This article is from the Australian Property Journal archive

AN offshore investor has splashed out $81.6 million for the inner Melbourne headquarters of Rathbone Wine Group, netting the family that bought the site in 2014 for $31 million a hefty pay day.

The structured off-market expressions of interest deal brokered by Dawkins Occhiuto’s Chris Jones is expected to come in on a 3.6% yield. Rathbone Wine Group – owner of Yering Station, Xanadu and Mount Langhi Ghiran – has agreed to a new 13-year lease extension at 262 Lorimer Street. Commencing annual net rental of just over $3 million, including fixed annual rental growth of 2.75%

Positioned on a 1.69-hectare parcel at the corner of Sabre Drive, overlooking the Yarra River, the property comprises a 15,246 sqm building that features a temperature-controlled warehouse and distribution facility, four levels of office, a ground-level public café, and a multi-storey car park, with quick access to the West Gate Freeway, CityLink and the Port of Melbourne.

“Industrial and logistics has emerged post-2020 as the most sought-after traditional asset class and that is reflected in this trophy asset sale which is the strongest industrial pricing Victoria has seen and, in no uncertain terms, a benchmark yield which pre-COVID was unheard of,” Jones said.

“We expect continued occupier demand will continue to deliver strong and sustained real rental growth over the medium to longer term as yields bottom out and the supply of more affordable land is exhausted.”

Evidence of continued yield compression at the lower end of the range would emerge in the immediate term as pending transactions were finalised, he added, while the presence of long-term occupiers and the development of business parks and unit estates, resulting in a scarcity of opportunities to invest at scale, would maintain downward pressure on yields of similar properties.

Benjamin Martin Henry of Real Capital Analytics revealed in Australian Property Journal’s Talking Property podcast that industrial demand has outstripped retail and offices combined for the first time.

Jones said bidders of the Port Melbourne site took the view that the asset represented “best in class investment attributes” with an outstanding tenant, Rathbone Wine Group, very strong growth prospects, prime location with first-rate transport and port access, and a modern, efficient building complex with excellent site access.

Four kilometres from the CBD, the property is within the 480-hectare Fishermans Bend urban renewal precinct that is forecast to accommodate 80,000 people and create 80,000 jobs by 2050.

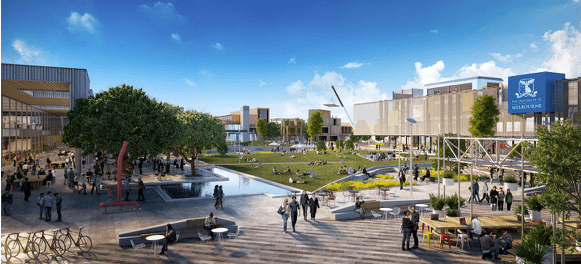

The property is also within immediate proximity of the Fishermans Bend Innovation Precinct which includes the circa $180 million former General Motors Holden site redevelopment and a new campus of Melbourne University’s Faculty of Engineering and Information Technology.

On the other side of the Westgate, a local family is hoping for a $30 million windfall from the sale of a 1.4-hectare warehouse site that has been the longstanding base of Frank Walker’s National Tiles, and adjoining Goodman Group’s new 10,000 sqm retail project which features a full-line Woolworths supermarket and Dan Murphys.