This article is from the Australian Property Journal archive

MORE than half a billion dollars is expected for a former Shell oil refinery site in Sydney’s west that is set to become a $1 billion last-mile industrial and logistics estate.

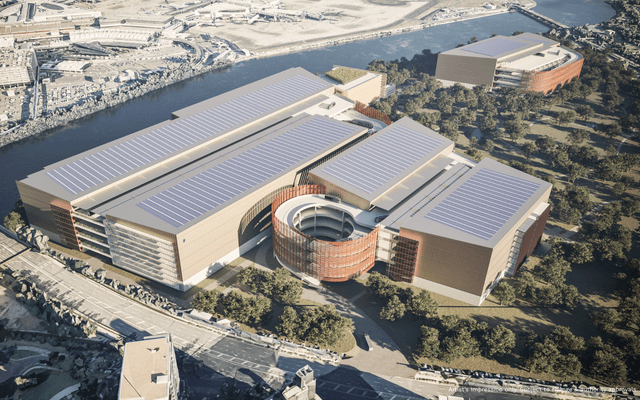

The 25.6 hectare Rosehill Central site has the potential to deliver over 140,000 sqm of warehousing facilities. Its IN3 heavy industrial zoning offers a range of uses, with the approved 13-lot subdivision allowing for sites ranging in size from 8,060 sqm to 36,330 sqm.

Interests associated with Viva Energy have put the site to the market through CBRE’s Jason Edge and Michael O’Neill together with Colliers’ David Hall and Tony Durante.

The land can be sold in one line or as individual or multiple serviced lots and is diagonally opposite Rosehill Racecourse. Institutional developers have made $500 million worth of infill development sites transactions in central western Sydney this year and are tipped to go after the entire site.

“The successful Rosehill Central purchaser will be able to capitalise on the lack of competing stock in the market and the huge volume of enquiry for industrial & logistics space in Sydney’s central west, which has accelerated by 20% due to rising e-commerce penetration,” O’Neill said.

CBRE data shows more than 200,000sqm of pent-up tenant demand in the central west market with a vacancy rate of just 0.34%. Rents have jumped by 10% in the March quarter with more growth on the way and little new stock is expected until 2024.

Hall said the Rosehill Central site represented one of the last remaining large scale industrial and logistics development sites east of Parramatta.

“This location provides seamless access to the densely populated centres of Sydney, creating the perfect last-mile logistics location and an exceptionally efficient e-commerce location supported by lower inbound and outbound transportation costs, lower toll costs and proximity to population and key logistics infrastructure,” Hall said.

Rosehill Central is located on the corner of Devon Street and Colquhoun Street, close to James Ruse Drive, Victoria Road and the M4 Motorway.

In western Sydney, stage three of the Westconnex is scheduled for completion next year and will deliver an estimated drive time saving of 40 mins between the region and south Sydney and accelerate rental growth in the central west.

It is expected to be the biggest industrial infill transaction since Qantas sold off nearly 14 hectares of land in Mascot last year to a consortium led by logistics property player LOGOS and Australian Super. The deal included 21,795 sqm distribution centre with a long-term leaseback agreement, and a further three development sites totalling 98,645 sqm immediately adjacent to the Sydney Kingsford Smith Airport Precinct. They will be redeveloped by the buyers into a $2 billion four-level ramp up, logistics, e-commerce and last-mile logistics hub.

In Australian Property Journal’s Talking Property podcast, MaxCap Group’s David Oudshoorn said that he doesn’t think it will be too long before more multi-level industrial developments are seen at inner-city last-mile logistics sites.

Mascot has also just seen a 10,100 sqm warehouse and office complex site with potential for 30,300 sqm of building tipped to the market with expectations of $90 million.

Expressions of Interest close 14th June.

The Sydney industrial market was the busiest nationally in the March quarter, seeing $1.53 billion worth of deals. Global real estate firm Hines last month made its first Australian industrial acquisition, buying a portfolio of four assets in Sydney and Brisbane for $211.5 million that included a Chullora site with development upside.