This article is from the Australian Property Journal archive

AUSTRALIAN farmland brought in a negative return over the third quarter, with income returns continuing a downward trend.

According to ANREV’s the latest quarterly Australian Farmland Index Q3 2023, income returns of -0.47% and capital growth of -1.19% led to a total return of -1.66% for the quarter.

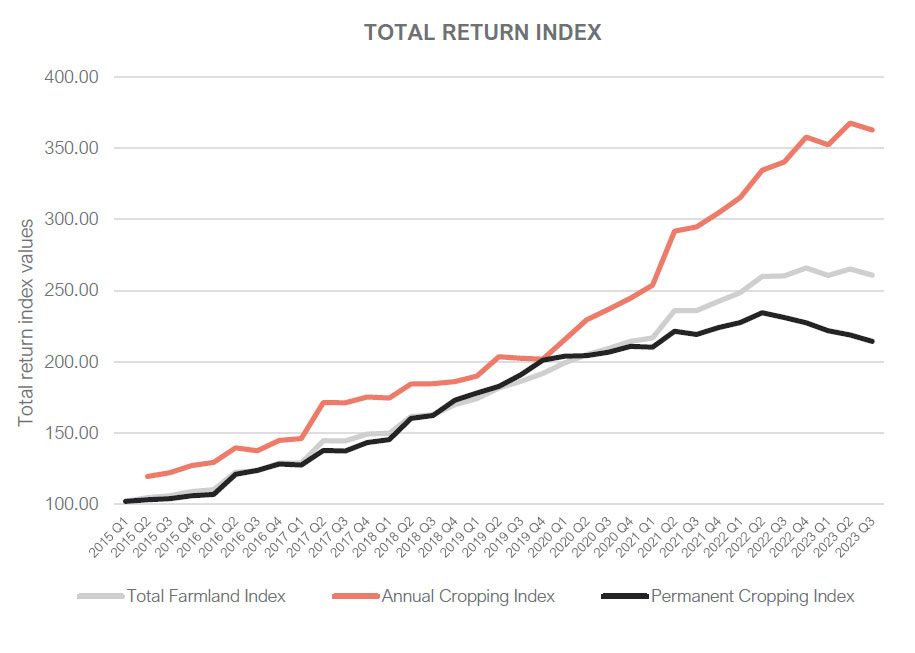

The Australian farmland total annualised return since inception at 31 March 2015 to 30 September 2023 came in at 11.57% with income returns of 5.20% and capital growth of 6.16%.

While over the last five years Australian farmland recorded a total annualised return of 9.88%, with an income return of 4.46% and capital growth of 5.23%.

With the last three years seeing a total annualised return of 7.61% across 3.09% income return and capital growth of 4.41 %.

Total Annual Farmland—crops and livestock—income returns remained on a downward trend for the September 2023 quarter, down 1.76% for the quarter and 4.34% for the year.

Meanwhile, the Trade Lamb Indicator also dropped to 411.41c/kg cwt in early September 2023 from 804.29 c/kg cwt in early January 2023.

Likewise, the Eastern States Young Cattle Indicator fell from 850 c/kg cwt in January 2023 to 357c/kg cwt at 30 September.

At the same time, the 2022/23 summer and 2023 winter crops underpinned the index with historically high grain, oilseed and cotton prices and good yields.

ANREV attributed the 0.42% decline in capital returns over the quarter to interest rate hikes, diminishing livestock prices and a forecast change in weather patterns.

Permanent Farmland—horticulture—returns also remained on a downward trend with a 3.17% fall in capital for the quarter and 7.51% fall for the year.

With income returns over the quarter at 1.10% and at 0.16% for the year.

The index is currently comprised of 62 different properties with a market value of more than $1.98 billion in farmland made up of 45% are permanent and 55% annual (farmland assets by property counts.