This article is from the Australian Property Journal archive

AUSTRALIAN retailers are sprinting to Christmas before consumer caution takes hold early in the new year, and a difficult six months could bring a short and shallow retail recession, according to Deloitte Access Economics.

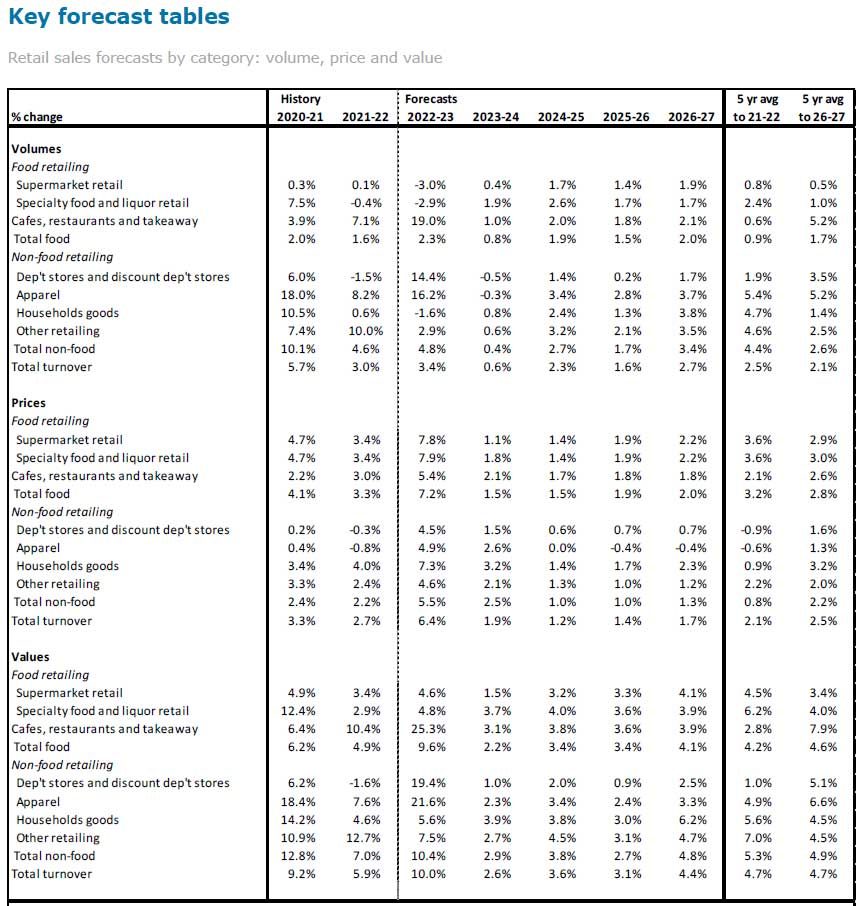

According to Deloitte Access Economics’ latest Retail Forecasts, year-to-December growth in nominal retail sales is expected to grow by 10.4%.

“But most of this is expected to be driven by prices, as retailers try to maintain their margins by passing on rising costs,” said the report’s principal author, David Rumbens.

Retail prices are anticipated to grow by 7.6% over the year to December.

“For now, we’re expecting the holiday season and end-of-year events to throw the retail sector a lifeline,” Rumbens said.

“Looking ahead, retailers are likely to face a difficult six months as they ring in the new year. With cost of living pressures and a mortgage rate squeeze clouding the horizon, retailers are growing pessimistic about the state of the consumer in 2023.”

Some 58% of respondents to the recent Deloitte Retailers’ Holiday Survey expect consumer confidence will deteriorate through 2023. Consumer confidence has risen for a third straight week but remains at “exceptionally weak” levels, according to ANZ and Roy Morgan research.

Rumbens said sales are expected to curtail at the start of 2023.

“The result could see the sector entering a short and shallow ‘retail recession’. Sales volumes are anticipated to decrease by 0.2% and 0.4% over the March and June quarters of 2023, respectively, and few retail categories are expected to be spared, with a wide sweeping reduction in demand expected.

“Sales are likely to pick up through the second half of 2023, but result in a bottoming at zero real growth over the year to December 2023. So a more sombre 2023 after a sprint to Christmas in 2022.”

He said it would “only be a matter of time” before poor sentiment was reflected in spending. Internationally, nominal retail spending in the US decreased by 1.3% and UK sales volumes fell by 3.0% in the September quarter. Nominal retail turnover in Australia lifted 2.3% during the period, but growth in sales volumes slowed to just 0.2%.

Retailers are also facing stiff competition as consumers switch to higher spending on services rather than goods, evidenced by the difference between total consumer spending growth and real retail growth.

Meanwhile, household wealth decreased by 3.3% during the June quarter, driven by a fall in housing prices and revaluation losses in superannuation as higher interest rates and poor performances across the domestic and international stock markets impact superannuation returns. According to the report, the threat to discretionary spending is “still very real”.