This article is from the Australian Property Journal archive

PROPERTYLINK’S suitor and Pan-Asia logistics giant ESR has struck a deal with Allianz Real Estate to invest US$1 billion into India’s fast-growing industrial property market, keen to tap into the boom in e-commerce spending which is growing at 51% per annum, the highest rate in the world.

The joint venture will focus on developing and acqateuiring large-scale facilities in eight key cities including Mumbai, Pune, Chennai, Delhi, Ahmedabad, Kolkata, Bangalore and Hyderabad.

ESR co-founder and president Charles de Portes said India presents a unique opportunity with e-commerce revenue set to rise to US$120 billion in 2020.

“We are delighted to partner with Allianz, an existing strategic partner of ESR in other geographies. This JV with a leading institutional investor who has deep experience in Asia marks a key milestone in our regional growth plan. As one of the main contributors to Asian and global growth, India presents a unique opportunity for not only ESR, but also our domestic and international customers expanding with India’s economy as well as our preferred investment partners,” de Portes said. “The increasing internet and smartphone penetration, growing acceptance of online payments, and favourable demographics will continue to propel e-commerce growth, and hence spurring demand for modern logistics facilities,”

In India, e-commerce revenue is expected to jump from US$39 billion in 2017 to US$120 billion in 2020, growing at an annual rate of 51%, the highest in the world, according to India Brand Equity Foundation (IBEF), a trust established by the Indian government’s Department of Commerce, Ministry of Commerce and Industry.

Allianz Real Estate Asia Pacific CEO Rushabh Desai said India’s logistics sector is benefiting from favourable trends.

“India’s logistics sector is coming of age. The sector is benefitting from a lot of favourable trends, such as stellar consumption patterns, continued infrastructure spending, increasing transparency and the nation-wide implementation of a uniform indirect tax system.

“This is the second time we are collaborating with ESR in the Asia-Pacific region. They have built a best-in-class team in India to take advantage of the favourable environment for logistics. The pipeline indicates a strong start to the programme.” Desai said.

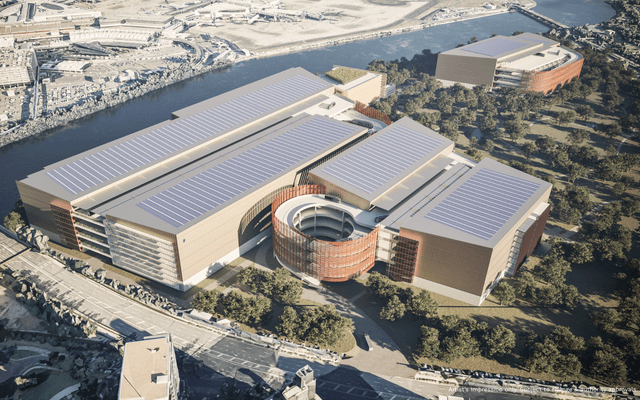

Since entering in 2016, ESR has accelerated growth in the Indian market over the last 18 months and currently has approximately 7 million sq. ft. of developable GFA.

ESR continues to eye opportunities in Australia’s logistics and industrial property market, after recently taking over Propertylink for $723.4 million.

It marks further entrenchment in Australia’s growing industrial and logistics sector for ESR. Earlier this year, it bought out developer Commercial and Industrial Property from Charter Hall and its partners, to use as a seed asset for its foray into the Australian market.

Australian Property Journal