This article is from the Australian Property Journal archive

BUYERS and sellers of office towers need to make up a 30% gap on price expectations for the market to return to “normal” liquidity, which together with the impact of higher capital costs dragged down Australian commercial real estate transactions in the June quarter to their lowest level since 2011, according to new data from MSCI Real Assets.

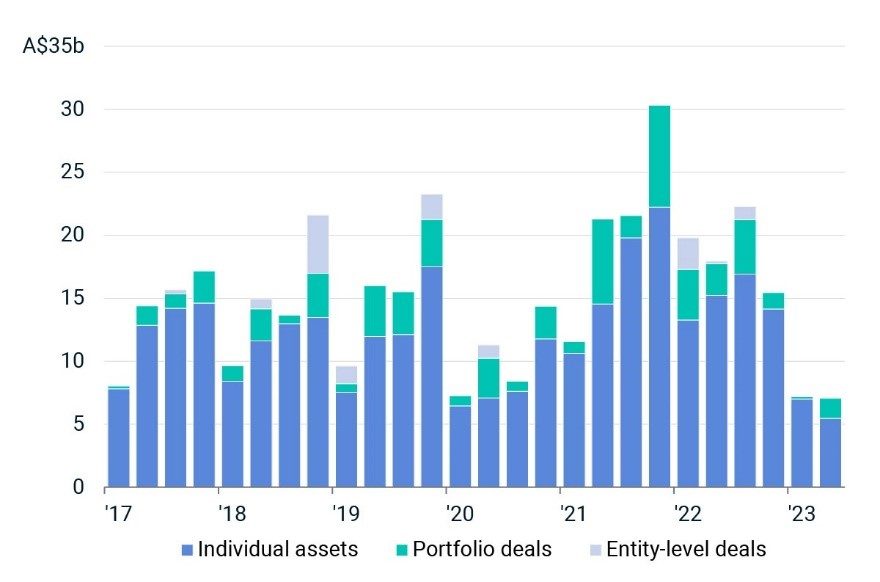

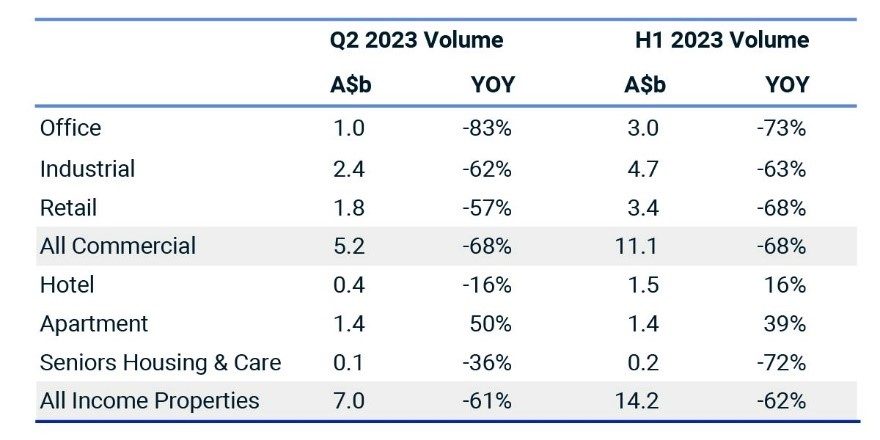

Transaction volumes for the period totalled $7.0 billion, according to MSCI’s latest Australia Capital Trends, a 61% decline relative to the same period in 2022 and a 49% decrease against the five-year average.

It’s the second quarter straight quarter sales are at the their lowest since 2011, marking a sustained face-off between buyers and sellers.

Deal count also dropped by close to half compared to the five-year average, while office sales fell below the retail sector and the build-to-rent apartment market.

“This is a worrying sign for the market as the slowdown is becoming more entrenched,” said Benjamin Martin-Henry, head of Pacific real assets research at MSCI.

“Overall volumes haven’t seen declines of this magnitude since the slump induced by the Global Financial Crisis.”

“Still, in times like these opportunities are out there, but only at the right price and that’s the biggest sticking point at the moment.”

Multiple interest rate hikes by the Reserve Bank of Australia since May last year and the subsequent impact on lending rates for investors have muddied the outlook for pricing, leaving many buyers and sellers at stalemate, he said.

Office sales tumbled by 83% in the second quarter relative to a year earlier, down to just $983 million – the lowest quarterly result since 2009. Slated transactions in the pipeline are expected to be finalised at well below previous book values. Dexus has confirmed its 44 Market Street tower in the Sydney CBD has sold at a 17.2% discount to book value, while it is also reportedly selling 1 Margaret Street at a 21% discount; Mirvac has found it difficult to find a buyer of its 60 Margaret Street tower at a satisfactory price.

The MSCI/Mercer Australia Core Wholesale Monthly Property Fund Index showed that annual capital growth for office funds was -7.9% in the second quarter, contributing to a total return decline of -4.4%.

David Green-Morgan, global head of real assets research at MSCI, said the MSCI Price Expectations Gap model – which estimates the amount sellers would need to shift their price expectations to bring transaction activity back to “normal” levels of liquidity – shows that Australian offices have one of the widest gaps of any of the markets covered by the firm.

“The gaps in pricing positions in Australia’s largest sectors and markets, which are around 30%, contribute to its status as one of the worst performing markets globally.”

The Sydney office market – typically Australia’s most active market segment – was only the fifth most-traded segment in the first half of 2023, handing over the title to the city’s industrial market, which netted $2.175 billion in sales during the half. Melbourne’s retail ($1.186 billion), build-to-rent/apartment ($941 million) and industrial ($888 million) were all next. Each of the top five saw sizable falls except for the Melbourne build-to-rent/apartment market, which was up 202% year-on-year.

The industrial, office and retail sectors all saw asset sales in the June quarter. Despite a significant 62% decline in volume year-on-year to $2.4 billion, the industrial sector took the lion’s share of investment in the first half of the year, with 33% of total acquisition volume across all property types.

The shift in consumer spending away from brick-and-mortar retail has dented demand for retail assets, according to MSCI, causing an increase in yields. Sales of retail assets in the June quarter totalled $1.8 billion, bringing the year-to-date total to just $3.4 billion, a 68% decline on 2022. The MSCI/Mercer Australia Core Wholesale Monthly Property Fund Index showed annual capital growth for retail funds was -4.0% in the second quarter.

However, momentum in the build-to-rent sector continued to grow. In the second quarter, $1.4 billion in sales were completed, ahead of deal activity in the office sector. Cross-border investors have been a significant presence in this sector, accounting for around half of the units that have either been completed or are currently under construction in Australia since 2015, Martin-Henry said.

Among the major deals was Japan’s Mitsubishi Estate, alongside the Clean Energy Finance Corporation, acquiring a partial stake in a Mirvac portfolio of both operational and under-development build-to-rent assets.

Mitsubishi Estate’s acquisition helped bolster cross-border investment levels in the second quarter after a very slow start to 2023, but the trend of diminished overseas investment in Australia has continued. Overseas buyers accounted for only 23% of acquisitions in the first half of the year, compared to a 10-year average of 29%. The annual share has been decreasing since it touched 34% in 2019.

“Acquisitions by offshore investors picked up in the second quarter; an encouraging sign after such a poor start to the year”, Martin Henry said. “Where they are deploying capital is interesting as well: they are shying away from offices, which have long been the preferred sector in Australia, and focusing more on the hotel and BTR sectors.”