This article is from the Australian Property Journal archive

ONGOING concerns over the impact of online retailing continues to drive shopping centre landlords to reconfigure their tenancies mix to future-proof their centres, while landlords increasingly take on pop-up shops as a means of boosting income.

JLL’s latest Retail Centre Managers’ Survey, which takes in 106 of its managed retail shopping centre – a majority being neighbourhood and sub-regional centres – found that while occupancy improved, landlords are needing to deal with retailers consolidating their store networks.

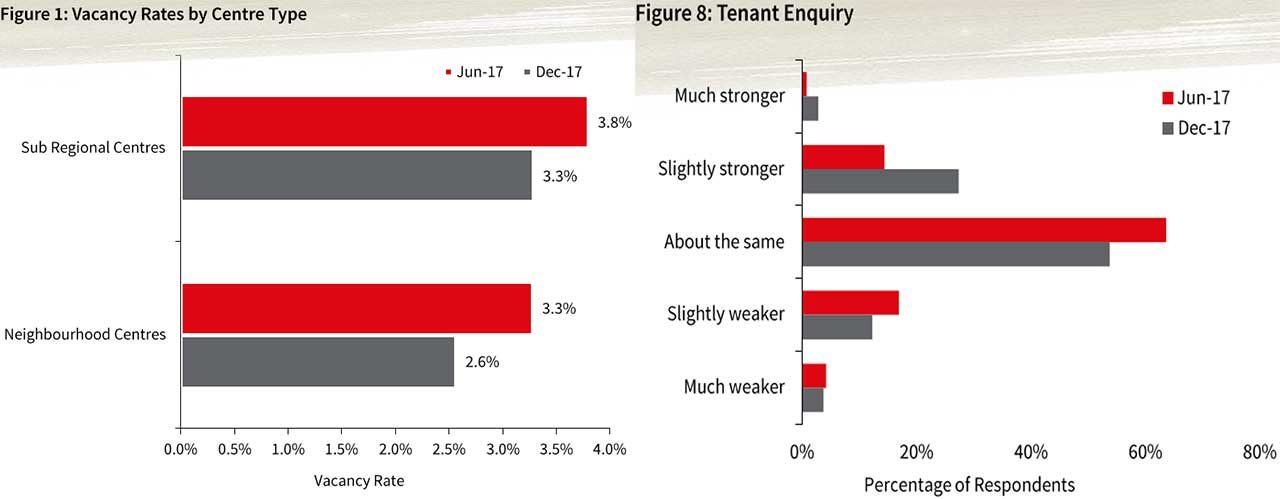

Neighbourhood centre vacancies fell 0.7% in the six months to December to 2.6%, well below the 4.3% five-year half-yearly average, while sub-regional centre vacancy tightened from 3.8% to 3.3% over the period.

“Strong population growth is also supporting sales growth and the demand for retail space in some centres, particularly in Sydney and Melbourne,” the survey said.

Fashion retailers that signalled store rationalisation strategies through the period included Specialty Fashion Group, which will close more than 300 stores by 2020; Diana Ferrari, following a decision to its apparel line and focus on footwear; Michael Hill is closing 24 of its 30 Emma & Roe stores; and Myer confirmed it would shutter 19 stores amid a sustained period of struggle.

JLL said it has tracked a further three retailers who fell into voluntary administration in 2017 following its August 2017 edition of the survey, and a further five retailers as of last month.

“Five of these eight retailers facing insolvency issues operate in the fashion and accessory sector, which exposes a total of 108 stores to potentially close. Approximately 32% of specialty floorspace in sub-regional centres is leased to apparel tenants.

A number of fashion retailers have found the blending of their bricks-and-mortar operations and e-commerce challenging. The number one factor anticipated to impact moving annual turnover (MAT) has remained “expected changes to tenancy profile”, followed by “growth expectations within trade area” and “planned refurbishment activity”.

“Centre Managers have pursued extensive remixing strategies to reduce exposure to fashion and accessory brands and been replacing these tenants with food operators to expand their fresh food and restaurant offering to drive high customer foot traffic,” the survey said.

JLL’s head of property &asset management – Australia, Richard Fennell said a number of landlords are transitioning their tenant profiles with retailers who are less likely to be disrupted by online retailing.

“In addition to food and beverage operators, it’s health, gyms, medical centres, other medical-related services and insurance that are expanding in shopping centres,” he said.

Major Australian retail property trusts are in the midst of a $1.6 billion spend on shopping centre redevelopments in a bid to update their assets.

Promotional discounting continues to weigh down retail sales growth. Clothing and footwear prices having fallen by 3.0% in the year to December, and by 0.8% for household goods.

“However, the non-retail categories of household consumption continue to record the highest price increases, including education, health and housing, all of which are major components of household budgets,” Fennell said.

Anchor tenants in neighbourhood centres continue to be a key influence of occupancy levels. Positive leasing enquiry in the takeaway food and beverage retail sector was reported by 59% of respondents and 44% for the specialty food retail sectors.

Landlords are also looking to take advantage of the added income stream from casual leasing deals, or pop-up shops, with 59% of centres now accommodating retailers on the short-term deals, up 48% on the previous six-month period, while increases in enquiries were seen by 19% of respondents, and 75% said the level was consistent.

“Short-term lease arrangements are attractive to retailers looking to test the market, create brand awareness and/or individual operators with small space requirements.”

Charity organisations are the most common operator looking for casual space, with 50%, followed giftware operators at 33% and pledge operators at 31%, while 23% of centre managers received enquiry from a fashion retailer for casual space, up from 21%.

Centre managers are more optimistic on retail sales growth over the next 12 months compared to the previous surveys, with 56% expecting an increase. Total shopping centre MAT improved only slightly, with sub-regional centres showing growth of 1.0% in the year to December and neighbourhood centres just 0.2% in neighbourhood centres.

However, 37% of managers expect some level of rental growth in specialty rents over the next 12 months, and 43% believe rents will stay the same over that same period.

Sub-regional speciality rents grew by a modest 1.1% in the year to December– the lowest figure reported in the last eight surveys and below the current inflation rate of 1.9%. Neighbourhood centres reported a growth rate of 1.2% in the year to December, up from -0.9% in the year to June.

Only 14% of managers said no incentive was needed to attract new tenants, while 63% said a 10% incentive was required, and 29% said 20%-plus was needed.

Australian Property Journal