This article is from the Australian Property Journal archive

AS it prepares to be wound up, Australian Unity Office Fund (AOF) posted a modest fall in funds from operations in FY24, as it shops around its last remaining asset.

AOF found a buyer in recent weeks for its 64 Northbourne Avenue office building in Canberra – taking a 35%-plus haircut from the peak book value – leaving just the 468 St Kilda Road office building in Melbourne in its portfolio as it neared the end of its selldown program.

AOF posted full-year funds from operations of $16.8 million for FY24, or 10.2c per unit, down from the previous year’s $19.3 million, at 11.7c.

Net tangible assets was down from $1.91 per unit to $1.39.

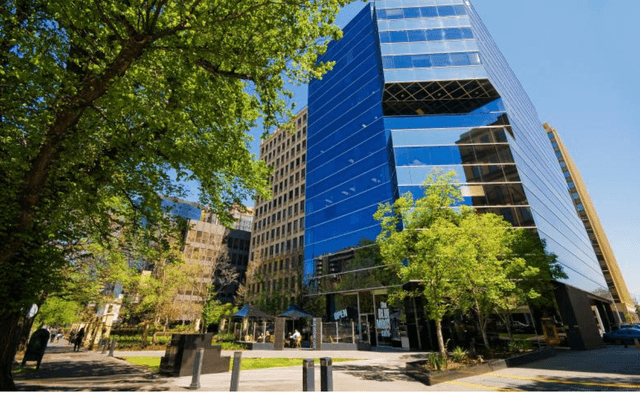

“AOF will continue discussions with prospective buyers regarding the potential disposal of 468 St Kilda Road, Melbourne,” its responsible entity, Australian Unity Investment Real Estate Limited (AUIREL) said.

“Subject to the progress of those discussions, market conditions, and any superior proposal, the AUIREL currently intends to make a determination to dispose of AOF’s main undertaking (including the distribution to unitholders of proceeds of relevant property sales) and seek unitholder approval to do so.”

468 St Kilda Road has been independently valued at $62.0 million.

The sale of 64 Northbourne Avenue followed the divestment of a refurbished vacant Parramatta office tower and adjacent car park for $80.5 million – nearly $70 million less than what the asset was valued at just two-and-a-half years ago – just a few months after it pitched plans for a 68-storey build-to-rent tower on the expansive CBD site.

The AOF asset sales have included 94-96 York Street in Beenleigh for $29.7 million, below what AOF paid in 2021 when it bought the then-new building for $33.52 million, and 150 Charlotte Street in Brisbane for $64.5 million. That price came in above the book value of $60 million, but represented a hefty capital loss for AOF, which paid $105.75 million in 2017 when it acquired the Brisbane CBD office building.

Shareholders are expected to be paid out proceeds from a wind-up via a trust.

The fund had come close several times in recent years to being sold.

Meanwhile, AOF has announced the departure of fund manager Nikki Panagopoulos.

“Nikki is an exemplary property leader. She has successfully delivered AOF’s strategy during challenging market conditions to execute on leasing, refurbishments and asset sales, whilst maintaining strong unitholder relationships,” said AUIREL chair Peter Day.

“On behalf of the Board of AUIREL I thank Nikki for her integrity, dedication and commitment to AOF and wish her all the very best for the future.”