- What CBRE expects investment sales to pick up next year

- Why First-half 2024 deals were up 5% compared with the five-year average

- What next Distressed sales will continue to be a big part of the residential land market through early next year

Commercial real estate in Vancouver is moving in a positive direction, CBRE said in its 2025 outlook, released Thursday morning.

Despite some bumps in the provincial economy, investor confidence is on the rise in the wake of interest rates being lowered, the brokerage said. It expects trading volumes to rise.

“Overall, we are heading in the right direction and expect more positive news in 2025,” Jason Kiselbach, managing director of CBRE Vancouver, said.

More sales in the offing

Investment sales have led to some optimism for the coming year as the first half of 2024 saw a 5% bump compared with the five-year average.

This year, there have been 15 transactions valued at more than $50m, including the largest office sale in five years and a regional record industrial land sale. Plus, several large deals have been announced this fall.

“And we anticipate the return of institutional and REIT acquisitions, particularly in the multi-family and industrial sectors,” Kiselbach said.

Bright spots in the market

The office market, which has been hovering at a vacancy rate of around 11% to 12%, is expected to improve, CBRE said.

While smaller businesses have been giving up space due to hybrid and remote work, larger companies value their office space in the long term. Overall tenant demand has increased with diversified businesses searching for space and willing to sign longer leases.

Meanwhile, the brokerage said, population growth in the city has led to a robust retail market, including big brands taking up locations in the busy retail areas of Robson and Burrard Streets.

Still, a decline in spending threatens to hit luxury retailers, as nonessential spending becomes the first victim of wallets being tightened.

But some weakening fundamentals

Despite the population growth supporting the retail sector, the residential rental sector has seen rents soften in the city, with a few possible reasons for the trend.

“This may be the result of loss people moving to Alberta, underlying weakness in the economy, or we may simply be nearing the ceiling of what people can pay for a one-bedroom unit in the Greater Vancouver Area,” Kiselbach said.

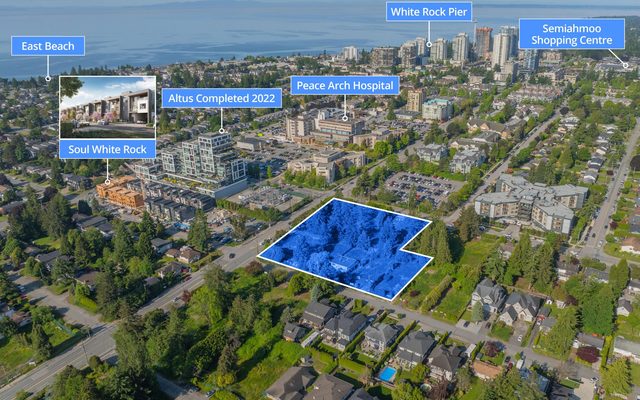

The city still has the lowest vacancy rate in North America at 1% due to an undersupply of housing. Against that backdrop, development land, especially for residential and mixed-use projects, is persistently the most challenging in Vancouver, according to the brokerage.

Developers can no longer count on rising prices to offset construction costs, leading to an increase in court-ordered sales in the city.

“We anticipate that distressed deals will continue to represent a significant portion of the residential land market through early 2025,” Kiselbach said.

The outlook for the industrial market was also less stable, with demand declining after several years of historically low vacancy rates, CBRE said, stressing that the market is adjusting to the changing demand. A slew of new construction, the second-highest amount on record, has led to the expectation that pre-leasing of industrial space will be at a seven-year low.