This article is from the Australian Property Journal archive

ONLINE retailing is driving demand for industrial space, which is on track for a record result in 2017, according to JLL.

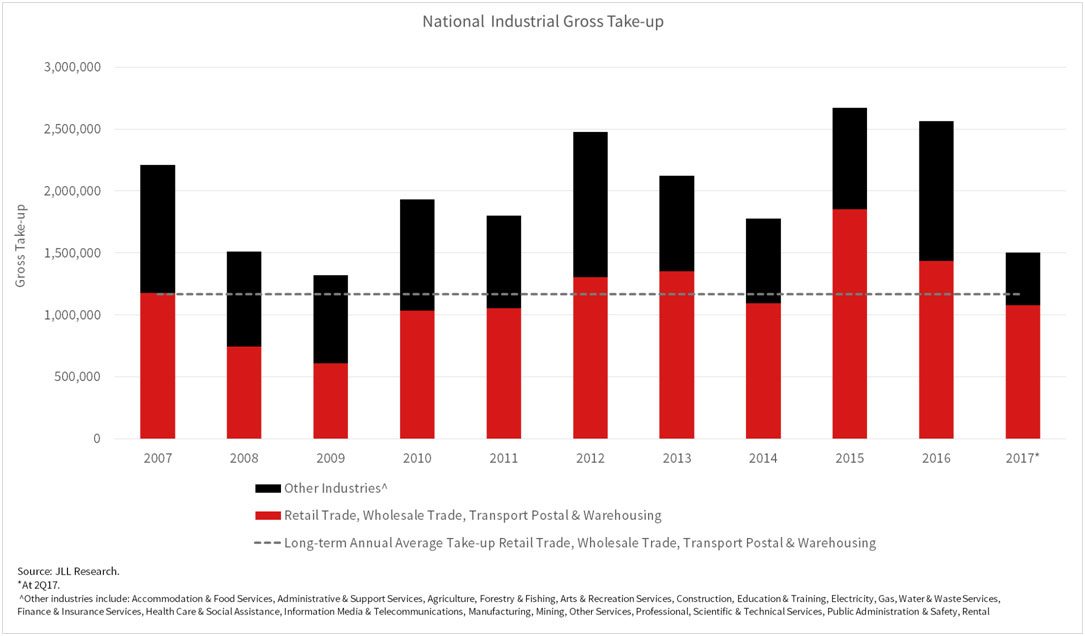

JLL research reveals that since 2015 the annual gross take-up recorded by the retail, wholesale and the transport, postal & warehousing sectors was 54% above the 10-year average of 1,165,700 sqm.

In the first half of this year, over a million sqm of industrial leases were recorded.

Total take-up activity so far was led by Sydney (510,000 sqm) and Melbourne (377,237 sqm) markets. Brisbane showed a notable improvement in leasing demand with 219,731 sqm in leases taking place in 1H17.

“We are seeing retailers increase investment into their supply chains and go through the process of evaluating their supply chain requirements. The requirements from fulfilment centres will evolve as retailers look to capture a greater volume of online sales,” JLL’s head of industrial Australia Michael Fenton said.

“As margins continue to come under pressure from online sales and the entry of foreign players, retailers will look for ways to streamline their cost structures.

“This will involve the integration of their brick-and-mortar and online sales channels. From a logistics perspective, the key will be having well-located distribution centres to service their shops and customers directly. This is leading to a net increase in the demand for quality distribution space,” he added.

JLL’s research manager Sas Liyanage said despite the headwinds faced by the in-store retail sector, logistics requirements have continued to climb in recent years.

Liyanage said the growth in online sales has transpired in industrial demand.

“Over the past 10 years, gross absorption from the retail, wholesale and the transport, postal & warehousing sectors would account for 56% of leasing activity.

“In 1H17, they have accounted for 72% percent of national take-up. We believe retailers will continue to invest in their e-fulfilment capacities to safeguard themselves against the threat from well-equipped international and online retailers.” Liyanage said.

Fenton said retailers are aware of the consequences of not adapting quickly enough.

“The current competition for online sales will renew focus on delivery times and costs to the consumer.

“As such, retailers are now striving for more efficient logistics networks, involving a renewed focus on rebalancing their in-store and industrial requirements,” he concluded.

Australian Property Journal