This article is from the Australian Property Journal archive

SAVILLS Investment Management and Lendlease’s Australian Prime Property Fund (APPF) Commercial are looking to take advantage of market conditions by selling 800 Collins St in Melbourne.

Industry sources expect the property to fetch around $280 million.

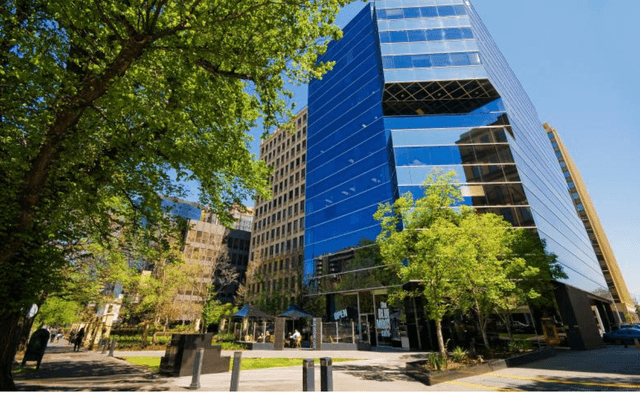

Located in Docklands, the A grade building was built in 2010 and comprises 28,619.2 sqm of office space and 873.4 sqm of retail space, incorporating ground floor retail shops and 10 upper levels of office space with two levels of parking.

It was purpose built for Myer with an end value of $175 million and in 2010, European fund manager SEB Asset Management acquired a 50% stake for $76.87 million on a cap rate of 7.75%. SEB AM was taken over by Savills IM in 2015.

JLL’s Langton McHarg and Paul Kempton and Savills’ Ian Hetherington, Simon Fenn and Ben Azar have been appointed to handle transaction via an EOI campaign closing on Wednesday 1 November 2017.

The building is fully leased to retail giant Myer and Latitude Financial Services (formerly GE Money) who have entered a 10 year lease, providing a Weighted Average Lease Expiry (WALE) to circa six years.

In March this year, Myer gave up more than a third of the space it occupied as part of its optimisation strategy. In August, Latitude Financial Services leased the 9,744 sqm of space free up by Myer’s downsizing.

“The Melbourne office market is rated by JLL in the top two best performing office destinations in the world making Melbourne office assets very attractive in comparison to other office markets,” McHarg said.

“Over the last two years Melbourne has continued to increase its relevance on the global investment stage and is forecast to become Australia’s largest city by 2030. It is experiencing a phase of extraordinary positivity due to its strong economy, infrastructure and culture that is extending across all of its property markets,” he added.

Hetherington said 800 Collins St will attract the focus of investors globally.

“We are anticipating very strong interest in this asset, particularly because of its prominent Collins St location and desirable building features.

“Currently, vacancy rates are circa 1%, therefore we expect strong growth going forward. The area remains popular with tenants in the banking, finance and insurance sectors due to the larger floor plates and ‘campus style’ buildings,” he added.

Centuria Capital bought it four years ago for $91 million.

Australian Property Journal