This article is from the Australian Property Journal archive

EXPANDING existing businesses, creative industries and the booming education sector have pushed Sydney city fringe office vacancy rates below those in the CBD.

According to Knight Frank’s Sydney City Fringe Office Market Report June 2019, an undersupply of space is also leading to surging rental growth in the fringe.

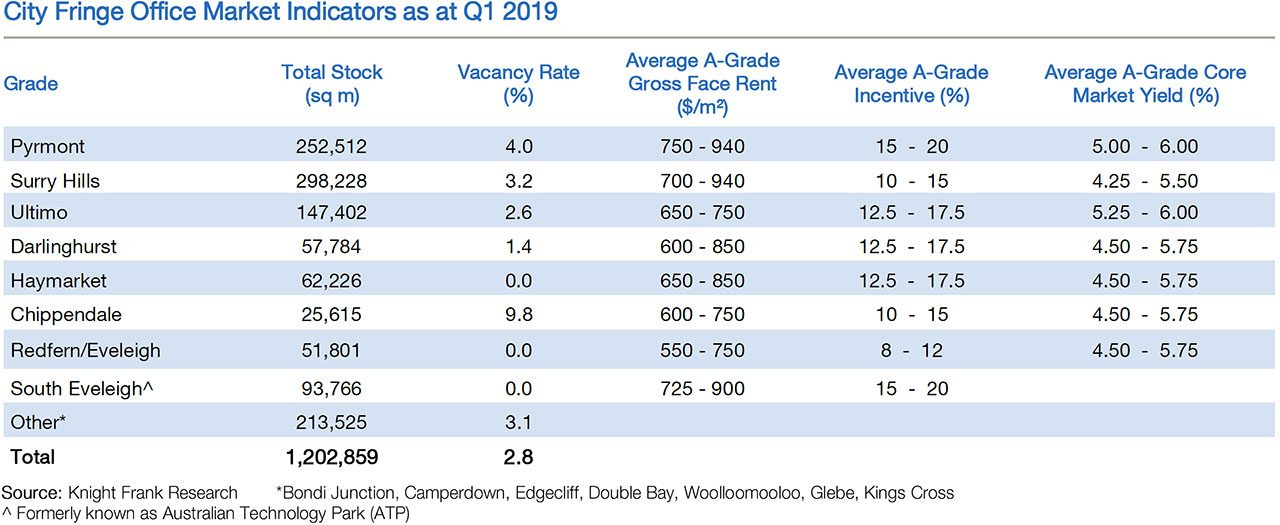

Vacancy rates in the fringe fell to 2.8% at the end of the first quarter this year, compared to the 4.1% in the CBD.

Above-trend population and employment growth, as well as higher business investment and new infrastructure, had driven the take-up, Knight Frank associate director research Katy Dean said.

“Additionally, the continued evolution of greater Sydney and growth of knowledge-intensive industries on the back of both technological adoption and progress is helping to elevate the status of the CBD’s southern fringe areas to a thriving economic, amenity-rich commercial office destination.”

Demand coming from knowledge-intensive industries including education, professional services, information, media and technology and start-up businesses had driven transformation in the office market from Central to Eveleigh, with Pyrmont, Ultimo and Surry Hills at the centre of the transformation.

“However, growing demand from creative industry for fringe office space and the ongoing expansion of the education base in Ultimo has driven the expansion of other commercial office precincts including Redfern and more recently, Eveleigh on the back of Mirvac’s South Eveleigh development.”

Undersupply has spurred double-digit growth in most of the fringe precincts over the past year, with some rates exceeding those recently achieved in the CBD recently. Pyrmont gross face rents have surged 26% from $750 to $940 per sqm. Growth was followed by Surry Hills (21%), Ultimo (18%), Haymarket (17%), Redfern (13%), Chippendale (12%) and Darlinghurst (4%).

Surry Hills average rents of $820 per sqm reflect a 50% increase since the first quarter of 2016, while Sydney CBD rents which have increased by 25% over the same period.

On a net effective basis, rents in Surry Hills have double to average $610 per sqm, and vacancies are down to 3.2%.

“Expansion to the south certainly has the potential to accommodate increased demand by taking advantage of the availability of infill development opportunity in the area, with infill set to drive the southern CBD expansion.”

Knight Frank head of office leasing Sydney South, Nick Lau said while Central to Eveleigh is at the forefront of the state government’s urban growth plans, the competition for commercial office space on the southern fringe had been underpinned by its amenity characteristics, including the typically low-rise buildings and gentrification of underutilised or disused industrial buildings.

The education sector is driving demand, with a push from larger providers seeking spaces of 2,000 sqm and above within the fringe boundaries.

The seven-level concrete Harry Seidler-designed building at 372 Elizabeth Street in Surry Hills – known as Seidler Surry Hills – has been offered for lease, bringing 4,400 sqm of space to the market. Interest is expected due to its architecture, and features including 17-metre wide column-free floorplates and frameless floor-to-ceiling glass, and its location.

“Seidler Surry Hills is positioned in the heart of Sydney’s sought-after creative hub, with great transport connectivity and other amenity,” said Lau, who is marketing the space with colleague Nick Sinclair.

Lau said further rental growth is expected across the fringe with no speculative supply under construction and future supply non-existent.

Investment volumes averaged around $566 million annually over the five years to 2018. Around 25% of assets have been acquired by offshore funds, with domestic investors accounting for the balance, led by institutional funds and trusts, and private investors.

Average prime yield ranges in some cases up to 125 bps wider than those in the CBD, but sit around the low 5% range, with Surry Hills averaging sub 5%.

Jonathan Vaughan, Knight Frank commercial sales NSW said the upturn in investor demand had come off the back of elevated investment in the CBD and tight leasing market fundamentals that had seen strong rental growth and low vacancy influence tenant decision-making regarding location.

“The lower price point could also be considered an attractive entry point for many investors who to some extent have been priced out of the Sydney CBD or are simply targeting a growth precinct.

“Although the fringe may have been traditionally viewed as the choice location for smaller tenants, demand from larger occupiers, mostly fintech and education, has been encouraging.

Major deals include AEW’s acquisition of 19 Harris Street, while MTAA acquired the office component of 100 Broadway in Chippendale for $77.14 million in December on a yield of 5%, and Marks Henderson bought the refurbished warehouse style building at 19 Foster Street, Surry Hills for $39.5 million, on a passing yield of 4.8%.

In March last year, the same buyer acquired 29-43 Balfour Street, Chippendale, a former factory and warehouse building, for $30 million and is undertaking a refurbishment.