CBD.

Stagg said this is the biggest car park portfolio to be offered for sale in the Melbourne CBD for more than 10 years.

“On its own, this portfolio is substantial and unique, but current market conditions elevate the offering to an unprecedented level.

“The sale of the two properties comes at a time when the number of purpose-built commercial car parks throughout the Melbourne CBD and city fringe is rapidly reducing. A number of parking facilities have recently been or are scheduled to be demolished to make way for new residential and commercial developments,” Stagg said.

“Combined with a proposal by Melbourne City Council to limit on-St parking, this has seen the cost of car parking dramatically increase in recent years. Therefore, commercial car parks are a rare and highly prized investment that provide excellent cashflow,” he added.

Wolman said the properties were both situated within a rapidly developing education and lifestyle precinct, close to RMIT University and the University of Melbourne.

“The location also provides immediate access to other CBD amenities including the Queen Victoria Market and Melbourne Central.

“The proximity of both sites to Queen Victoria Market, which is subject to a major revitalisation project being led by Melbourne City Council, would make the portfolio even more attractive to potential purchasers,” Wolman said.

Stagg expects the portfolio would be hotly contested by local and international investors and developers.

“These buyers will recognise both the significance of a commercial car park portfolio investment opportunity of this size plus the huge underlying land areas and future development potential.

“The flexible zoning will enable a number of major development outcomes to be explored, including residential, commercial, student accommodation, hotel and education, subject to approvals,” Stagg said.

The international expressions of interest closes Thursday 8 October, 2015.

Australian Property Journal