This article is from the Australian Property Journal archive

AFTER a less dramatic year for house price growth in 2024, Australia’s home value will continue to rise in the coming years, albeit at a slowing rate.

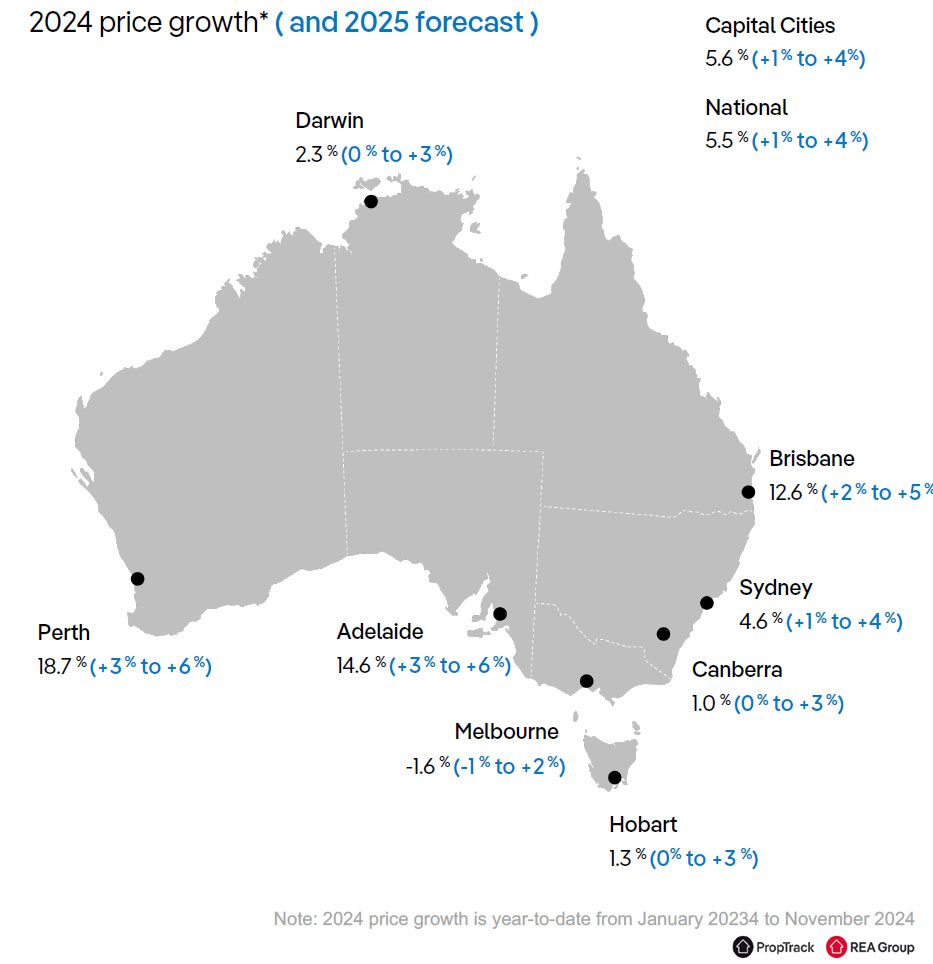

According to REA Group’s PropTrack Property Market Outlook Report December 2024, Australian property prices are forecast for a 4% bump over 2025, compared to a 5.5% rise in the year to November 2024 and the 6.9% growth recorded in 2023.

ANZ is forecasting a similar outcome, with capital city housing prices anticipated to grow 2.7% in 2025 and 4.1% in 2026.

“Australia’s property market has shown unexpected resilience in 2024, with home prices rising nationally despite varied performance across the country and an influx of new properties hitting the market,” said Cameron Kusher, director of economic research at REA Group.

“The increase in available stock has boosted sales volumes but also led to softening demand, which has been a contributing factor to slowing price growth. With more options, buyers face less urgency to purchase, and properties are spending a longer time on the market.

While again at a slower rate, both Perth and Adelaide will continue to outpace the rest of the country in home price growth over 2025, according to PropTrack.

With Perth and Adelaide expected to see up to 6% growth in the new year, after rising 18.7% and 14.6% over the year to November 2024.

On the other end of the spectrum, Melbourne is expected to see the weakest performance in 2025, following a loss of 1.6% in 2024 so far, the Victorian capital is forecast for a value change between -1% and +2%.

Brisbane has recorded a 12.6% increase over the year to November and Sydney has seen an increase of 4.6% over the same period, with 2025 projected for a more moderate 2% to 5% and 1% to 4% respectively.

While Hobart, Darwin and Canberra are all expected to see increases up to 3% in 2025, following gains of 1.3%, 2.3% and 1% respectively in the year to November 2024.

“Property market conditions in 2024 have been far from uniform across the capitals and regions, with significant variations reflecting diverse supply and demand dynamics,” added Kusher.

“With price growth moderating, stock levels rising, and the expected timing for interest rate cuts delayed, we anticipate weaker price growth compared to recent years.”

ANZ is forecasting a more diverse multi-speed market in 2025, with a 0.7% increase for Sydney, just 0.1% in Melbourne, 5.8% in Brisbane, 3.5% in Adelaide, 8.5% in Perth, 0.1% in Hobart and Darwin and a decline of 0.9% in Canberra.

With ANZ anticipating a somewhat more robust 2026, with a 3.7% gain in Sydney, 4.9% in Melbourne, 4.8% in Brisbane, 2.4% in Adelaide, 4.5% in Perth, 1.8% in Hobart, 1.5% in Canberra and 2.2% in Darwin.

Over the five years to November 2024, national dwelling values up 47.9%, led by Adelaide at 80.9%, according to PropTrack.

Brisbane followed with a 80.7% gain over the period, Perth up 79.1%, Sydney 41.2%, Hobart 40.7%, Canberra 38.2%, Darwin 29.8% and Melbourne up 17.1%

2024 also saw an increase in total listing volumes across all capitals but Adelaide and Darwin, while capital city enquiries per listing were down 8.6%.

Nationally, median days on market were up from 27 days in November 2023 to 34 days in November 2024.