This article is from the Australian Property Journal archive

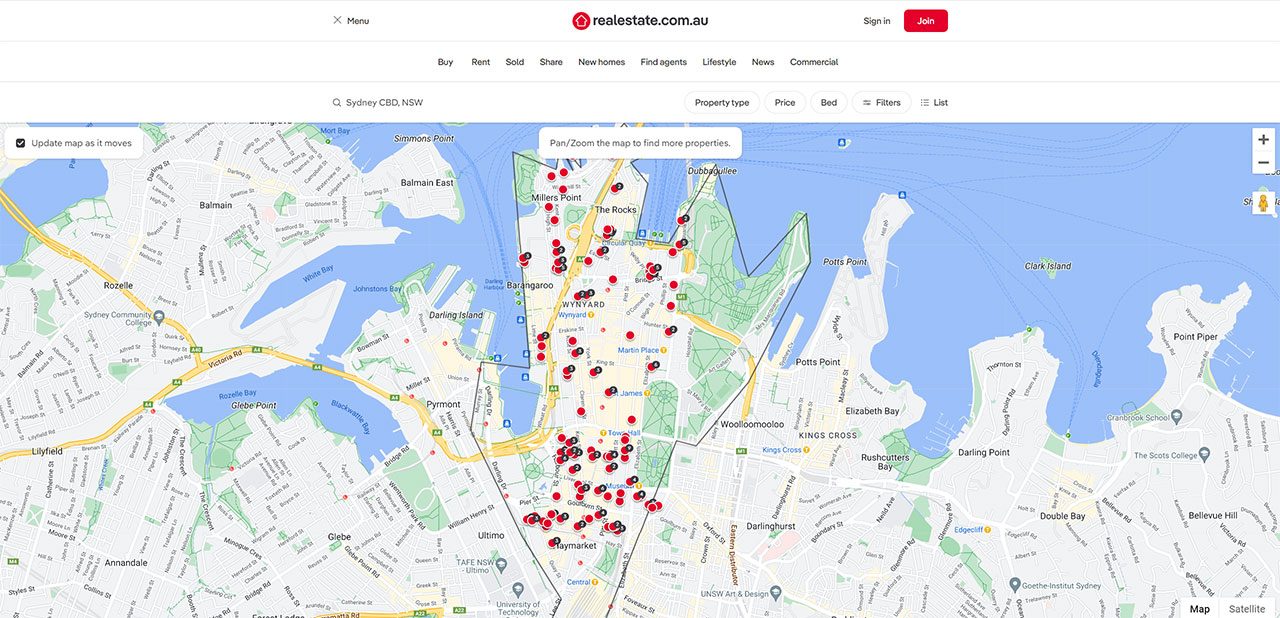

NEWS Corp’s REA Group – operator of major real estate portals realestate.com.au and realcommercial.com.au – reported strong first-half revenue and profit growth as it enjoys improved home listings in Sydney and Melbourne.

Revenue was up 18% to $726 million on the prior corresponding period, while EBITDA was up 22% to $439 million. Net profit was up 22% to $250 million.

The group will pay an interim dividend of 87.0c per share, up 16%.

“Australia’s residential property market remains healthy, with national listings growth driven by Sydney and Melbourne while other markets are more subdued. Increased activity continues to be driven by strong demand, supported by near-record employment, high levels of immigration and greater confidence that interest rates have stabilised,” it said.

“Supply is also improving as sellers become more confident in the level of demand, which has resulted in reduced time to sell.”

In its Australian business, residential revenue increased 19% to $505 million. Buy revenue growth was driven by a 19% increase in buy yield and a 4% increase in national listings, partly offset by the 3% negative impact of revenue deferral. Buy yield benefited from a 13% average national price rise, increased use of its top-tier listings product, and total depth penetration, and a 3% positive impact from geographical mix due to the outperformance of the higher yielding Sydney and Melbourne markets.

Rent revenue increased with an 8% average price rise and growth in depth penetration, partly offset by a 2% decline in listings.

REA Group recorded 10.6 million people visiting realestate.com.au each month on average, with 52% exclusively using the portal. It averages 126.1 million average monthly visits, while there were 3.2 million unique properties tracked by their owner, up 41%, and 2.1 million average monthly buyer enquiries, up 15%.

REA Group said national residential listings were up 12% year-on-year in January, with Sydney and Melbourne listings both increasing by 28%. Combined listings for December and January were in line with the six-year average. If the trend continues for the remainder of the financial year, it anticipates FY24 year-on-year listings growth of 3% to 5%.

Commercial and developer revenue increased 11% to $80 million. Commercial revenue growth was driven by an average 11% price rise, increased depth penetration and higher listings across both sale and lease. Developer revenues were up modestly on the prior year, with increased project profile duration and a price rise in the prior year offsetting a 23% decline in project commencements.

Media, data and other revenue was up 21% to $60 million, or flat excluding the impact of the acquisition of CampaignAgent – likened to an Afterpay for vendor-paid advertising.

REA Group’s Australian business, which includes data and insights business PropTrack, recorded core revenue growth of $682 million, up 17%.

Its business in India recorded revenue growth of 21%, to $44 million. Revenues from property and advertising increased 32%, with Housing.com benefiting from price rises, increased depth penetration and customer growth, while improving market conditions drove higher PropTiger commissions.