This article is from the Australian Property Journal archive

MELBOURNE homebuyers who bought in the outer suburbs because homes were more affordable are $80,000 worst off, because they are paying significantly higher household, commuting and utility costs.

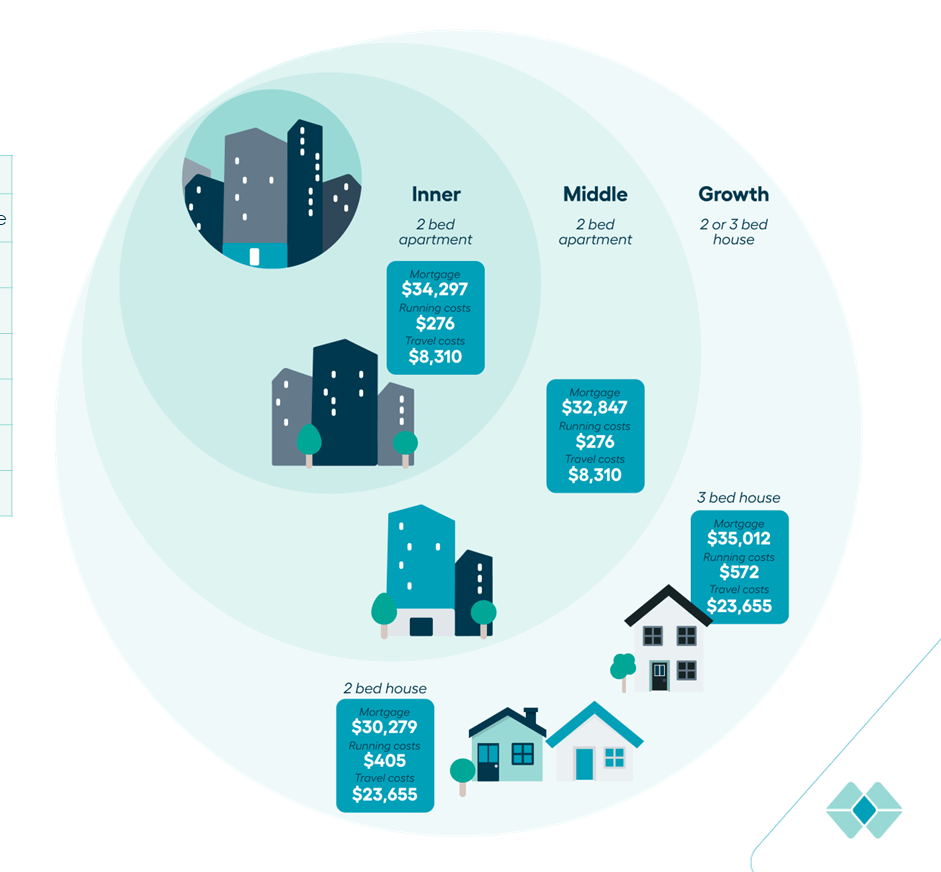

According to a SGS Economics and Planning report commissioned by Great Southern Bank, the ongoing costs of a two- or three-bedroom house in a growth area on Melbourne’s urban fringe can be 27% and 38% higher, respectively, than a 2-bedroom inner city apartment.

SGS found that once ongoing living expenses – such as higher energy bills, fuel and public transport – are added to mortgage payments, owners of a two-bedroom house in Melbourne’s outer suburbs could be spending up to $11,500 more each year than those who purchase a two-bedroom apartment in an inner-ring suburb.

The additional annual cost is more than $16,000 for a three-bedroom house, or $80,000 over the first five years of owning a home.

Great Southern Bank chief customer officer Megan Keleher said potential homebuyers need to understand the sometimes-forgotten ongoing costs of home ownership, adding that the report will help homebuyers make informed and sustainable housing choices.

“While homebuyers are often attracted to the affordable purchase price of homes in outer growth suburbs compared to the inner city, this research highlights the importance of weighing up the long-term costs against the potential upfront savings,” said Keleher.

The report found parking, car ownership, fuel and public transport costs were more than twice as much for those living in outer growth suburbs at around $23,700 annually, compared to the average inner-city commuter spend of $8,300.

“While some Australians are offsetting this cost by working from home, it remains an important consideration for those who regularly travel to their place of work,” she added.

Household running costs, including energy and water, were also higher for larger homes with gardens in the outer suburbs. With power bills rising by more than from 1 July 2023, the short-term financial and long-term sustainability benefits of smaller, more energy and water efficient homes with high energy and water efficiency is likely to become even more important.

SGS principal Andrew McDougall said there are large costs attached to housing residents in new suburbs on the urban fringe, rather than in established areas.

“These include increased infrastructure costs, commuting cost and time, and potential environmental impact of transport and land consumption. These costs quickly add up for both the home buyers and the broader community.”

Recently the NSW Productivity Commission’s found that by building new homes and leveraging existing infrastructure in established suburbs, it could save up to $75,000 in infrastructure costs per home.

Meanwhile the Victorian government recently announced its Housing Statement – The Decade Ahead 2024-2034, a plan to deliver 800,000 new homes over the next decade, or 80,000 per year.

Outgoing premier Daniel Andrews has promised to reform the planning system and cut red tape, which he blamed for delaying supply of new housing.

Keleher said when homebuyers are weighing up options, it’s worth factoring in potential costs of home ownership over the next three, five, or 10 years, not just the upfront purchase costs.

“The property location and size of the home can impact ongoing living expenses, including energy and water bills and transport costs. These factors are becoming even more important for homeowners looking to balance cost of living pressures,”

Keleher said existing homeowners who don’t have energy efficient features in their homes, or who face longer commuting times, do have options to reduce their environmental footprint – and ongoing costs.

The bank recently launched new personal loans recently, designed to help customers cut their energy costs and reduce the emissions from their cars and homes.