This article is from the Australian Property Journal archive

DESPITE challenges in the tertiary education sector due to the pandemic, the emergence of innovation and knowledge precincts and university tuition reform has spurred investment interest in Australia’s burgeoning healthcare and life sciences real estate market.

A new CBRE Viewpoint report highlighted how life science real estate has gained institutional investment acceptance over the past decade and has now filtered through to the Australian market. Some $549 million worth of healthcare, medical centres and hospitals transacted during 2019 – an uplift of more than 100% from 2018.

That trend has been established overseas. REITs, private equity and foreign entities injected US$6.8 billion into the sector in the US alone in 2019, reflecting 95% annual growth.

The increasing overlap of education and healthcare has proven to be a springboard for investment in healthcare and life sciences real estate. CBRE’s national director of science and research, project management, David Keenan said the Parkville campus of the University of Melbourne is an exemplar of this, with the institution anchoring the precinct with several major hospitals.

“From those foundations, a rich research and innovation district has developed over time to include world class medical research and associated entities.

“Australia’s tertiary system has an increasingly important role to play in its creation and support of a more skilled and educated workforce.

“Adding value at the front and back end of the traditional value curve is one of Australia’s greatest opportunities at present – a real opportunity to differentiate and build on many world-leading industries, with these developing precincts and their ecosystems a key contributor to this.”

New precincts underway across the country include the Tonsley Innovation District in South Australia, Fishermans Bend in Victoria, Western Australia’s Murdoch Health & Knowledge Precinct, Australian Unity’s billion Herston Quarter in Brisbane – where a new public hospital is about to be completed – and Westmead in New South Wales.

Charter Hall and Western Sydney University have just secured the CSIRO as a key tenant for their $350 million Westmead health and research precinct, where construction has just kicked off. The hub will deliver over 43,000 sqm of health, education, research and business space.

The parties have already delivered a 26,500 sqm vertical campus at One Parramatta Square, and are developing a $280 million engineering innovation hub at 6 Hassall St, where some 27,000 sqm of space will be delivered and occupied by WSU and UNSW.

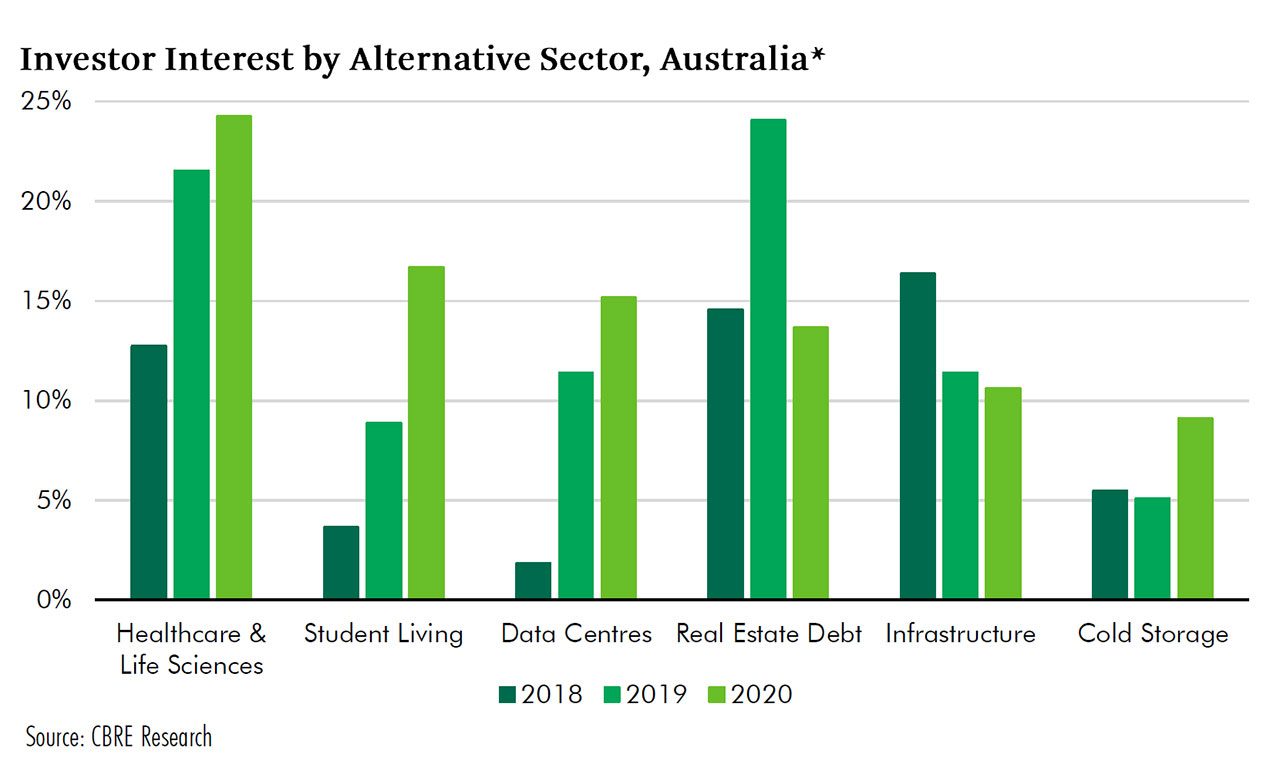

CBRE senior managing director of capital markets, Pacific, Mark Coster said although COVID-19 had impacted investment flows, interest in alternative sectors such as education had been rising, underpinned by the search for yield and income security.

“Increasingly, education and university real estate is viewed as an attractive investment sector, with investors actively raising capital for these assets. Universities in particular continue to offer key investment fundamentals that capital is seeking – despite the current challenges of closed international borders and some campuses running online only.”

Universities grew their international student based by 79% over the decade 2019, to more than 360,000, according to the Department of Education, while revenue per student rose by over 50% in the 10 years to 2019. The absence of lucrative funds due to the pandemic has forced the hand of some universities, who have slashed jobs and looked to offload assets in a bid to assist liquidity and bolster cash reserves. Universities Australia expects $16 billion in revenue to be wiped out between now and 2023 across the country’s tertiary education sector.

In Melbourne, RMIT is hoping to release $120 million of capital by offering its Bourke St tower in the CBD with a leaseback, and was joined shortly afterwards by Swinburne University moving to offload a Flinders Ln building barely one year since its acquisition.

CBRE senior research analyst Nicholas Volk said although in short-term distress, universities would remain a secure long-term investment given their government backing and upside in the return of international student revenue.

Volk said the federal government’s plans to incentivise STEM courses from 2021 would help stimulate the downstream development of more specialised laboratory and medical facilities. The proposal would see the cost of some humanities courses doubled, while science and maths based would be among degrees made cheaper, as would, environmental sciences, health, psychology and agriculture.

“In pushing students towards STEM courses, it is reasonable to see the flow on benefits to these strategic priorities,” Volk said.