This article is from the Australian Property Journal archive

SOARING rents and a restricted pipeline of smaller Melbourne office spaces in the coming years will prompt tenants to buy rather than lease their offices, according to Knight Frank research.

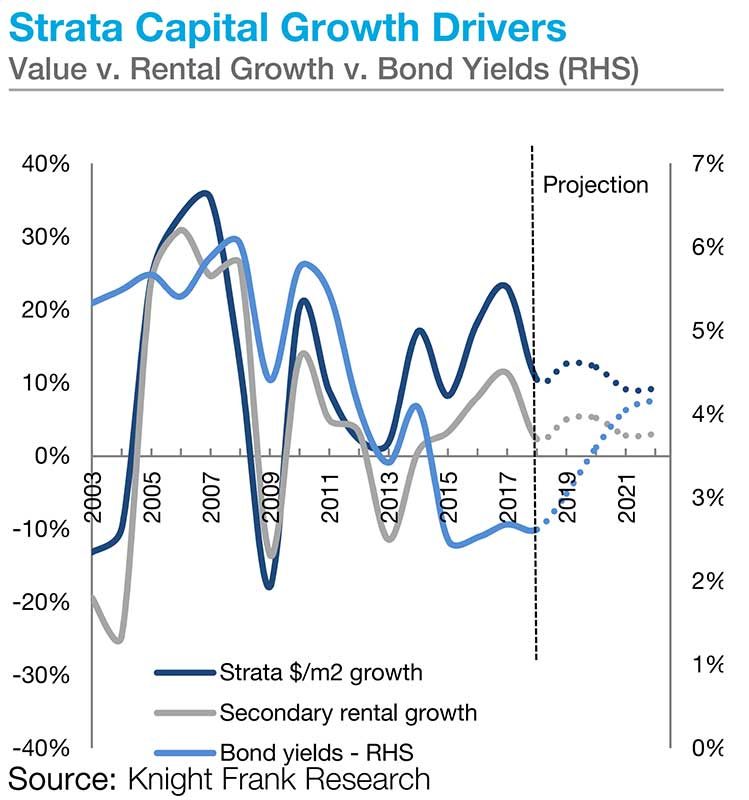

Strata office values have jumped by more than 20% over the year to July, Knight Frank’s associate director of research, Kimberley Paterson said, with the average rate at $8,539 per sqm, and between $10,000 per sqm and $11,500 per sqm at the higher end of the market.

Over the same time, secondary net effective rents in the CBD have increased by 11.3% and secondary face rental growth of 9.3% due to a lack of prime grade options. Constrained new supply over the next 12 months will continue to support strong rental growth, with secondary face rents tipped to rise by an average of 4.5% per annum over the next two years.

“With no major office developments scheduled for completion until mid-2018 combined with limited space available across the Melbourne CBD market for sub 500sqm space, this will continue to put tremendous pressure on effective rents and entice many tenants to opt for purchasing their offices, rather than renting, as a more cost effective solution,” Paterson said.

Paterson said that while interest rates remain low and demand for renting office space in the CBD is high, the attractiveness for tenants to purchase office space rather than lease is expected to increase demand for strata suites over the next 12 months.

Enquiry levels for space between 100 sqm and 500 sqm size bracket has increased by 45% in the 12 months to July. Despite the addition of 517 Flinders Lane, 140 Bourke Street and 41 Exhibition Street to supply in 2014, new strata supply overall has been subdued. Total vacancy rates fell from 3.7% to 2.6% in the 12 months to July according to the PCA, which is the lowest level since it began tracking data in 1994.

“The expected capital appreciation for strata office space will be underpinned by strong rental growth, limited supply and positive tenant demand in the sub-500sqm office category,” she said.

Commercial strata buildings have attracted strong interest from investors amidst a lack of opportunities for investors looking acquires assets in the $5 million to $10 range, particularly within 5km of the CBD.

Prices are expected to continue their growth march of around 11.5% per annum over for 2018 and 2019, given heightened demand and a lack of new supply. Moderation isn’t expected until 2021, when overall supply levels and interest rates begin to rise.

The majority of that new supply will be in the prime grade market, but a flow-on effect to the strata and secondary markets is expected.

“In addition, increased borrowing costs over the long-term will start to become an important consideration for many investors over the next few years. Looking ahead, there are a number of important implications for market participants. Existing strata owners with higher opportunity costs of capital will be encouraged to take advantage of the current strong market while the depth of demand remains,” Paterson said.

Australian Property Journal