This article is from the Australian Property Journal archive

COMMERCIAL property market sentiment is at a decade high across Australia, but it masks the mix expectations for different sector.

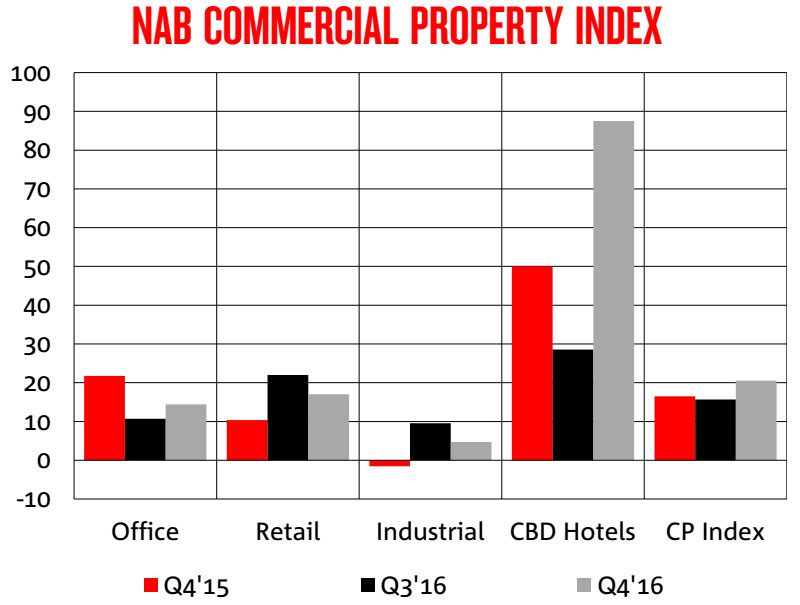

NAB’s Commercial Property Survey – Q4 2016 found that the commercial property index rose five points to round out last year to +21, the highest level since the survey began in early 2010.

NAB chief economist Alan Oster said that the improvement in the index was largely due to very big gains in CBD hotels and small gains in the office sector.

“While we continue to see an uneven performance across sectors, the performance of CBD hotels has more than offset the lower sentiment that we’re seeing in both retail and industrial markets,” he said.

Confidence rose sharply in CBD hotels from +29 to +88 over the quarter on the back of strong expectations for occupancy, capital and revenue per available room (revPar) growth.

However, it was soft across all other sectors, with office up modestly to +14, retail down by 5 to +17, and industrial down by 5 to +5.

New South Wales led sentiment with +47, but was down 8 points. Victoria fell 14 points to +16, whilst sentiment in South Australia/Northern Territory rose 27 points to neutral and in Queensland by 6 to +1, but Western Australia weakened further to -61.

Prospects for capital growth over the coming 1-2 years improved, and led by CBD hotels, but were scaled back albeit still growing in all other sectors. Retail was strongest in NSW and Victoria, office in NSW and industrial in NSW and Queensland.

The office sector is forecast to provide the best income returns in the next 1-2 years, led by very strong growth in NSW of 3.5% and 3.7% respectively, whilst at the other end of the scale WA is looking at falls of 4.2% and 3.1%.

Rents in the retail and industrial sectors are tipped for modest growth in all states except WA.

Overall office vacancy saw small tightening from very high levels in Queensland and SA/NT offset survey-high vacancy in WA and increases in NSW & VIC (but from low levels).

Vacancy in office and industrial markets are set to fall in the next 1-2 years, with WA again the only exception in the office market, and rise in retail.

Australian Property Journal