This article is from the Australian Property Journal archive

AROUND 61,000 new apartments could be completed in Sydney between 2015-2017 and prices continue to rise, with a one-bedroom unit in the city averaging $1.02 million, according to JLL.

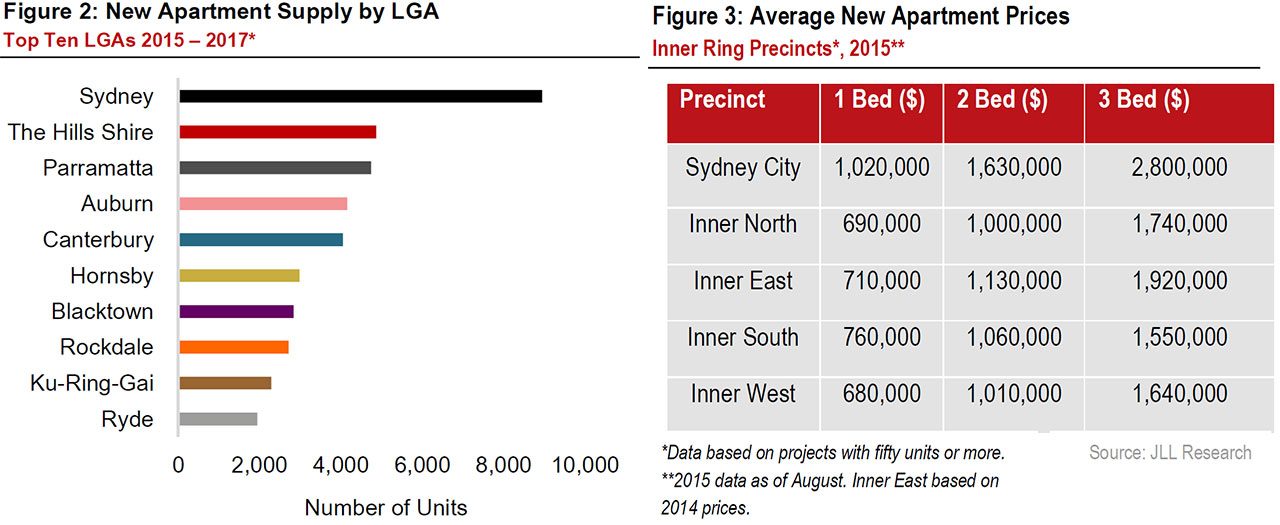

JLL’s report, Sydney Apartment Market Indicators, predicts 61,000 new units could be completed between 2015-2017, based on projects with 50 units or more, which exceeds 44,500 net completions between 2012–2014, according to the NSW Department of Planning and Infrastructure’s Metropolitan Development Program.

Although the report said the number of completions over the 2015-17 period is more likely to sit at 46,500 units, after adjusting this number based on the likelihood of each project completing on a scale of “proposed” to “under construction”.

JLL’s director of residential research Rupa Ganguli said the Sydney residential market continues deep into the eleventh hour of a housing upturn, as sellers take advantage of continued capital growth and buyers look for opportunities in a market offering plenty of choice in housing stock.

“Interest rates have remained stable and this reflects the general ‘wait and see’ approach that investors are taking.

“Based on our projections of the apartment supply pipeline, our view is that supply in the new apartment market will continue to meet buyer demand for multi-unit dwellings until at least the end of FY2016. An undersupply in the Sydney market since even before the turn of the decade will not be corrected overnight,” she added.

The report found Parramatta is increasingly becoming a destination for buyers, accounting for 8% of new apartment supply between 2015-17, closing the cap on the Sydney City, which represented 15%. Compared to 2012-2014, 18% of supply was located in the City of Sydney LGA versus Parramatta LGA’s 9%.

Other pockets were also picking up across the Greater Sydney region, including The Hills Shire, Auburn, Hornsby, Blacktown and Rockdale LGAs.

“Each has its own reason for the increase, although most share common themes of affordability, proximity to transport nodes, rising supply and increased infrastructure,” Ganguli said.

Meanwhile JLL’s national director of valuations and advisory NSW Tyrone Hodge said solid demand for residential development sites in the inner ring 10 km around the CBD were now causing a convergence of prices for sites with development approval.

“Waterloo, North Sydney, Botany and Surry Hills – these suburbs in the inner ring within 10 km from the CBD have recorded the highest number of residential development sites purchased in 2015 to August.

“At a macro level however, a more interesting trend that is developing are the corridors of activity emerging across the Greater Sydney metropolitan, driven by upcoming and existing transport projects. Distinct concentrations of site sales are appearing across major transport lines such as UrbanGrowth’s Central to Eveleigh corridor, the Northern and Western Line linking St Leonards through to Hornsby, Stage 1 of WestConnex between Parramatta and Haberfield, and the North West Rail link as a part of The Hills Corridor Strategy by the NSW Department of Planning & Environment,” Hodge said.

With the combination of city and water views, sites in the Sydney CBD and Inner East commanded the highest average rate per unit for sites with planning approval. At an average $750,000 per unit in the CBD and $360,000 in the Inner East – sitting well above the others in the inner ring.

Outside of these two, there is a convergence of average prices at a rate per unit in the inner ring, with the Inner North, South and West all falling in the $200,000 – $300,000 per unit range.

In the CBD itself the range in prices extends from $250,000 to $1,250,000 at a rate per unit basis, purely because of the trading of “blue-chip sites” with the potential for prime residential in the $500,000+ rate per unit range.

Hodge said in line with rising site values, prices of new apartments continue to be strongest in the Sydney City and Inner East precincts, which have the advantage of both city and water views.

“A convergence of prices at a one bedroom level shows, with the exception of Sydney City, that developers are competing on introductory one bed price points to lure lone person households at affordable rates.”

The report found the price of one-bedroom units in Sydney City averaged $1.02 million in comparison the Inner North is $690k, Inner East is $710k, Inner South is $760k and Inner West $680k.

Not surprisingly, rising prices has seeing gross rental yields also decline.

According to JLL, Sydney and Melbourne gross rental yields for units both trended to their lowest levels in over five years as at June 2015, a result of continued growth in capital values.

Yields for units in Sydney were at 4.2% and Melbourne at 4.1% as of June 2015, with Sydney a whole percentage below Brisbane at 5.1% while the Gold Coast sat even higher at 5.5%.

“The lower yields story is not so damning when put in context, considering Sydney is experiencing the second highest annual rent growth across the major cities in the unit market. Yields at this time speak more of the impressive capital growth we have seen rather than being a function of rent price growth,” Ganguli said.

Australian Property Journal